I’ll be honest, I really like Krispy Kreme donuts. The Original Glazed fresh off the line is hard to beat. But while I enjoy the product, I can’t say the same for the stock. Based on current fundamentals and price action, Krispy Kreme (DNUT) is one of the weakest names in the market.

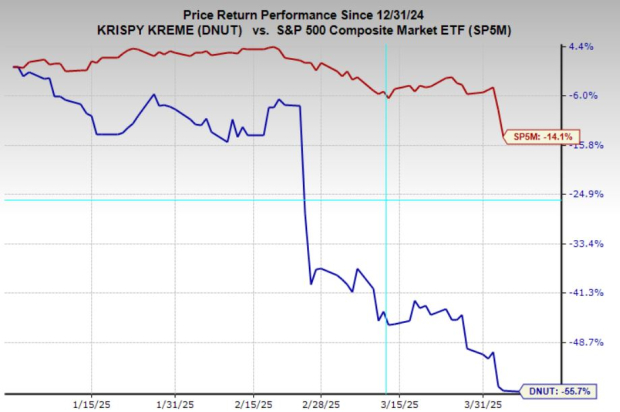

Krispy Kreme stock has been a major underperformer, falling 56% year-to-date and 79% over the past five years. Not only has the stock price struggled, but analysts have been lowering their earnings estimates sharply over the last year and more recently, giving it the lowest Zacks Rank.

Image Source: Zacks Investment Research

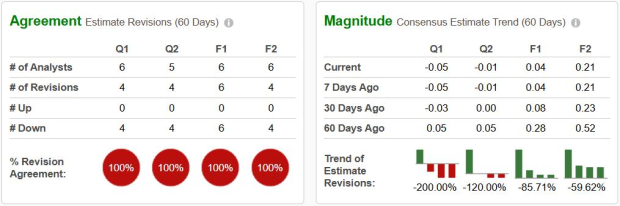

Krispy Kreme Earnings Forecasts Continue to Fall

DNUT currently holds a Zacks Rank #5 (Strong Sell), which reflects ongoing downward revisions in earnings estimates. Current quarter earnings estimates have flipped negative, this year’s estimates have cratered 86% and next year’s have fallen by 60%.

EPS have declined meaningfully since its post-IPO period, and the company continues to struggle with margin compression and operational inefficiencies. Revenue growth has been modest, though flat in the last year, and not enough to offset rising costs and a lack of bottom-line focus.

Image Source: Zacks Investment Research

Should Investors Avoid DNUT Stock?

While the brand remains strong and the product well-loved, the stock does not currently offer a compelling case for investment. Earnings estimates are still falling, technical momentum is negative, and the company has yet to deliver on the kind of growth and profitability investors need to see.

In this incredibly challenging environment, where selectivity, defensiveness and business model robustness across regimes are being rewarded, DNUT is a name to avoid until the earnings picture begins to stabilize and the stock shows signs of technical support.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Krispy Kreme, Inc. (DNUT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)