Options Time Decay Explained: Understanding and Trading Theta

Options don’t last forever.

Once you hit the buy button, the countdown begins.

The price of an option slowly declines every day that passes, thanks to time decay (AKA theta).

It starts like a wave far out in the ocean, slow and steady at first, building as the clock ticks away.

By the time it reaches expiration, the option can be worth a fraction of the original price.

That’s why option buyers need to get the timing and direction of a move right.

Without a clear understanding of option time decay, you can quickly find your position underwater, even if the stock moves in the direction you expected.

Fortunately, time decay is predictable. This predictability creates opportunities for traders who understand how to use theta to their advantage instead of letting it work against them.

But to turn time decay from your enemy into your ally, you need to understand how it works, when it accelerates, and most importantly - how to measure it.

This article explores:

- What is time decay, and how do you read it

- Why does time decay eat away at the price of an option

- How traders can profit from time decay

- Real examples using Barchart's suite of options tools

Let's start by exploring exactly how time decay works and why it's such a powerful force in options trading.

Understanding How Time Decay Works in Options Trading

People will use time decay and theta interchangeably because they mean the same thing.Theta is the Greek symbol used to represent time decay.

Time decay eats away at the extrinsic value of an option’s price every day, assuming nothing else changes.

That’s why people often call extrinsic value the 'time premium.'

At expiration, the extrinsic value of an option is zero.

To get the extrinsic value of a stock, you need first to determine the intrinsic value of an option.

Here’s how you do that:

- Call options only have intrinsic value if the strike price is below the stock’s current price.

- Put options only have intrinsic value if the strike price is above the stock’s current price.

- The intrinsic value is the difference between the strike price and the stock’s current price.

The extrinsic value is everything left over once you subtract the intrinsic value from an option’s price.

As we alluded to in the introduction, time decay is minimal when the expiration date is far into the future. Time decay increases at an exponential rate as you approach expiration.

The graphic below helps illustrate how this works.

Options with expiration dates far into the future, like leaps, see very little time decay, whereas same day expiration options, or 0DTE options, lose all their extrinsic value by the close of that session.

So how do we determine the amount of time decay?

Time Decay and the Price of an Option

Option prices are comprised of three components:

- Time until expiration - The amount of decay speeds up as we approach the expiration date

- Distance between the strike price and the stock’s current price (AKA Delta) - As the distance between the strike’s price and the stock’s price grows, the amount of time decay (and the stock’s option price) shrinks.

- The implied volatility (AKA Vega) - More implied volatility (option demand) means more decay.

In the previous section, we saw how time decay speeds up as you approach expiration.

Now, let’s take a look at how the other two components.

The graphic below gives you a visual representation of how time decay changes with respect to the distance between the strike price and the stock’s current price.

Theta is greatest when the strike price equals the stock’s current price.

As you move further away, time decay declines rapidly at first and then more slowly.

To help you understand this concept, think about a slow-moving stock like Coca-Cola. Rarely do we see Coke’s stock move by more than a few percent each month.

So, if you bought a call option that expires in 30 days with a strike price 20% higher than the stock’s current price, it’s going to be very cheap because the odds of Coke’s stock going up by 20% or more are very small.

Since the option is so cheap, there is very little premium for time decay to chip away at.

Implied volatility simply makes options more or less expensive all else being equal.

So, if the implied volatility increased on the graphic above, you would get something like the blue line shown below.

Trading Strategies to Profit from Time Decay

As an options trader, you can take one of two roles: a net buyer or a net seller.

Net buyers are long options, meaning they profit when the value of their options increases. Conversely, net sellers are short options, profiting when the value of their options decreases.

Since time decay works against long options, net sellers are positioned to capitalize on this phenomenon.

However, selling options can be a bit challenging for newer traders.

You see, unlike buying options, where you can only lose the amount you spend on an option, selling options can come with greater risks. This comes into play when you’re selling ‘naked’ options.

Fortunately, there are some simple strategies that work well for both beginners and experienced traders that allow you to define your risk before enter the trade.

Let’s take a look at one of the most popular among traders and investors.

Covered Calls: A Conservative Approach

A covered call is a great options strategy to cut your teeth in options selling, especially if you already own stock.

Covered calls involve selling call options against a long stock position.

The payoff graph looks something like this:

The credit you receive for selling the call option pads your profits. But, it caps your potential at the strike price.

Conversely, you don’t get a premium if you simply own the stock, but you have unlimited upside potential.

This strategy is ideal for moderately bullish to neutral markets, allowing traders to profit from both time decay and potential stock appreciation.

The risk is limited to the downside movement of the underlying stock, which isn’t much worse than owning the stock, making it a relatively conservative approach. Plus you get to keep the premium.

To implement a covered call strategy, you would first purchase 100 shares of the underlying stock (unless you already own the stock). Then, you would sell one call option contract for every 100 shares owned.

If the stock price remains below the strike price at expiration, you keep the premium received from selling the call and maintain ownership of the stock.

If the stock price rises above the strike price, you may be obligated to sell your shares at the strike price, capping your potential profit.

Evaluating Trade Ideas With Barchart

Barchart’s Premium tools allow traders to quickly scan and analyze various strategies.

Here are two ways you can find covered call ideas.

Covered Call Screener - All Stocks

Let’s say you like the idea of a covered call but aren’t sure where to start.

Barchart’s Covered Call prebuilt screener allows you to see the top covered call ideas all in one spot.

This prebuilt screen provides you with a lot of great information all at once.

Let’s focus in on one stock so we can understand each ideas potential.

This line item represents the following covered call idea:

- Buy 100 shares of GameStop at the current price of $26.54

- Sell the $75 call strike that expires on 1/17/2025, about 60 days from now

- Receive a $1.97 credit

The trade cost us a net debit of $26.54 - $1.97 = $24.57.

With this information, we have a few scenarios that we want to analyze:

- GameStop’s stock stays exactly at $26.54 until expiration

- GameStop’s stock goes to or above the $75 strike

- GameStop’s stock goes to $0

Let’s start with the first scenario where the stock remains flat. That means we don’t make or lose any money on the stock itself. But, we make money on the call option we sold for $1.97. 4

So, our return if the stock remains flat would be: $1.97/$24.57 = 8.0%

Ok, but what about if the stock goes to or above $75?

We still get the $1.97. But we also get all the capital gains up to $75.

So, our potential return is: ($75.00 - $24.57) / $24.57 = 205.3%.

Now, let’s take this a step further and annualize that 205.3% to see our potential if we keept finding great trades like this one after another.

That annual return would be: 205.3% / 60 Days x 365 Days = 1,248.6%.

While looking at our profit potential is great, we also want to understand our total exposure here.

To do that, we multiply the net debit by 100 to get $2,457, which is the most we can lose if the stock goes to zero.

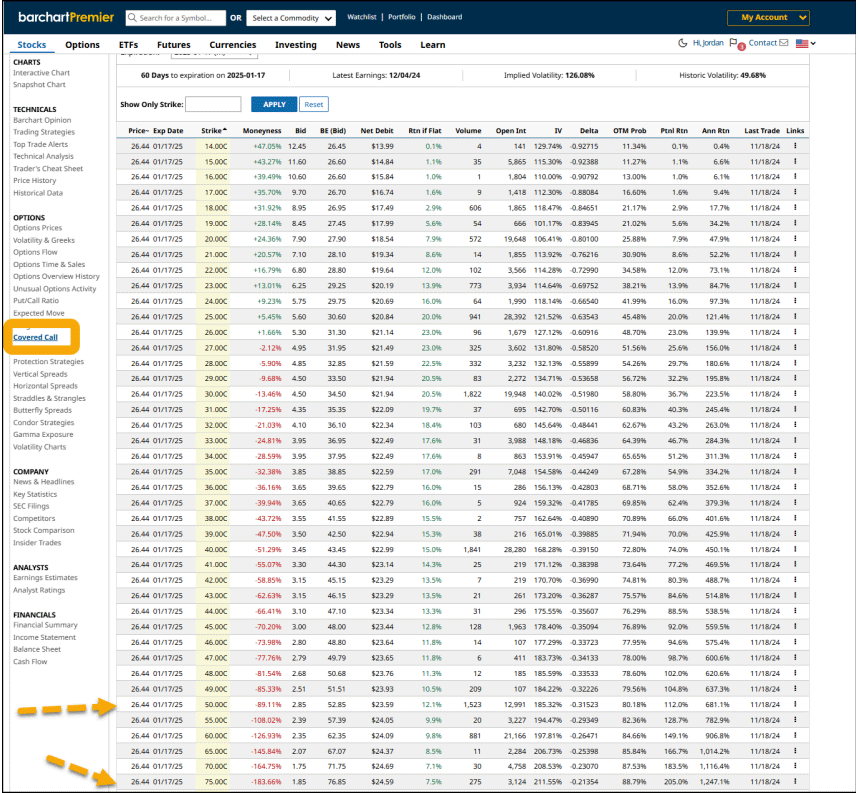

Covered Call Screener - Specific Stock

We can also analyze different covered call options for a specific stock.

Let’s stay with GameStop and expand our view to all the strike prices for the expiration 60 days into the future.

The table displays all the strikes from in-the-money options that are as low as $14 all the way to $26.

We then get all of the out-of-the-money options from $27 to $125.

The ‘Moneyness’ tells us how far in or out of the money the option is based on the stock’s current price.

You can see how the price of the option decreases as the strike price moves up.

If the stock trades at $26.44, then every call option from $27 and higher are made up entirely of extrinsic value.

Looking at our choices, we see that the probability of $75 being out-of-the money at expiration is around 88.8%.

By going with at $50 strike price those odds only drop to 80.1%, while our credit increases from $1.85 to $2.85.

This might be a better choice since we still have plenty of upside for the stock, but we also get a larger credit.

Now, let’s look at what happens if we choose an expiration that’s only 18 days into the future.

Notice how all of the premiums shrink.

We only get $0.57 if we sell a $50 call option compared to the $2.85 we would have gotten on the same strike that expires 60 days into the future.

Why might this be a better choice for us?

If you recall, the theta curve tells us that time decay speeds up as we approach expiration.

So, we get more time decay per day than we’d get with an option that’s 60 days into the future.

That’s why the annualized return is just 681% for the $50 call option that expires in 60 days, but it’s 1,891.4% for the one that expires in 18 days.

Final Thoughts

Time decay is a powerful force in options trading, and understanding how to harness it can be the key to consistent profits. By grasping the fundamentals of theta and how it impacts option prices, you can develop strategies that turn time decay from an enemy into an ally.

Remember, success in options trading requires discipline, patience, and a willingness to continuously learn and adapt. By combining a solid understanding of time decay with robust tools and a thoughtful approach to risk management, you can position yourself for long-term success in the exciting world of options trading.

With Barchart's suite of options tools at your disposal, you have the power to analyze time decay, evaluate potential trades, and make informed decisions that align with your financial goals. Start harnessing the power of time decay today and take your options trading to the next level.