Selling vs Buying Options: Which Strategy Delivers Better Returns?

Imagine standing at a crossroads in your trading journey, pondering a question that could shape your financial future: Should you buy options, betting on significant market moves, or sell options, aiming for steady income?

Every successful options trader faces this pivotal decision: should I buy or sell options?

This choice fundamentally shapes your trading approach and potential returns.

Option buyers can turn small investments into dramatic gains when they correctly predict market moves, while option sellers aim to profit from steady premium collection—much like running an insurance business.

While buying options offers the allure of those headline-making gains, many professional traders prefer selling options. By collecting consistent premiums and carefully managing risk, sellers can compound smaller but more frequent profits into significant returns over time.

But which path is right for you?

The truth is, both buying and selling options can be profitable. The key lies in understanding when and how to use each strategy effectively, aligning them with your trading goals and market conditions.

In this comprehensive guide, we'll explore:

- The fundamental differences between buying and selling options

- Common pitfalls that cause most retail traders to lose money buying options—and how to avoid them

- The secret behind professional traders' preference for selling options

- How implied volatility impacts both strategies

- Real-world trade examples using Barchart's suite of options tools

- Step-by-step analysis for choosing the right strategy for your trading style

Whether you're a seasoned trader or just starting out, this guide will equip you with the knowledge and tools to make informed decisions in the options market.

The Fundamental Differences Between Buying and Selling Options

Buying and selling options represent opposing approaches - one profits from dramatic market moves, while the other capitalizes on market stability and time decay.

How Buying Options Works

When you buy an option, you're purchasing the right (but not obligation) to:

- Buy shares at a fixed price (call option)

- Sell shares at a fixed price (put option)

For example, buying a call option that expires in 30 days gives you the right to purchase 100 shares at your chosen strike price anytime before expiration. Your maximum risk is limited to the premium paid, while your potential profit is theoretically unlimited for calls or capped at the stock going to zero for puts.

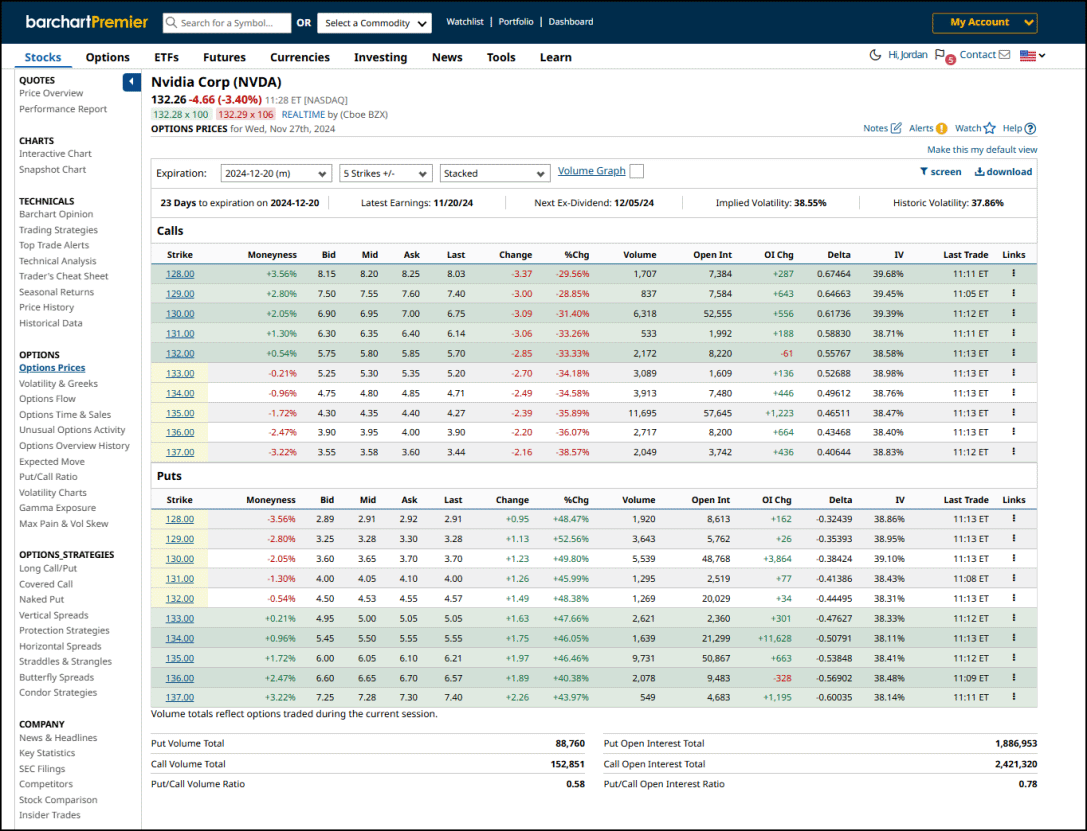

When analyzing potential trades in Barchart's options chain, focus on these key metrics:

- Strike price relative to current stock price - determines how much the stock needs to move for profitability

- Days until expiration - impacts how much time your trade has to work out

- Option liquidity (volume and open interest) - ensures you can enter and exit trades easily

- Implied volatility - tells you if options are expensive or cheap relative to historical prices

Let’s use NVIDIA’s options chain as an example.

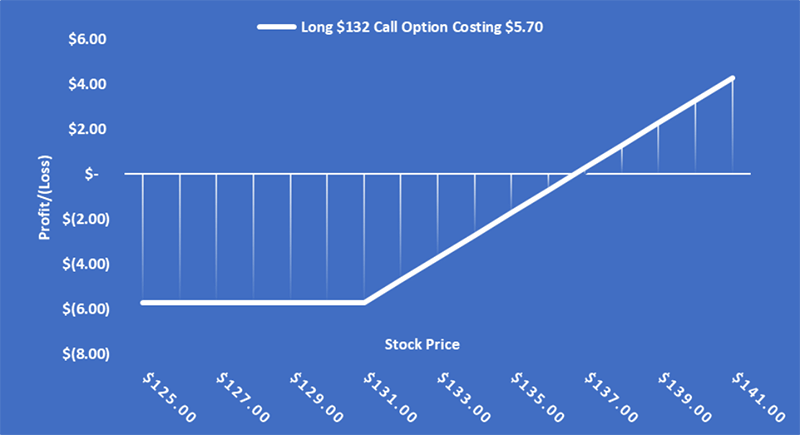

Looking at Nvidia's option chain, we can see the $132 strike call option expiring in 23 days trades for $5.70. As a buyer, you'd pay $570 ($5.70 x 100 shares). To break even at expiration, Nvidia would need to reach $137.70 – your strike price plus the premium paid.

The payoff graph looks like this:

How Selling Options Works:

When you sell an option, you're collecting premium in exchange for taking on an obligation to:

- Sell shares at a fixed price (call option)

- Buy shares at a fixed price (put option)

As an option seller, you receive payment upfront but take on substantial risk if the trade moves against you.

Unlike buying options where losses are capped at your premium paid, selling calls exposes you to unlimited losses if the stock rises, while selling puts risks significant losses if the stock falls sharply.

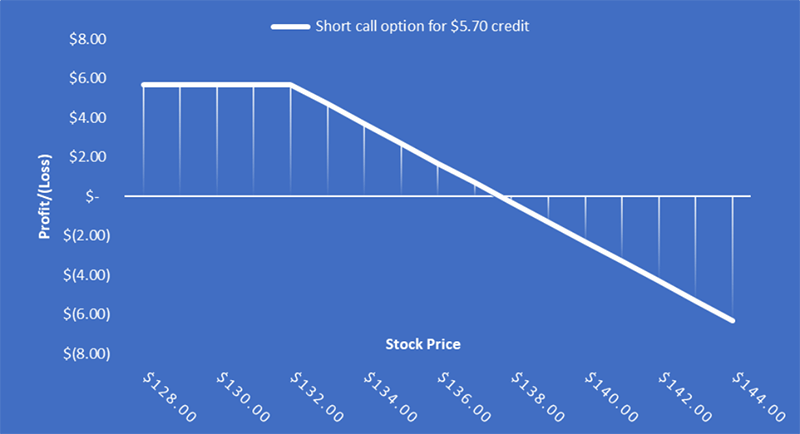

Let's see how this plays out using Nvidia's current option chain:

Using the same option as an example, you'd collect $570 upfront as a seller. However, your potential loss is significant if Nvidia's stock surges higher, as you'd be obligated to deliver shares at $132 no matter how high the stock climbs.

The payoff graph for selling the call option looks like this:

These opposing payoff structures create three critical distinctions between buying and selling options:

- Time Decay (Theta): Time decay works against option buyers, reducing their option's value daily. Meanwhile, sellers profit from this decay, earning a portion of their collected premium each day.

- Probability of Profit: Option buyers typically have a lower probability of profit (around 25-40%) but higher potential returns. Option sellers enjoy higher win rates (often 60-75%) but face larger losses when they're wrong.

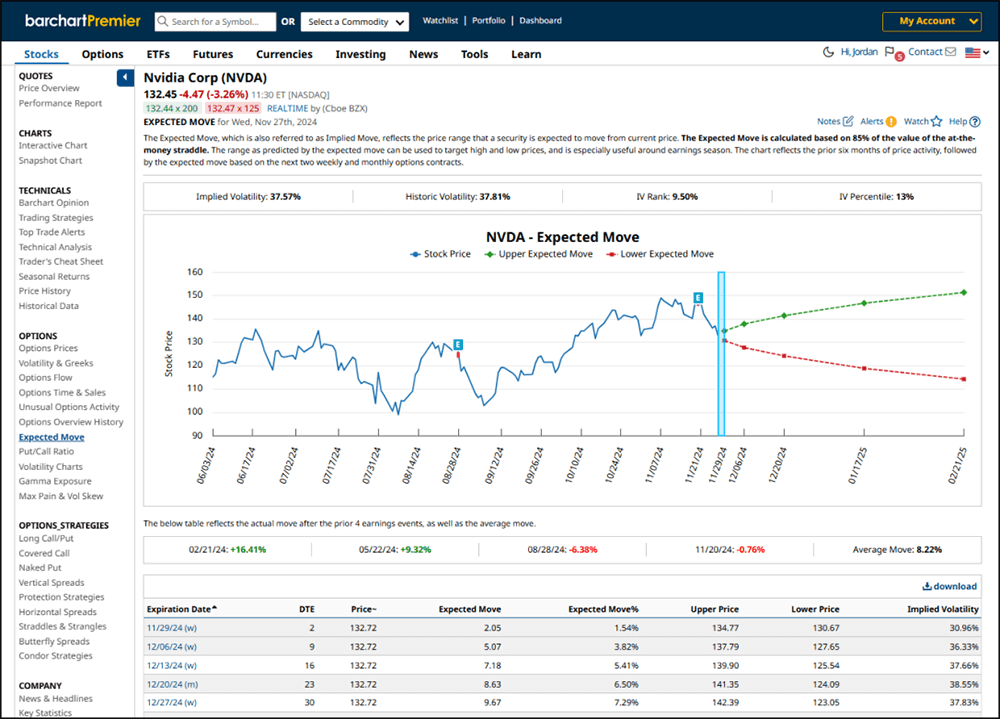

- Impact of Volatility: Using Barchart's Expected Move tool below, we can see Nvidia's implied volatility currently sits at 37.57% with an IV Rank of 9.50%. This tells us option prices are relatively cheap compared to historical levels. Option buyers want to purchase when IV is low like this, while sellers prefer elevated IV levels where they can collect more premium.

The expected move chart shows NVIDIA's historical price movement patterns and projects a potential $8.63 swing in either direction over the next 23 days. This helps traders assess whether current option prices align with the stock's typical volatility.

This natural tension between buyers and sellers creates opportunities for both strategies. The key is understanding when to employ each approach based on market conditions and your trading objectives.

Understanding Why Options Buyers Struggle

The allure of options buying is undeniable. Stories of traders turning a few hundred dollars into thousands capture our imagination. Yet the reality is more complex.

Let's examine why many options buyers face challenges and, more importantly, how to overcome them:

The Mathematics of Multiple Trades

Many new traders focus on single-trade potential without considering the impact of a series of trades. Here's why this matters:

If you lose 50% on a trade, you need a 100% gain just to break even. String together a few losses, and the math becomes even more challenging. Lose 50% three times in a row, and you need a 700% winner just to get back to your starting point.

This isn't meant to discourage options buying but to highlight why position sizing and risk management are crucial.

The Volatility Trap

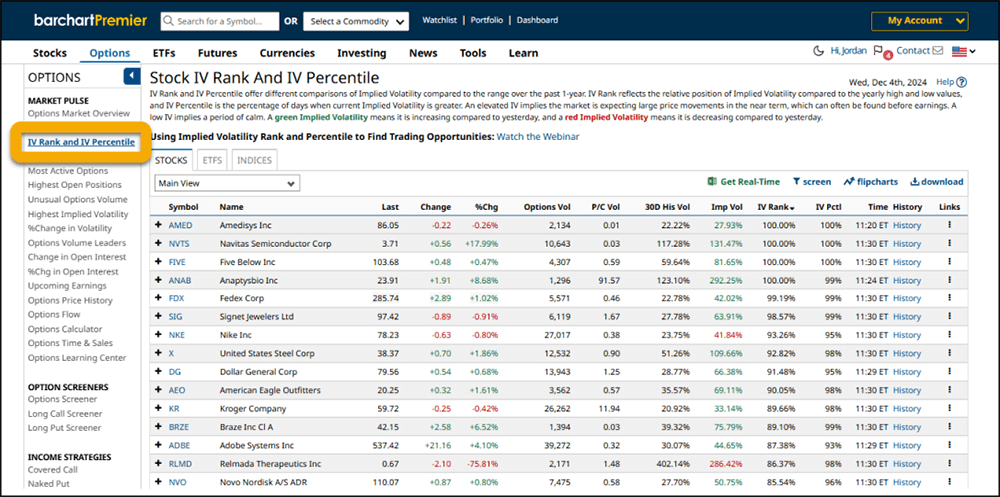

Many traders buy options when implied volatility is high, effectively overpaying for their positions. Using Barchart's IV Rank indicator, you can quickly identify when options are historically expensive or cheap.

Here's what to look for:

- IV Rank below 25%: Options are relatively cheap

- IV Rank above 75%: Options are relatively expensive

The best opportunities for options buyers often come when IV Rank is low, giving you more runway for profitable trades.

Using Barchart’s IV Rank & IV Percentile prebuilt scanner, you can quickly locate and sort stocks with the highest or lowest IV Rank or IV Percentile as shown below.

You can also view the IV Rank and IV Percentile for individual stocks in “Options Overview” within the Price Overview.

Timeframe Misalignment

Many traders choose expiration dates that are too close, giving their trades insufficient time to work out. While shorter-dated options are cheaper, they're also more susceptible to time decay.

Using Barchart's Expected Move calculator helps you better align your timeframe with the stock's typical movement patterns. For example, if the Expected Move shows a stock typically needs 30 days to move 5%, buying weekly options expecting that same movement is setting yourself up for failure.

We can use the NVDA graphic from earlier to see how the expected move dollar amount and percentage changes as the expiration cycles extend into the future.

A Better Approach to Buying Options

Instead of viewing options buying as a way to get rich quickly, successful traders approach it as a strategic tool. Here's how:

- Use Barchart's IV Rank to time entries when options are relatively cheap

- Align trade duration with expected move projections to increase the probability of success

- Size positions small enough to survive a string of losses

- Focus on high-probability setups rather than lottery tickets

By understanding these challenges and using the right tools to address them, you can improve your odds of success as an options buyer. However, this also helps explain why many professional traders prefer to sell options – a strategy we'll explore in the next section.

The Professional Edge in Options Selling

While buying options offers the allure of large gains, selling options provides distinct advantages that attract professional traders. The key lies in understanding probability and leveraging time decay to your advantage.

The Power of Being the House

Think of options sellers like casino operators. Just as casinos rely on a small statistical edge played out over thousands of hands, options sellers profit from high-probability trades repeated consistently.

Using Barchart's Options Screener, you can find high-probability setups by filtering for:

- Options with elevated IV Rank/Percentile

- Strikes with specific probability of profit

- Minimum volume and open interest levels

Premium Collection Mechanics

Unlike buyers who need to correctly predict both direction and timing, sellers can profit in multiple ways:

- Stock moves in their favor

- Stock stays flat

- Stock moves slightly against them but not beyond break-even

Using Barchart's Expected Move calculator helps determine appropriate strike prices that balance premium collection with probability of success.

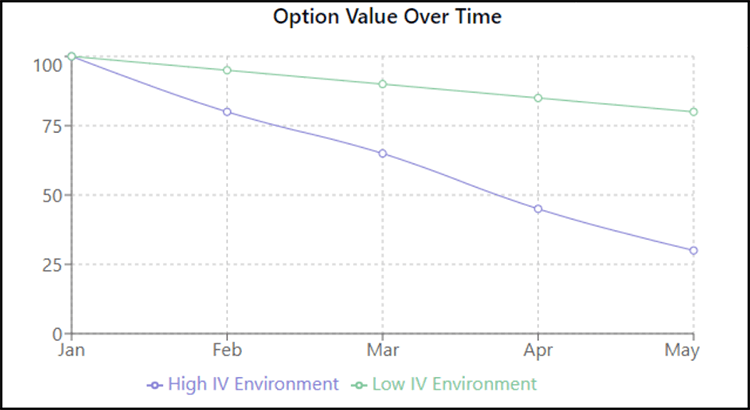

Managing Risk Through Implied Volatility

Professional sellers use elevated implied volatility to their advantage. Since IV tends to revert to its mean over time, selling options when IV sits well above normal levels provides a statistical edge.

Looking at NVIDIA's data, we can see its IV Rank is currently 9.50%, with options implying a $8.63 move over the next 23 days. At these levels, put options would pay relatively small premiums since IV is near yearly lows.

Compare this to when IV Rank is high - the same put options might pay 2-3 times more premium while still having the same probability of success.

This difference in premium directly impacts your margin of safety and potential returns.

Position Sizing for Sustainability

While options buyers risk only their premium, sellers face larger potential losses. Professional traders address this through careful position sizing:

- Limiting individual positions to 1-3% of portfolio value

- Spreading risk across multiple uncorrelated underlyings

- Focus on liquid options with sufficient volume and open interest

- Using strategies like spreads to cap potential losses

By focusing on these core principles and leveraging the right tools, sellers can build a sustainable edge in options trading. The key is consistency and disciplined risk management rather than seeking outsized gains on individual trades.

Final Thoughts

Success in options trading isn't about exclusively buying or selling - it's about understanding when each strategy offers the best opportunity. While buying options provides defined risk with unlimited upside potential, selling options harnesses the power of time decay and probability.

The key is matching your strategy to current market conditions:

- High IV environments favor sellers

- Low IV environments benefit buyers

- Portfolio size and risk tolerance shape position sizing

- Proper tools and analysis improve timing

By understanding these dynamics and using Barchart's suite of options tools, you can make more informed decisions about when to buy and when to sell.

FAQ

What's the minimum account size needed for options selling?

Account minimums vary by broker and strategy. While covered calls can be implemented with as little as 100 shares plus options approval, other selling strategies may require margin accounts with larger balances.

Which options strategy has the highest probability of profit?

Selling out-of-the-money options typically offers the highest probability of profit but comes with larger potential losses if the trade moves against you.

How do I know if I should be a buyer or seller?

Consider your account size, risk tolerance, and market conditions. High IV environments generally favor sellers, while low IV environments benefit buyers.

What's the most important metric to watch when trading options?

Implied volatility relative to its historical levels (IV Rank/Percentile) helps determine whether options are expensive or cheap, making it crucial for both buyers and sellers.