Types of Options Trading: Complete Guide to Stock Options

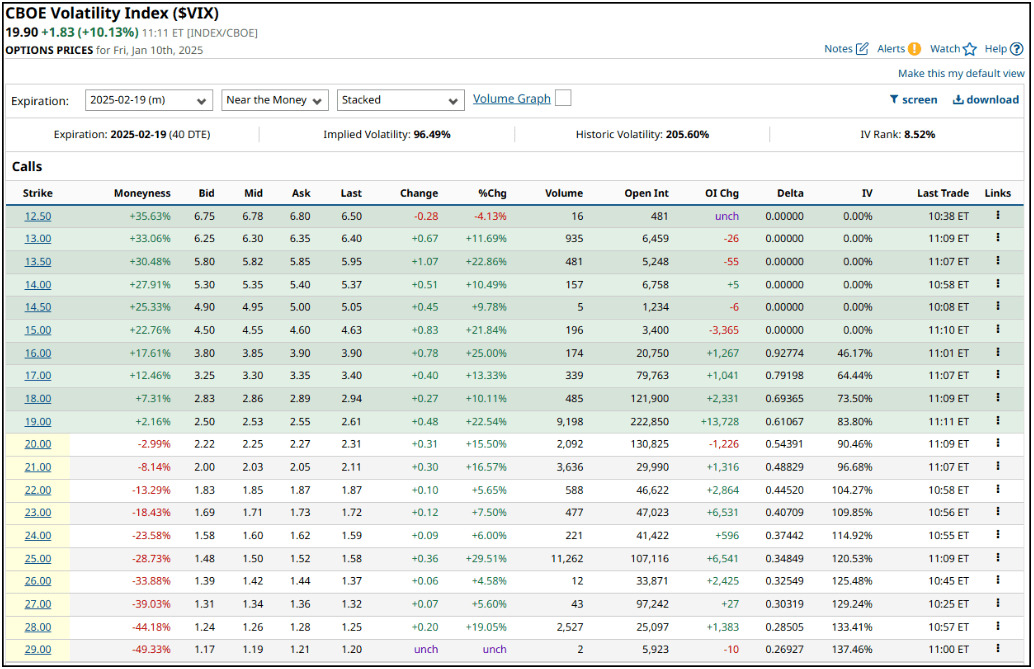

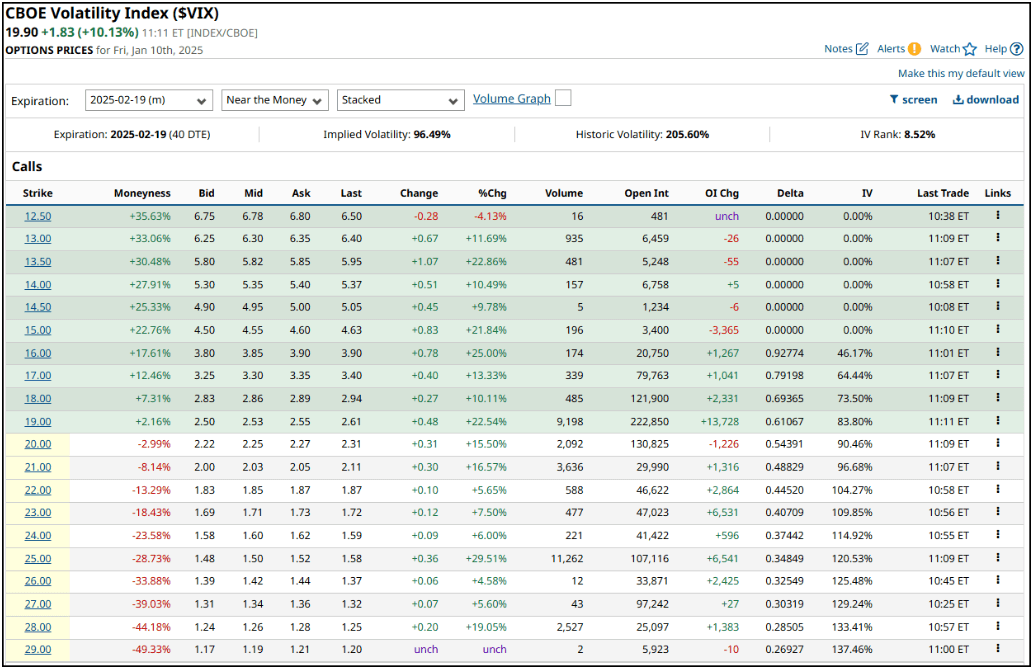

The VIX surged over 10% in a single day - jumping from around 17 to nearly 20.

Yet VIX call options expiring in 40 days barely moved. Even deep in-the-money calls showed surprisingly small changes.

This isn't a glitch - it's a perfect example of how different option types behave in ways that can catch traders off guard.

The muted reaction stems from settlement rules unique to VIX options, which are European-style and reflect expectations for volatility at expiration—not current levels.

This single detail about settlement style can transform what looks like a perfect volatility trade into a frustrating position.

Professional traders leverage these distinctions to their advantage, knowing exactly when to use stock options, index options, ETF options, or futures options to maximize their trading outcomes.

In this guide, you'll learn:

- The key differences between option types and when to use each

- How settlement styles impact your trading decisions

- Which options work best for different strategies

- How to use Barchart's tools to analyze trading opportunities

- Practical ways to manage risk across option types

Let's explore what makes each option type unique and how to use them effectively in your trading.

Understanding Different Types of Options

If you're new to options trading, the variety of choices can feel overwhelming.

Should you trade Apple stock options or the entire Nasdaq through index options? What about ETFs or futures?

Each type serves a unique purpose, and choosing the right one can make or break your trading strategy. There are three main types of options.

Stock Options: The Building Blocks

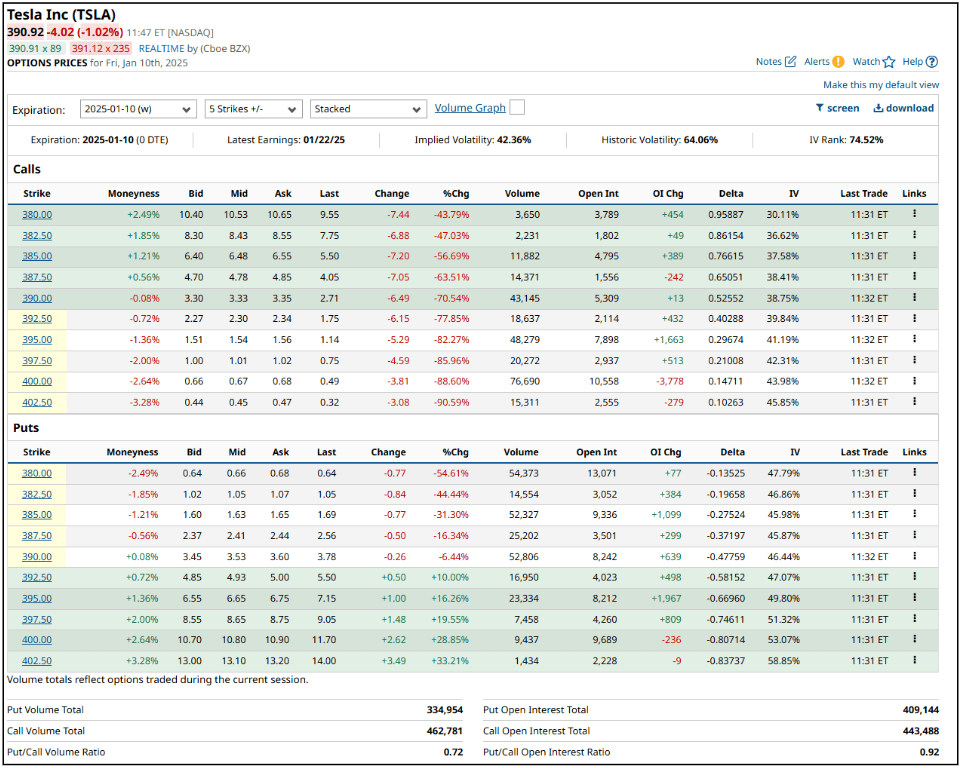

Walk into any trading room, and you'll hear familiar names - Tesla calls, Amazon puts, SPY options. These are the building blocks of options trading, and they share common DNA that makes them perfect for beginners and professionals alike.

Think of stock options like ordering a meal for one - you're getting exposure to a single company.

ETF options? That's like ordering a buffet—you get a basket of stocks in a single trade.

Want to trade the entire tech sector? XLK options have you covered.

Looking for broad market exposure? SPY options let you trade all 500 S&P stocks with a single click.

Both types share key features that make them trader-friendly:

- Exercise them anytime before expiration (American-style)

- Get real shares when you exercise (physical settlement)

- Control 100 shares per contract

- Trade them from 9:30 AM to 4:00 PM ET

Using Barchart's options chain, you’ll see similar metrics like volume for activity, open interest for positioning, and implied volatility to gauge cost.

Index Options: Trading Market Direction

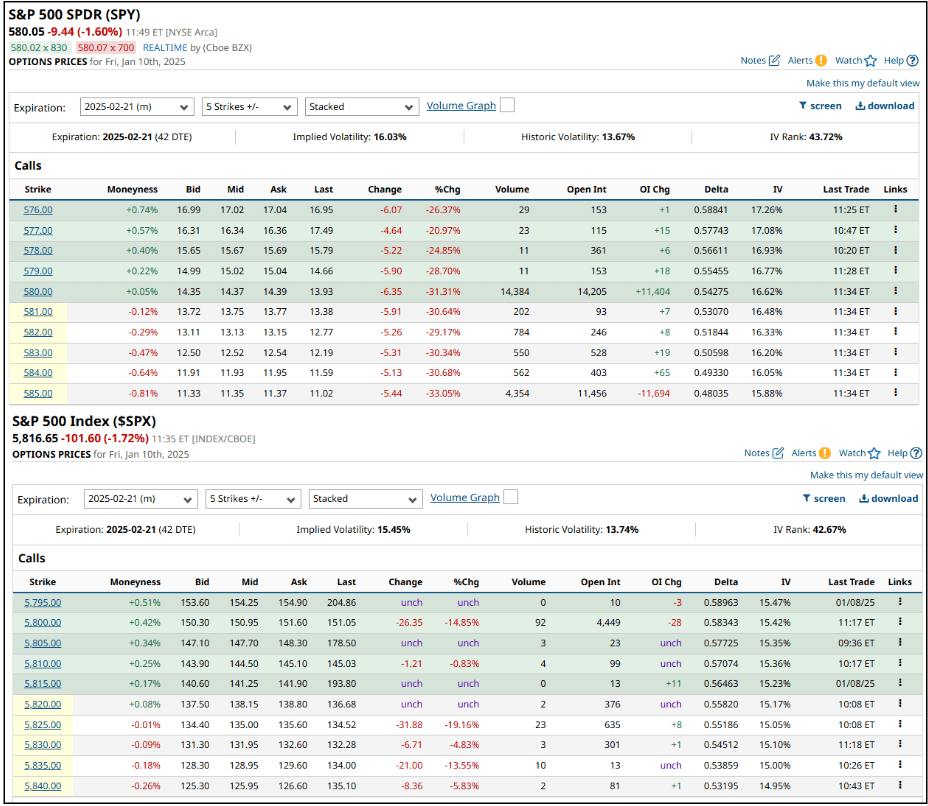

Step into the world of index options like the S&P 500 (SPX) or Nasdaq-100 (NDX), and the rules change.

Remember our VIX example from earlier? That wasn't just a quirk - it's a perfect window into how index options play by different rules.

Unlike their stock and ETF counterparts, index options are more like a cash-settled bet on market direction. No shares change hands, and you can only exercise at expiration. It's a purer form of market exposure, often with better tax treatment to boot.

Key differences from stock options include:

- E European-style exercise (only at expiration)

- Cash settlement (no physical shares delivered)

- Larger contract values than ETF equivalents

- Better tax treatment (60/40 rule)

- No early assignment risk

- No dividend complications

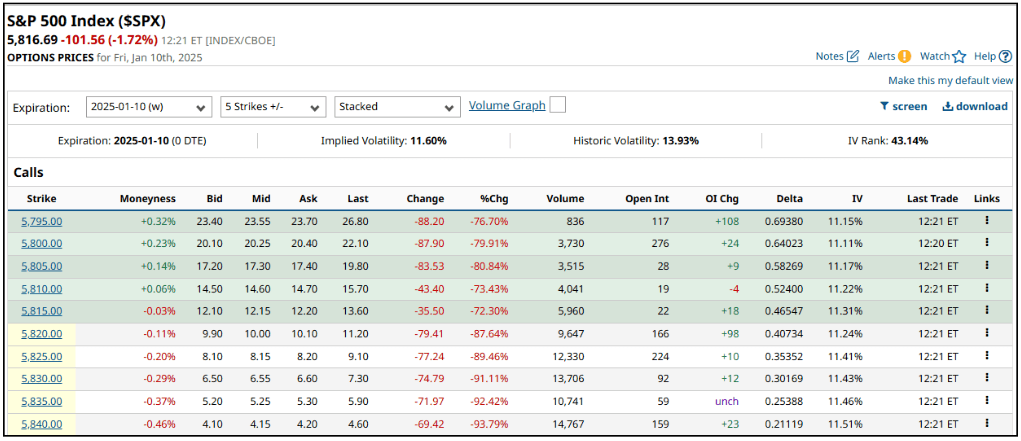

Want to see how differently these behave?

Pull up SPX and SPY options side by side in Barchart's platform. Same market, different instruments, and sometimes surprisingly different results.

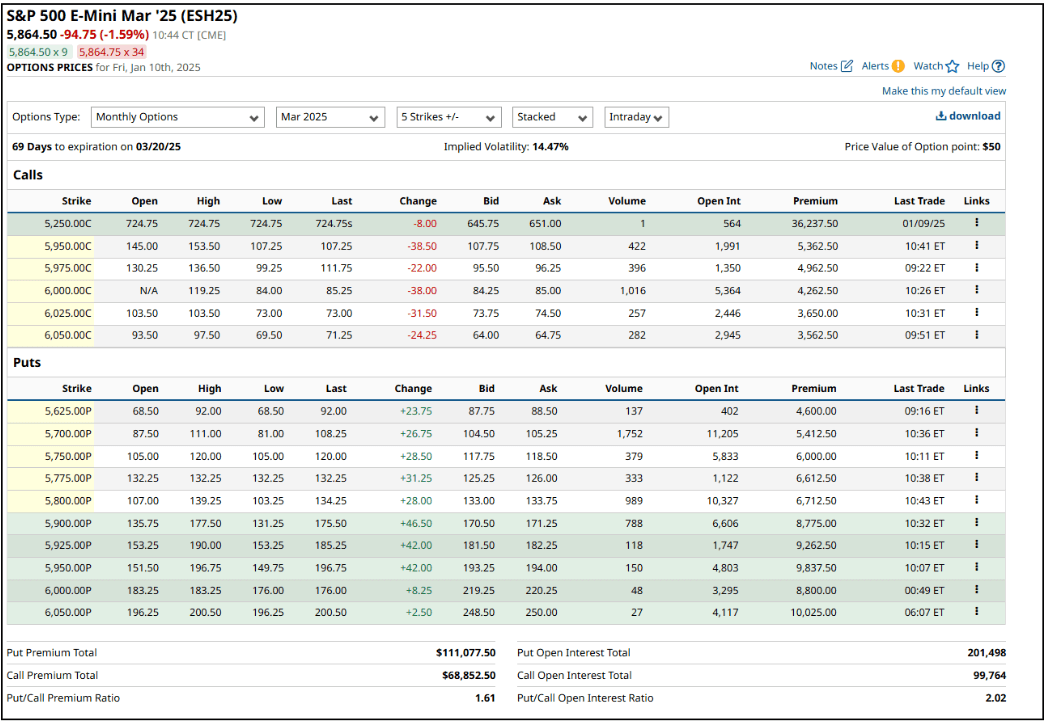

Futures Options: Trading Beyond Stocks

Futures options add another layer to the trading landscape by giving you the right to buy or sell futures contracts instead of stocks. This opens up entirely new markets - commodities like oil and gold, currencies, even VIX futures - but it also introduces new complexities.

Let's break down what makes futures options unique:

Key Characteristics:

- Exercise into futures contracts, not shares

- Most are American-style exercise

- Different expiration cycles than stock options

- Trade nearly 24 hours a day

- Often larger contract sizes

- Unique margin requirements

- Different tax treatment (Section 1256 contracts)

Take the popular E-mini S&P 500 futures options (ES). Exercise a call option? Instead of getting SPY shares like you would with an ETF option, you'll receive an E-mini futures contract.

That's why understanding futures trading becomes essential before diving into futures options.

Using Barchart's Futures Options Chain, let’s analyze the ES options.

Looking at today's ES options chain, we can see these characteristics in action:

- Each contract point is worth $50, making that 5,950 call worth $5,362.50 ($107.25 × 50)

- With 69 days until expiration, implied volatility sits at 14.47%

- Active trading across both calls and puts, with over 300,000 contracts of total open interest

- A put/call open interest ratio of 2.02 suggests traders are positioning defensively

The chain also reveals important market dynamics through the put/call ratios. With a premium ratio of 1.61, more money is flowing into puts than calls, while the higher open interest ratio indicates traders have been building defensive positions over time.

Settlement Styles: Where Theory Meets Reality

Remember our VIX example? Well, settlement styles create similar disconnects across all option types - but few traders notice until it impacts their P&L.

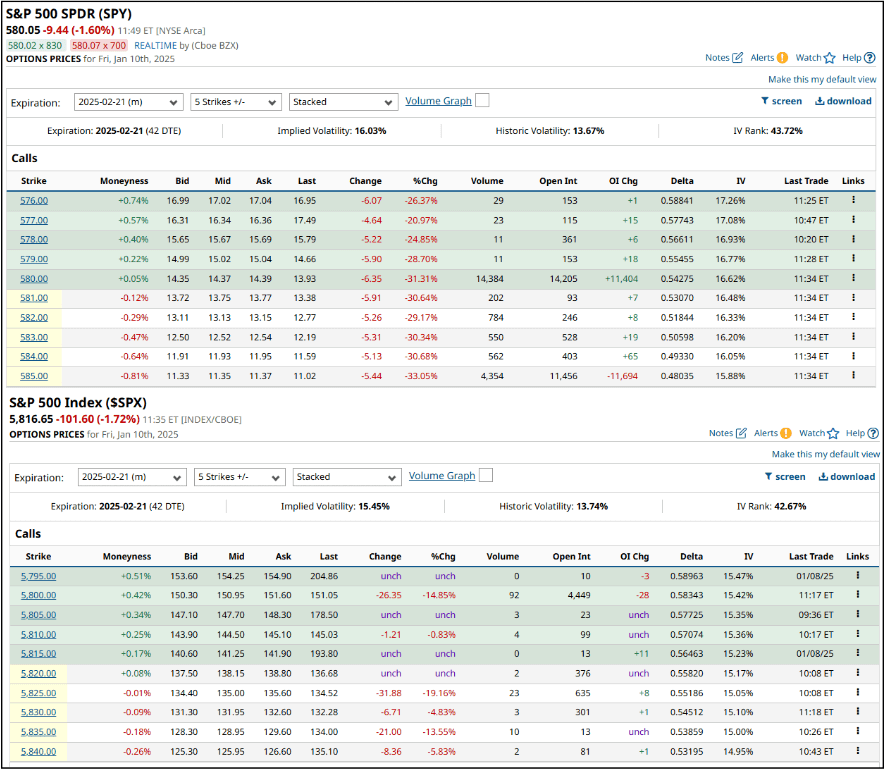

Let's look at a perfect example playing out in the S&P 500 market right now.

Pull up SPY and SPX options side by side in Barchart's platform, and you'll spot something interesting: Looking at the February options, you can see a stark difference in how these contracts are priced. The SPY 580 call trades around $14.37, while the equivalent SPX 5,800 call (adjusted for the 10x multiplier) trades for $150.95.

That's a $7.25 difference per share ($150.95 vs $143.70) - not exactly pocket change when you're trading multiple contracts.

Why the gap? It's not just academic - this price difference stems from three critical settlement distinctions.

| Feature | SPY Options | SPX Options |

|---|---|---|

| Settlement Style | American | European |

| Settlement Method | Physical (Shares) | Cash |

| Contract Size | $50,000 Notional | $500,000 Notional |

| Tax Treatment | Standard Stock Rules | 60/40 Rule |

These differences create real trading opportunities - if you know how to spot them.

The Hidden Impact of Dividends

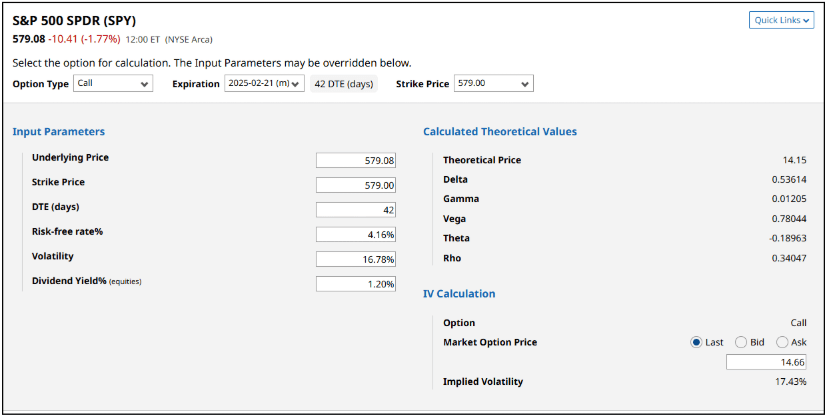

Let's dive deeper using Barchart's Options Calculator to see how these settlement differences play out in practice.

Notice how the calculator factors in SPY's 1.20% dividend yield?

That dividend expectation directly impacts option pricing - especially for American-style options where early exercise becomes a consideration.

Without that dividend, the theoretical value of that $579 call option from above jumps from $14.15 to $14.59

Deep in-the-money SPY calls might be exercised early to capture a dividend, while equivalent SPX options can't be exercised early at all. This creates opportunities around dividend dates that savvy traders exploit.

Making Settlement Work For You

Understanding settlement isn't just about avoiding surprises - it's about choosing the right tool for your strategy.

Trading broad market direction? SPX options eliminate early assignment risk and offer better tax treatment. The cash settlement means no shares to manage at expiration.

Want to run a covered call strategy? SPY options let you exercise early if needed and align perfectly with actual share ownership.

Here's a quick guide for choosing the right settlement style:

Use American-style (like SPY) when:

- Running strategies involving share ownership

- Trading around dividends

- Wanting flexibility to exercise early

- Managing smaller position sizes

Use European-style (like SPX) when:

- Trading pure directional views

- Seeking tax advantages

- Wanting no early assignment risk

- Trading larger position sizes

While picking the right settlement style sets the foundation for your trade, turning that choice into consistent profits requires careful attention to risk management.

Practical Risk Management

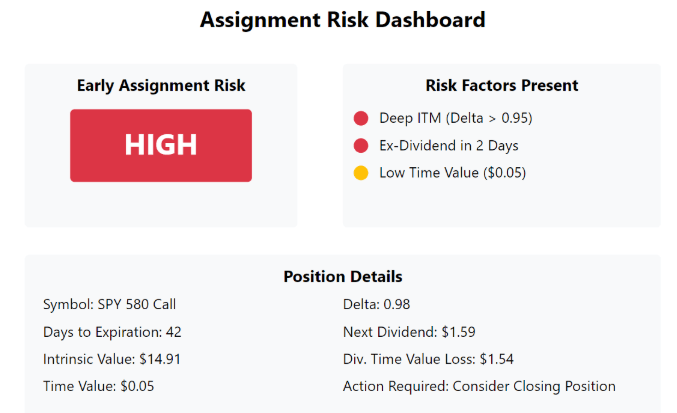

Settlement style affects more than just pricing - it changes how you manage risk. Let's look at a an example of how you might do assignment risk analysis:

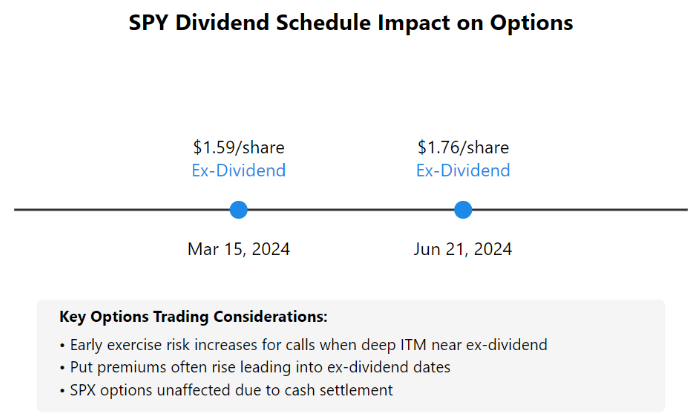

Looking at our SPY 580 call option, we can see three critical risk factors converging:

- The option is deep in-the-money with a delta of 0.98

- There's an upcoming dividend in 2 days

- The time value has eroded to just $0.05

This creates the perfect storm for early assignment.

Why?

Because with only $0.05 in time value remaining and a $1.59 dividend approaching, option holders can make an extra $1.54 per share by exercising early rather than waiting for expiration.

This scenario highlights why monitoring settlement risk is crucial:

For American-style options (like SPY):

- Track the time value vs upcoming dividends

- Watch for deep in-the-money positions (delta > 0.95)

- Consider closing positions before ex-dividend dates

For European-style options (like SPX):

- Focus on cash settlement impact near expiration

- Pay attention to position sizing due to larger contract values

- Understand the special opening quotation rules for settlement

Understanding these nuances isn't just about avoiding surprises - it's about transforming settlement style from a potential risk into a strategic advantage.

By choosing the right option type and actively monitoring assignment risk factors, you can build more robust trading strategies that align with your goals while minimizing unwanted assignments.

Trading Strategies With Barchart

Remember that VIX example we started with? Well, it perfectly illustrates why matching your strategy to the right option type can make or break your trading results.

Let's look at three strategies that showcase how different option types create unique opportunities - and how to spot them using Barchart's tools.

Volatility Trading: The VIX Puzzle

Today's VIX options market tells a fascinating story about how professional traders think about volatility.

Look at the February VIX options expiring in 40 days. Even with the VIX jumping over 9% today, these options barely moved. The 19 strike calls only rose about 22% despite being at-the-money.

Seems broken, right?

But check out what happened to the options expiring in just 12 days:

The near-term 19 strike calls jumped over 35%. Same index move, similar strike price, yet a completely different reaction.

This isn't random - it's exactly what savvy volatility traders expect.

European-style VIX options price based on where traders think volatility will be at expiration, not where it is today.

This creates two key opportunities:

- Short-term options react more to VIX spikes, making them better for directional trades

- Longer-dated options stay more stable, perfect for premium selling when volatility is elevated

Notice how the implied volatility (IV) differs dramatically between expirations - 123.64% for January versus 96.01% for February. This "term structure" of volatility offers opportunities for calendar spreads that other option types can't match.

Professional volatility traders use these distinctions to their advantage, often trading VIX options against VIX ETF options to capitalize on their different settlement styles and behaviors.

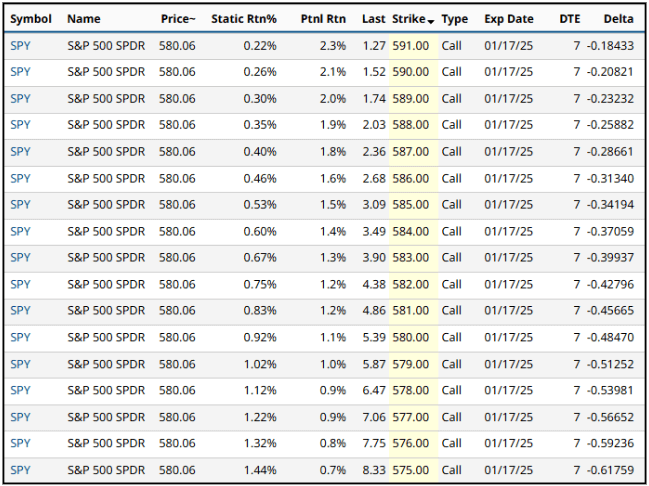

Covered Calls: Finding the Sweet Spot

While VIX options reward complex strategy, sometimes the simplest trades work best - like covered calls on SPY.

This SPY options chain reveals a classic covered call setup.

With SPY trading at $580.06, we can see a range of strikes offering different tradeoffs between immediate income and potential upside.

Look at how the potential returns line up:

- Conservative $591 calls: 0.22% static return but 2.3% if called

- Moderate $585 calls: 0.53% static return but 1.5% if called

- Aggressive $575 calls: 1.44% static return but 0.7% if called

The strike price you choose depends less on the option type and more on your market outlook. But the beauty of using ETF options for covered calls lies in their American-style exercise.

Unlike index options, you can adjust your position before expiration if needed. Rolling calls up and out becomes smoother since you're not locked into European-style exercise dates.

Plus, SPY options trade until 4:15 PM Eastern, giving you an extra 15 minutes to manage positions after the market closes - a small but important edge when you need it.

Spread Trading: Capital Efficiency

Speaking of edges, let's talk about one of the most dramatic differences between ETF and index options - position sizing for spreads.

While SPY and SPX options might track the same market, their contract sizes create very different dynamics for spread traders.

A single SPX option controls roughly $500,000 of notional value versus $50,000 for SPY. That 10x difference means the same spread strategy requires different approaches:

A 5-point spread on SPX might cost $2,450 to implement, while the equivalent 0.50-point spread on SPY would cost about $240.

This size difference creates natural preferences in the market:

- Smaller accounts tend to favor ETF spreads for position sizing flexibility

- Larger accounts often choose index spreads for tax efficiency and reduced transaction costs

- Professional traders might use both, selecting the right tool based on their specific goals

Looking at today's market, we can spot how this plays out.

With SPY trading at $580.06, let's compare two similar bullish positions:

A SPY call spread:

- Buy the $580 call for $5.87

- Sell the $585 call for $3.49

- Net cost: $2.38 ($238 per spread)

The equivalent SPX position would cost about $2,380 - controlling 10x more market exposure but requiring 10x more capital.

This capital efficiency drives real trading decisions. Want to scale into a position gradually? SPY spreads let you build in $240 increments. Trading a larger account? A single SPX spread might save you multiple commission charges.

But there's more to consider than just position size. Those index options come with unique advantages:

- European-style exercise eliminates early assignment risk

- Cash settlement means no shares to manage

- Favorable 60/40 tax treatment on gains

These features explain why professional traders often use both products - SPY spreads for flexibility and SPX spreads for efficiency.

Final Thoughts

Understanding different option types isn't just about knowing the mechanics - it's about matching the right tool to your trading goals.

Stock options give you precision when trading single companies. ETF options offer flexibility with lower capital requirements. Index options provide tax efficiency and eliminate early exercise risk. And futures options open doors to round-the-clock trading and different asset classes.

Your success depends less on which type you choose and more on how well that choice aligns with your strategy and resources.

Remember:

- Start with the strategy you want to trade

- Consider your account size and tax situation

- Choose the option type that best fits both

- Use Barchart's tools to analyze opportunities across all types

FAQ:

What's the main difference between ETF and index options?

Index options are European-style with cash settlement, while ETF options are American-style with physical settlement. Index options also typically control 10x more notional value and get preferential tax treatment.

Which option type is best for beginners?

ETF options often work best for beginners due to smaller contract sizes and familiar names. SPY options, for example, let you start with positions under $500.

Do I need different approvals to trade different option types?

Yes. While stock and ETF options typically require basic options approval, index options and futures options often need additional approvals from your broker.

How do settlement styles affect my trading?

American-style settlement (stock/ETF options) allows early exercise but creates assignment risk. European-style settlement (index options) eliminates early exercise risk but limits flexibility.

Why do some traders use both ETF and index options for the same strategy?

Professional traders often use both because each has unique advantages. They might use SPY options when they need precise position sizing or want to leg into a trade gradually, while using SPX options for larger core positions to benefit from tax advantages and reduced commission costs. The choice often depends on market conditions, capital efficiency needs, and specific strategy requirements rather than one being strictly better than the other.