Short Iron Condor Option Strategy

Hi, and welcome to the Options Learning Center. I'm going to show you how to sell iron condors and use Barchart to get the most out of the strategy.

What is a Short Iron Condor?

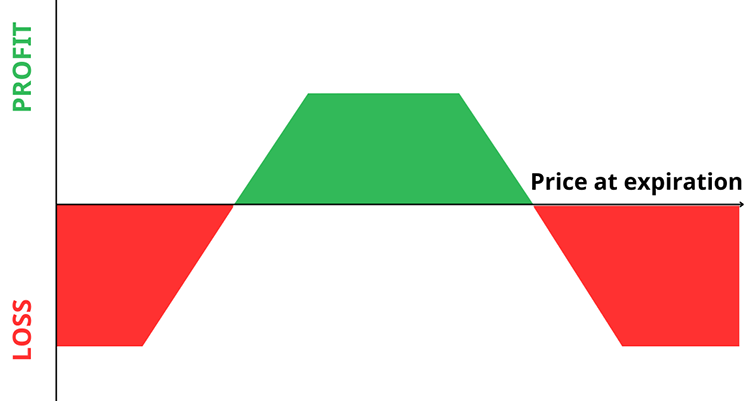

A short iron condor, or more usually known as just the iron condor, is a directionally neutral options strategy that combines two credit spreads: the bull put spread and a bear call spread, all using the same underlying security and expiration date. The fact this iron condor is short means that you will collect a credit.

The goal is for the underlying securities' price to remain between the short strikes until expiration and for all four options to expire worthless. When that happens, you'll enter the maximum profit condition and keep the net premium collected. If the underlying asset moves beyond the short strikes, the strategy will end up in a loss, however, it will be limited by the long options that act as a hedge.

Short Iron Condor Options Strategy:

- Neutral Market Strategy

- Bull Put + Bear Call

- Same Asset & Expiration

- Profit: Stock Price Trades Within Short Strikes

- Max Profit: Net Premium

- Loss: Stock Price Trades Beyond Short Strikes

Trade Examples

A short iron condor can be set up either by looking for new opportunities or with a specific stock or ETF in mind.

Screening The Market For Short Iron Condor Trades

To access the Short Iron Condor screener, go to Barchart.com, click on the Options tab, and then click on Short Iron Condor Screener. This will immediately bring you to the Results page, where you can find likely trades.

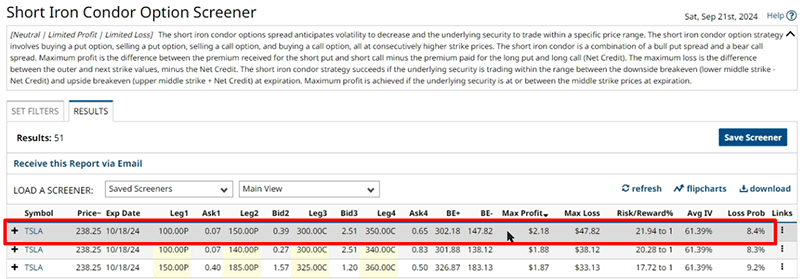

The default results page includes relevant trade information, like the trade legs, max profit, max loss, and probability of loss. Each column header can be clicked, allowing you to arrange the results from the highest to lowest of your chosen column header.

These results are already a perfect start that will offer you a healthy balance of risk and reward, while offering various trade ideas you can choose from. However, if you want a more granular search, open the Set Filters tab at the top left of the page. This brings you to a page which contains default filters for this specific strategy.

Filters range from options details to stock and company information like financials, technical analysis, and so on. Everything you might ever need is right here on the screener.

I do want to bring your attention to the Probability of Loss.

Generally, short iron condors have higher risk/reward ratios than most trades, so you'll likely want to keep your chance of loss to a minimum. The default value for the probability of loss is less than 50%, but I like trades heavily skewed in my favor, so I'll set the probability to less than 10%. Now, it's important to know that the lower the probability of loss, the lower the potential profit.

Let's click on See Results. I'll arrange the results according to the highest maximum profit to find a potential trade.

But before we proceed with the trade example, it's important to know that you can also save your screener to reuse it later. You can also have Barchart email you at a specified time with all the newest trades that match your filters. Just click Save Screener near the top right, then type in the name of the screener and click on when you want the email to arrive.

Let's use the first trade idea here on the list for illustration purposes.

This is a short iron condor on TSLA. Here's how it works.

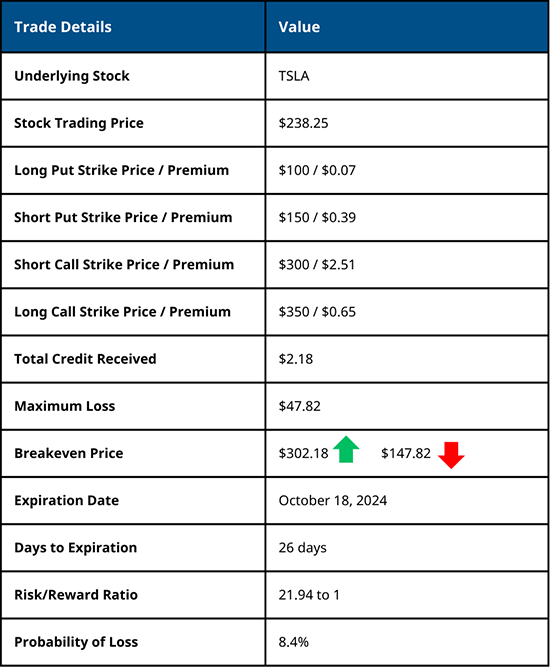

First, Tesla stock is currently trading at $238.25. You'll sell the $300-strike call and collect $2.51 per share and buy the $350-strike call for $0.65 per share. On the put side, you'll sell the $150-strike put and collect $0.39 per share, and then buy the $100-strike put for $0.07 per share.

This setup results in a total credit of $2.18 per share, or $218 total. Your maximum loss on the trade is $47.82 per share, with breakeven prices at $302.18 and $147.82. All options expire on October 18, 2024, 26 days from the scan date, and the trade has a risk/reward ratio of 21.94 to 1, with an 8.4% probability of loss.

Let's go ahead and break down the trade.

Profit Scenario

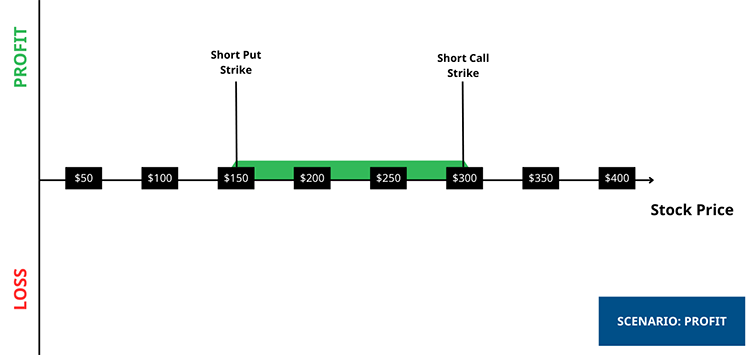

With this short iron condor, you want Tesla stock to trade between $150 and $300. Those are your short strikes at expiration. So, let's say Tesla's stock price trades at $240 by expiration. This means that all four options expire out of the money, and you get to keep the full premium credit for the trade, which is $2.18 per share, or $218 total.

To calculate the maximum profit, simply add the premium received from the short options, then subtract the premiums paid for the long options.

Credit Received: $0.39 + $2.51 = $2.90

Debit Paid: $0.07 + $0.65 = $0.72

Total Profit: $2.90 - $0.72 = $2.18

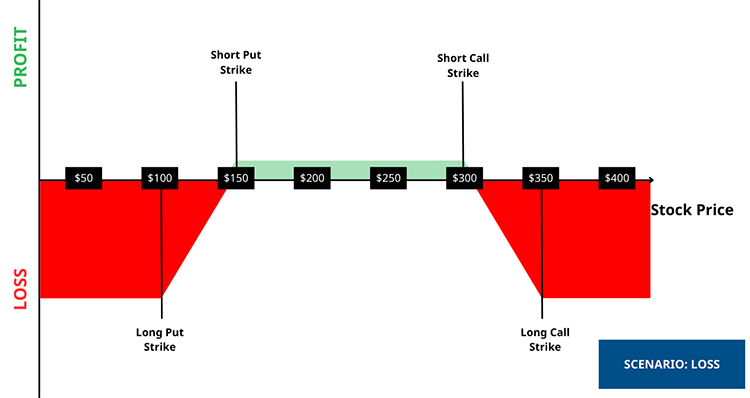

Loss Scenario

If, however, the price of Tesla stock trades beyond your long option strike prices, you'll hit the maximum loss condition for the trade.

To calculate the maximum loss, you can take the difference between the strike prices of one side of the trade (called the width of the spread) and subtract the net premium you received at the start. In this case, the width is $50, and you collected $2.18 in premium, making your maximum loss $47.82 or $4,782 per contract.

If, however, the price of Tesla stock trades beyond your long option strike prices, you’ll hit the maximum loss condition for the trade. To calculate the maximum loss, you can take the difference between the strike prices of one side of the trade (called the width of the spread) and subtract the net premium you received at the start. In this case, the width is $50, and you collected $2.18 in premium, making your maximum loss $47.82 or $4,782 per contract.

$150 - $100 = $50

$50 - $2.18 = $47.82 x 100 = $4,782

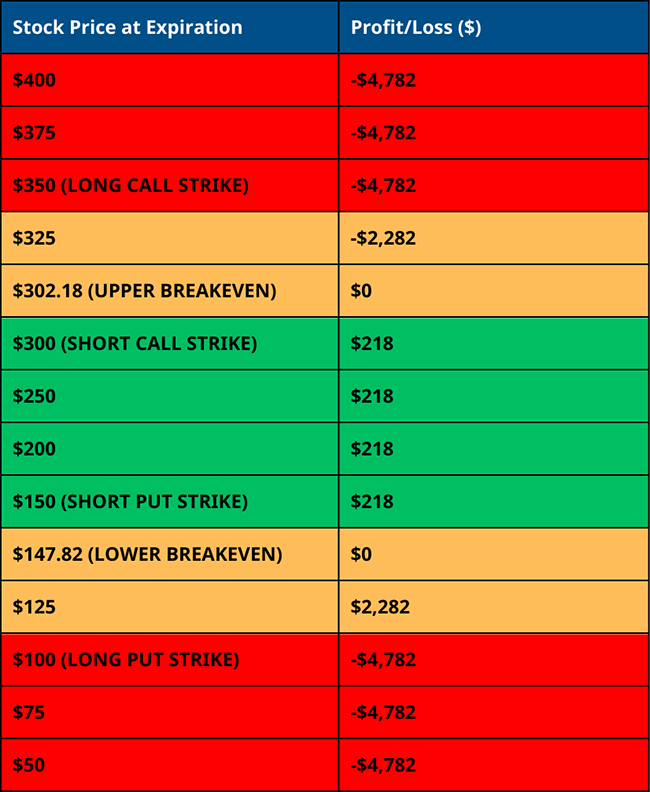

Profit/Loss Scenarios Across Different Price Points

Here's how the trade would look like if Tesla reaches certain prices at expiration:

As you can see, if Tesla's price stays within the short strikes at expiration, you'll achieve maximum profit. Meanwhile, any price movement beyond the long strikes will result in maximum loss. The area between the long and short strikes will lead to partial losses or gains, depending on the price relative to the breakeven points.

Screening For Short Iron Condors With Specific Assets

So far, you've learned how to scan the market for short iron condor trades. But what if you wanted to use the strategy for a specific asset, like on Nvidia?

Barchart also allows you to search for short iron condors for a specific asset. All you need to do is go to the stock or asset's Price Overview page on Barchart.com. Once there, look for Condor Strategies. Then look for the Short Iron Condor tab. From here, you can change expiration dates, strike prices for the different trade legs, and rearrange the results based on different filters.

Pros and Cons

One of the biggest advantages of a short iron condor is its limited risk, which makes it a favorite of many traders. The profit range can also be quite broad, making the chances of profit better than many trades. However, maximum profits are capped.

Due to its neutral bias, short iron condors are great for low-volatility markets. It also hugely benefits from time or theta decay since options lose their value as they approach expiration. Lastly, flexibility is one of the most underrated benefits of a short iron condor, as you can adjust the trade by rolling strikes or expiration dates to manage risks, and improve profitability.

Pros:

- Limited Risk

- Wide Profit Range

- Excellent In Low-Volatility Markets

- Time Decay

- Flexibility

However, it's worth mentioning that short iron condors, like all short options trades, have limited profitability, which is capped at the net credit you receive. It is also vulnerable to massive price swings and requires accurate forecasting and analysis. Further, with its four trade legs, higher commissions, and trading fees are taken out of your profit. Iron condors can also be susceptible to early assignment on both the downside and upside, which can impact the trade.

Cons:

- Limited Profit

- Vulnerable To Significant Price Movement

- Requires Accurate Forecasting

- Complexity

- Assignment Risk

Conclusion

The short iron condor is a particularly popular trading strategy due to its limited risk profile, yet it requires a somewhat static market for it to work. That's why it's important to assess your trades closely, utilize every tool you have, including option screeners, and consider the chances of profit before jumping in.

If you'd like more information, visit the Barchart Options Learning Center, where you can find more information about the short iron condor, as well as all the trading strategies we have available.

Back to Top ↑