In Shakespeare’s Richard III, the iconic playwright wrote, “Now is the winter of our discontent made into a glorious happy summer by the accession to the throne of Edward of the House of York.” On May 6, 2023, King Charles of the House of Windsor will ascend to the throne at his official coronation. Meanwhile, the coming months could mark a winter of discontent in the UK and throughout Europe as scarce energy supplies cause high prices and some frigid days and nights.

Coal has been a four-letter word for those addressing climate change. Europe faces a winter where Russian natural gas supplies look likely to be a weapon in the economic war against “unfriendly” countries supporting Ukraine. Coal prices have risen to the highest in history in 2022, and they could move even higher over the coming months as cold weather descends over Europe.

Rotterdam coal corrected from its 2022 record peak

Before 2021, the all-time high for thermal coal for delivery in Rotterdam, the Netherlands, was in 2008 at $224 per metric ton.

The chart highlights the rise to a new record peak at $465 in March 2022. On October 14, the price was still above the pre-2021 high at the $258 level.

Newcastle coal prices remain near the all-time highs

Coal futures for delivery in Newcastle in New South

Wales, Australia, reached a peak of $139.05 per ton in 2011.

The chart illustrates that the Australian coal futures eclipsed the 2011 high in July 2021, reaching $457.80 in September 2022. At the $387.50 level on October 17, the November Newcastle coal futures were not far below the record high.

Russia will use the seasons to inflict pain on NATO members

As the war in Ukraine continues to rage, sanctions on Russia and Russian retaliation against “unfriendly” countries supporting Ukraine have choked off energy supplies to NATO members in Western Europe. The 2022/2023 peak heating season in the Northern Hemisphere is on the horizon, and Europe depends on Russian natural gas supplies to generate the electricity that powers heat. Unless the geopolitical landscape undergoes a significant change over the coming weeks, Western Europe could be left out in the cold during the frigid winter months.

Russia is using energy as a retaliatory economic weapon against the NATO members in Western Europe. While the region has embraced natural gas and shunned coal, the demand for coal will probably rise over the coming months as Europe looks to replace gas power generation.

Russia is a leading natural gas producer and the most influential non-member of OPEC, the international oil cartel. Meanwhile, Russia is the sixth-leading coal-producing country.

Source: Worldometers.info

The chart shows that Russia is behind Indonesia’s output but ahead of South Africa. While the Russians are only sixth in coal production, they are the third leading exporter of the energy commodity.

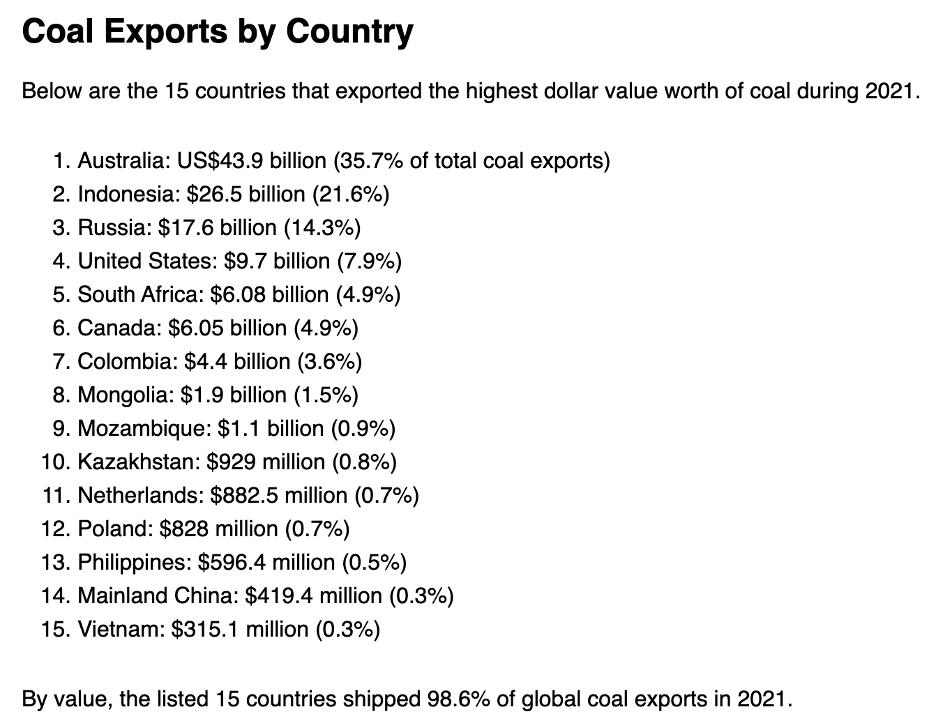

Source: Worldstopexports.com

Russia exported more coal than the US, accounting for 14.3% of the world’s exports in 2021.

China and India will consume more coal because of higher oil and gas prices

China and India may produce the most coal globally, but they are also the leading importers, and the two most populous countries account for 70% of global coal demand.

Source: Yearbook.enerdata.net

The chart shows that China and India dominate coal imports as their respective production is insufficient to meet domestic requirements. Australia, the leading coal exporter, is positioned as a coal supermarket for China and India.

Meanwhile, crude oil and natural gas prices at the highest level in years make coal, a less expensive fuel, even more attractive in the current environment. In July 2022, the IEA projected that despite a slowing global economy and lockdowns in China, soaring natural gas prices will push worldwide coal demand to an all-time high in 2022.

Fossil fuels continue to power the world

Over the past years, many countries, including the US and Western European nations, have established a timeline to reduce carbon emissions. A greener energy path to address climate change embraced alternative and renewable energy sources and shunned fossil fuels. However, crude oil, natural gas, and coal continue to be the energy commodities that power the world. China and India account for over one-third of the global population and continue to embrace coal for power generation.

The war in Ukraine has caused oil and gas prices to move to multi-year highs, and even though coal prices have gone along for the bullish ride, coal remains a cheaper alternative.

While coal prices have declined from the 2022 high, the coal markets could be in the eye of the bullish hurricane, and the coming months could see the prices move back to the 2022 peaks and beyond. A cold winter in Europe will cause plenty of discontent as all traditional energy prices could rise, and supplies may become scarce.

More Energy News from Barchart

- Crude Sharply Lower on Dollar Strength and Weak Chinese Fuel Demand

- Nat-Gas Follows a Slump in European Gas Prices

- Crude Falls on Dollar Strength and Weak Chinese Energy Demand

- Crude Moves Higher as the Dollar Retreats

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20showing%20a%20ray%20of%20light%20passing%20through%20cyberspace_%20Image%20by%20metamorworks%20via%20Shutterstock_.jpg)