.jpg)

Accuray Inc. (ARAY) is a medical device company dealing with the growth, production, and marketing of its customized treatment solutions for radiosurgery, intensity-modulated radiation therapy, image-guided radiation therapy, and stereotactic body radiation therapy. It aims to make cancer treatment shorter, safer, smarter, and more effective.

Incorporated in 1990, Accuray has expanded operations from its home base of the U.S. to tap into markets in Canada, Latin America, New Zealand, Australia, Europe, the Middle East, India, China, and the Asia-Pacific region.

Valued at $176 million by market cap, Accuray stock has plunged more than 37% this year, significantly underperforming the broad market. Shares of the penny stock, which trade below $2 each, fell 29% in a single session on May 2 as Wall Street reacted to its fiscal Q3 results.

ARAY Q3 Earnings Disappoint

Accuray swung to a Q3 loss of $6.3 million, or $0.06 per share, from its year-ago profit of $0.01 per share. The loss was wider than Wall Street expected, with analysts calling for a loss of $0.01 per share. Likewise, revenue fell 14.3% year over year for the period to $101.1 million, missing the estimated $113.65 million.

However, on the positive side, its gross orders improved by 21% to $89.1 million, while its book to bill ratio improved drastically to 1.8 from 1.2 in the previous year.

Management also posted its FY 2024 guidance, projecting full-year revenue in the range of $432 million to $437 million, with adjusted EBITDA between $19 million to $22 million.

Insider Buying Activity on ARAY

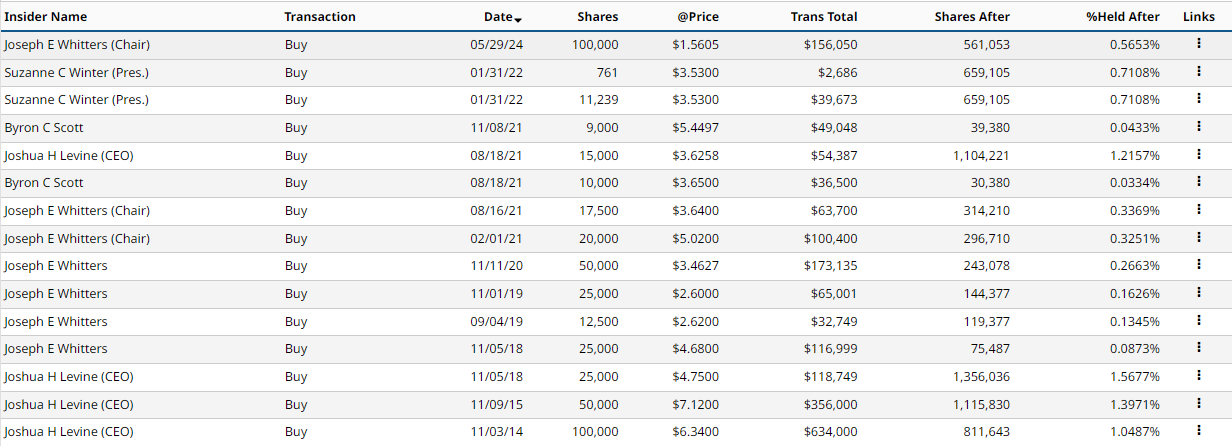

A few weeks after the earnings miss, Accuray Board Chair Joseph E. Whitters purchased 100k shares of the company at $1.56 each, taking the total value of the transaction to $156,050. With the recent purchase, the director now holds 561,053 shares, or 0.5653% of ARAY.

This is the biggest insider buying on the stock since 2014, and also the first insider purchase since 2022. Whitters himself last bought ARAY stock in August 2021, when the shares traded at $3.64.

Is ARAY a Buy?

The stock is very highly rated by the 4 analysts in coverage, who have a unanimous “Strong Buy” rating on ARAY.

The mean price target of $6.33 signifies expected upside potential of 255.6% from current levels.

Most recently, analysts at Roth MKM backed a “Buy” rating on ARAY after earnings, even as they lowered their price target to a Street-high of $7, down from the prior peak of $9. That implies expectations for ARAY to run more than 293% higher from here, with the brokerage firm attributing the company's recent earnings miss to delayed system approvals.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock(1).jpg)

/Chipotle%20Mexican%20Grill%20lunch%20by-%20dennizn%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)