SpreadEdge Capital specializes in seasonal spread trading across a wide variety of commodity markets. A spread trade is the simultaneous purchase and sale of the same commodity with different delivery dates. SpreadEdge publishes a weekly Newsletter that provides several seasonal spread trade opportunities every week.

Several indicators point to a rebound in Energy prices over the near term. These indicators include hedge fund position estimates, the daily and weekly charts, and relative price and positioning. Each of these indicators are reviewed in the following sections.

Hedge Fund Position Estimates Overview

The Commitment of Traders (COT) report, issued by the Commodity Futures Trading Commission (CFTC), offers a weekly snapshot of the positions taken by different market participants in the U.S. futures markets. This information aids traders and analysts in comprehending market sentiment and developments. Published every Friday at 3:30 PM Eastern Time, the COT report reflects positions held as of the previous Tuesday's closing business hours. Peak Trading Research assesses the latest COT report, examining alterations in price and open interest to provide an appraisal of net fund positioning daily.

Summary

- Cotton is at its lowest hedge fund position estimate for the past 52 weeks.

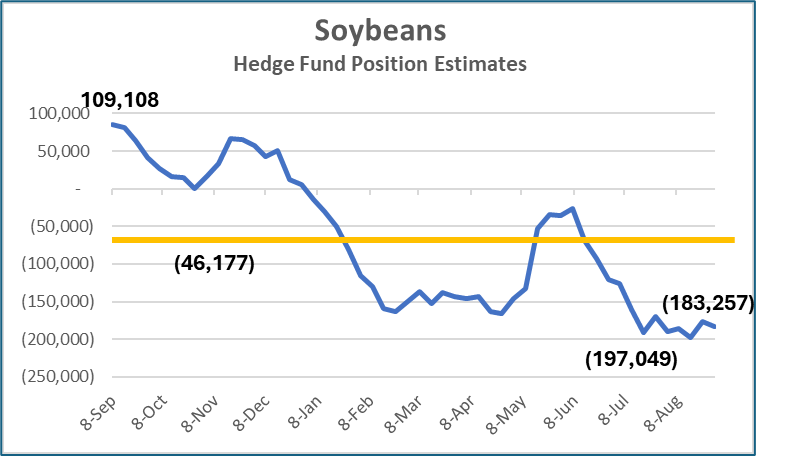

- Soybeans and Feeder Cattle are very near their lowest level.

Cotton

Hedge funds historically are net long Cotton. Over the past 3 years the average estimate is ~34,500 net long contracts and is 14,218 for the past 52 weeks. Hedge funds have moved from over 96,000 net longs to their current estimate of (53,421) net short contract in just 5 months,

Cotton broke through the declining wedge 2 weeks ago but has yet to mount much of a move higher. When hedge funds start to buy this market, we should see a move well into the upper 70's.

Soybeans

Hedge funds have started to reduce their record net short position over the past few weeks, but Soybeans remains very near its lowest level. Over the past 3 years hedge funds have averaged a net long position of 56,600 contracts making Soybeans nearly 250,000 contracts below average. As with Cotton, when hedge funds begin to unwind these record short positions, Soybeans has plenty of room to move higher.

Technically, Soybeans looks to be peeking through the downward channel. On Thursday, Soybeans closed over the upper section of the channel and looks ready to break higher.

To Trade This

I am currently long the December Cotton contract in a personal account. In addition, I have a short a Soybeans January, March calendar spread in client accounts. I will take profits on this trade when / if the Soybean break out is confirmed.

More Information

Use coupon code “SpreadEdge” and get the Weekly Newsletter and Daily Alerts for $1 for the first month.

For a limited time, you can receive my Futures Training Videos for free with a 3-month, 6-month, or 12-month subscription.

For a FREE eBook about the SpreadEdge seasonal spread strategy.

More Information

The SpreadEdge Weekly Newsletter is published every weekend and provides a broad overview of the important seasonal, technical, and fundamental indicators within the Energy, Grains, Meats, Softs, Metals and Currency markets. In addition, spread trade recommendations and follow-up on open trades is also provided. For a free copy of the Weekly Newsletter, please send an email to info@SpreadEdgeCapital.com

Darren Carlat

SpreadEdge Capital, LLC

(214) 636-3133

Darren@SpreadEdgeCapital.com

Disclaimer

SpreadEdge Capital, LLC is registered as a Commodity Trading Advisor with the Commodity Futures Trading Commission and is an NFA member. Past performance is not indicative of future results. Futures trading is not suitable for all investors, The risk associated with futures trading is substantial. Only risk capital should be used for these investments because you can lose more than your original investment. This is not a solicitation.

On the date of publication, Darren Carlat had a position in: KGZ24 , ZSF25 . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

/Nike%2C%20Inc_%20shopping%20by-%20hapabapa%20via%20iStock.jpg)