Here are three stocks with buy rank and strong value characteristics for investors to consider today, September 6th:

M/I Homes, Inc. MHO: This residential home-builder carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.7% over the last 60 days.

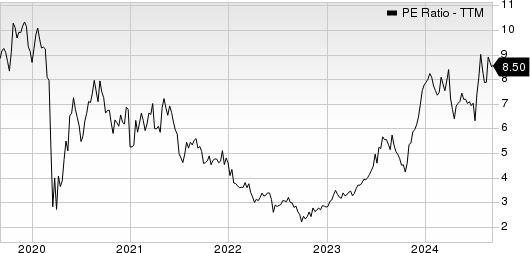

M/I Homes has a price-to-earnings ratio (P/E) of 7.87, compared with 11.10 for the industry. The company possesses a Value Score of A.

OFG Bancorp OFG: This banking and financial services company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.2% over the last 60 days.

OFG has a price-to-earnings ratio (P/E) of 10.48, compared with 11.40 for the industry. The company possesses a Value Score of B.

National Fuel Gas Company NFG: This diversified energy company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.9% over the last 60 days.

National Fuel Gas has a PEG ratio of 11.62 compared with 13.60 for the industry. The company possesses a Growth Score of B.

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

National Fuel Gas Company (NFG): Free Stock Analysis Report

OFG Bancorp (OFG): Free Stock Analysis Report

M/I Homes, Inc. (MHO): Free Stock Analysis Report

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20phone%20and%20stock%20data-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Close-%20up%20of%20computer%20chip%20with%20AI%20sign%20by%20YAKOBCHUK%20V%20via%20Shutterstock.jpg)