Shares of The Procter & Gamble Company PG, also known as P&G, saw no movement following its first-quarter fiscal 2025 results on Oct. 18, 2024, reflecting mixed investor sentiment. Let us examine whether this is tied to the company’s fiscal first-quarter results, outlook or other factors.

Procter & Gamble’s fiscal first quarter was a mixed bag, with the company beating the Zacks Consensus Estimate for earnings per share (EPS) but missing on revenues. PG’s revenues fell 1% year over year, a sharp contrast to the 6% rise reported in the first quarter of fiscal 2024 and a slowdown from 2% growth in the fourth quarter of fiscal 2024. Organic sales grew 2% year over year, down from 7% in the first quarter of fiscal 2024 and 4% in the fourth quarter.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Meanwhile, PG’s core EPS improved 5% year over year in first-quarter fiscal 2025, supported by pricing gains and productivity savings. The company is focused on enhancing productivity across its operations to fund investments, offset cost and currency challenges, and expand margins.

In first-quarter fiscal 2025, P&G’s core gross margin was flat year over year, but its currency-neutral gross margin improved by 10 basis points (bps), driven by 30 bps of pricing gains and 170 bps from productivity savings. The core operating margin also expanded by 30 bps, bolstered by 230 bps of gross productivity savings.

Additionally, the company’s bottom line was strengthened by continued volume and market share gains in North America. Organic sales in North America grew 4% in first-quarter fiscal 2025, driven by 4% volume growth. P&G's integrated strategy, which has driven strong results over the past six years, remains the foundation for balanced growth and value creation.

While the company has done a remarkable job in protecting its bottom line, backed by holistic cost-management initiatives, the significant slowdown in revenue growth requires further introspection.

What’s Behind the Slowdown in PG’s Sales?

Procter & Gamble has encountered several obstacles across its key regions in recent quarters, impacting its overall performance. Soft volume trends are evident in several enterprise markets across Europe, and the Asia-Pacific, Middle East and Africa regions, including Egypt, Saudi Arabia, Turkey, Indonesia, Malaysia and Russia. These markets have been particularly affected by geopolitical tensions, which have reduced consumer spending and slowed retail activity. Ongoing boycotts of Western brands in the Middle East add difficulties.

In Europe, P&G's focus markets have seen a notable slowdown, with average organic sales rising 7% over the past five quarters and volume growing 3%. In the first quarter of fiscal 2025, organic sales in Europe increased 3% compared with 50% growth in the prior-year quarter. The slowed sales were driven by inflation, currency devaluation and modest 4% volume growth in the European enterprise markets.

An analysis of other markets shows that Latin America's organic sales grew in the low-single digits, following strong 19% growth in the previous year. Brazil experienced mid-single-digit growth, while Mexico experienced steady growth compared with the prior year. Brazil and Mexico markets compared with strong 14% growth in the year-year quarter. Market conditions in the Asia-Pacific, Middle East and Africa region have been soft, with organic sales declining in the low-single digits.

PG also continued to struggle with further weakened market conditions and brand-specific headwinds on SK-II in Greater China — its second-largest market. As a result, organic sales in Greater China dropped 15% year over year in the fiscal first quarter. The soft market conditions in Greater China are mainly related to the ongoing economic challenges leading to lower consumer spending. Additionally, the brand-specific issues for its flagship beauty brand SK-II are influenced by the company’s Japanese heritage.

Procter & Gamble Underperforms Industry Peers

PG shares have shown a steady year-to-date rise. However, a close study of the stock performance reveals that it has underperformed the industry in the same period. Notably, the stock has risen 16.9% year to date compared with the industry’s rally of 20.6%.

Procter & Gamble’s shares have also underperformed its peers like Colgate-Palmolive CL and Unilever’s UL gains of 29.8% and 26%, respectively, in the year-to-date period. Meanwhile, PG shares have outperformed Clorox’s CLX growth of 13.6% in the same period.

PG Vs Peers

Image Source: Zacks Investment Research

The current share price of $171.28 reflects a 3.7% discount to the company’s recent 52-week high mark of $177.94. Also, the PG stock reflects a 20.2% premium from its 52-week low of $142.50.

PG is trading above its 50 and 200-day moving averages, indicating robust upward momentum and price stability. This technical strength reflects positive market perception and confidence in PG’s financial health and prospects.

P&G Stock Trades Above 50 and 200-Day Moving Average

Image Source: Zacks Investment Research

Is PG’s Premium Valuation Justified?

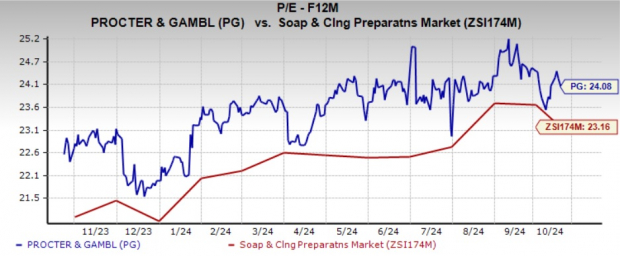

P&G is currently trading at a forward 12-month P/E multiple of 24.08X, exceeding the industry average of 23.16X and the S&P 500’s average of 22.27X. At current levels, Procter &Gamble’s stock valuation looks expensive.

The premium valuation indicates that investors have high expectations for PG’s future performance and growth potential. Investors may be skeptical about buying the stock at these premium levels and may wait for a better entry point.

Image Source: Zacks Investment Research

How to Strategize Your PG Stock Investment?

Procter & Gamble's first-quarter fiscal 2025 results reveal a mixed performance. The company is facing challenges from market issues in Greater China, tough macroeconomic conditions, geopolitical tensions in various regions, and significant currency volatility. Despite these hurdles, P&G's strong market position, emphasis on productivity and cost-saving efforts have been key strengths. Stability in North America and the company's commitment to an integrated strategy provide an optimistic outlook.

Given PG’s premium valuation, investors should examine the ongoing developments to identify an optimal entry point before investing. If you already own the Zacks Rank #3 (Hold) stock, maintaining your position can be beneficial, given the long-term growth prospects and the company’s strong market position. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Unilever PLC (UL): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

The Clorox Company (CLX): Free Stock Analysis Report

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)