High dividend yields are a double-edged sword. On the one hand, you can get a sizable amount of cash back from these investments each year. On the other hand, a high dividend yield is indicative of business weakness, which may lead to poor stock price performance and a potential cutting of the dividend in future years.

One of the few large stocks approaching a dividend yield of 8% is British American Tobacco (NYSE:BTI). The tobacco and nicotine conglomerate is dealing with sector headwinds and business missteps, but it also generates robust cash flow and trades at a cheap earnings multiple. With the stock's dividend yield approaching 8%, Wall Street is saying that the business will struggle in the coming years. If the business ends up being fine and the dividend keeps growing, investors may look back a few years from now and say this was a phenomenally cheap stock.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But which is the more likely scenario? Is British American Tobacco a buy here? Or is Wall Street right about the tobacco giant?

Declining volumes in cigarettes

Through a long history of mergers and acquisitions, British American Tobacco owns some of the most storied cigarette brands around the world. Camel, Newport, and Lucky Strike make up its globally spanning product portfolio, which has generated heaps of profits every year. However, customer volumes are now under fire.

Volume declines in cigarettes have begun to accelerate in many countries, especially the United States. While that's good for global health outcomes and celebrated by society, it's a headwind to British American Tobacco's business. Last year, combustibles volumes declined by 9% year over year, with sharp declines in the United States. Despite price hikes, the combustibles revenue declined by 4% year over year in 2024 in local British Pounds, although when adjusted for foreign currency movements and the selling of the Russian business, revenue in combustibles was flat compared to 2023.

Management is expecting more headwinds in 2025 with new excise taxes planned in Bangladesh and Australia, which will weigh on combustibles volumes. The business isn't going to zero overnight and will generate profits for many years, but it is a business undoubtedly in terminal decline.

Can new nicotine products catalyze growth?

British American Tobacco is well aware of the decline in its cigarette business, and has been planning for its future for many years. It has incubated or purchased multiple brands in new nicotine products, including nicotine pouches, heat-not-burn devices, and electronic vaping. Over the next five to 10 years, management expects this segment to drive most of the growth for British American Tobacco and eventually lead to growth in bottom-line profits.

In 2024, new categories revenue grew 8.9% year over year to 3.6 billion British Pounds, equivalent to around $4.56 billion in U.S. dollars. While any growth is good, these brands only made up 13% of overall revenue in 2024 and contributed minimally to profitability. Compare that to Philip Morris International, where close to half of revenue now comes from new nicotine products, and you can see that British American Tobacco is well behind in this nicotine sector transition.

Investors need to watch this line item closely in the years to come. If growth can accelerate and eventually replace the lost revenue in cigarettes, British American Tobacco's profit generation may extend further than Wall Street is expecting at the moment.

BTI Dividend Yield data by YCharts.

Why British American Tobacco's dividend can still grow

Even though the business is not in the best shape today, I think British American Tobacco's 7.7% dividend yield is sustainable. In fact, I expect its dividend per share to grow consistently in the years to come.

In 2024, British American Tobacco generated $12.8 billion (in U.S. dollars) in operating cash flow and $10 billion in free cash flow. After paying dividends, its free cash flow was $3.41 billion. After years of high debt levels, the company's debt ratios have come down, which will allow it to grow its dividend per share along with buying back more stock (which it plans to do in 2025).

All this being said, British American Tobacco has plenty of room to grow its dividend payout in the next five years, even if its cash flow doesn't grow. With steady growth coming from the new nicotine products and healthy leftover cash flow after dividend payments, I believe British American Tobacco is a good dividend stock to buy today, despite the ugly numbers coming from its cigarette segment.

Should you invest $1,000 in British American Tobacco right now?

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

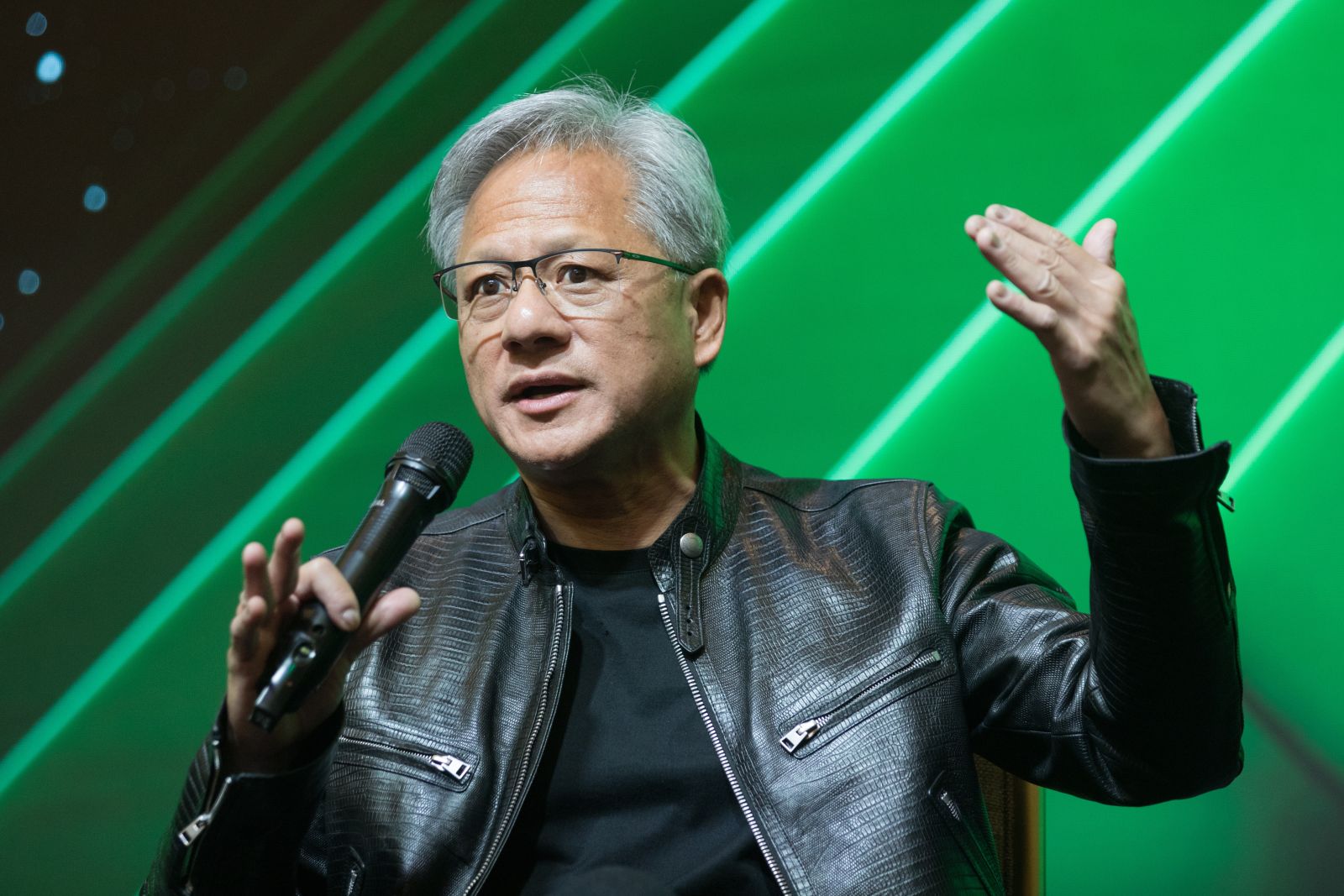

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,576!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of February 28, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock(1).jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Chipotle%20Mexican%20Grill%20lunch%20by-%20dennizn%20via%20Shutterstock.jpg)