At the close of trading hours on March 14, 2025, AT&T Inc. T was trading at $26.58 – in the vicinity of its 52-week high of $27.97. The stock has gained 53.6% over the past year compared with the industry’s growth of 41.2%, outperforming peers like Verizon Communications Inc. VZ but lagging T-Mobile US, Inc. TMUS.

With a customer-centric business model, AT&T is likely to benefit from the increased deployment of mid-band spectrum and greater fiber densification. An integrated fiber expansion strategy is expected to improve broadband connectivity for both enterprise and consumer markets, while steady 5G deployments are likely to boost end-user experience.

One-Year T Stock Price Performance

Image Source: Zacks Investment Research

Infrastructure Upgrade Lends Support to T

AT&T continues to enhance its network infrastructure, including 5G and fiber networks, to provide best-in-class coverage and capacity across the nation. The infrastructure investments position it for long-term growth by ensuring widespread access to its services. AT&T's commitment to closing the digital divide underscores its dedication to fostering inclusive connectivity and driving socio-economic progress as the digital landscape evolves.

By 2027, AT&T expects to complete the modernization of its 5G wireless network with open radio access network (Open RAN) technology, with mid-band 5G spectrum covering more than 300 million people by the end of 2026. By the end of 2029, it expects to reach more than 50 million locations with fiber, including about 45 million through organic fiber deployments and more than 5 million through Gigapower. This will coincide with its proposed plan to exit legacy copper network operations across most of its wireline footprint.

T Rides on Edge Compute Traction

AT&T anticipates gaining a competitive edge over rivals through edge computing services that allow businesses to route application-specific traffic where they need it and where it’s most effective — whether in the cloud, the network or on their premises. Through its Multi-access Edge Compute (MEC) solution, the company offers the flexibility to better manage the data traffic. The MEC leverages an indigenous software-defined network to enable low-latency, high-bandwidth applications for faster access to data processing. Utilizing machine learning techniques and more connected devices, the MEC could transform the way data-intensive images are transferred across the industry on a real-time basis.

The company has extended its long-standing business relationship with Google Cloud to offer end-to-end solutions for improved customer experiences. The solutions are likely to facilitate diverse businesses to better harness edge connections and edge computing capabilities as increased 5G deployments give rise to a large quantum of data.

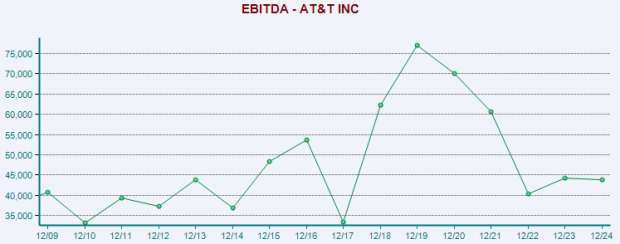

Eroding Margins Weigh on AT&T

Despite wireless traction, AT&T is facing a steady decline in legacy services. The company’s wireline division is struggling with persistent losses in access lines as a result of competitive pressure from voice-over-Internet protocol service providers and aggressive triple-play (voice, data, video) offerings by the cable companies. High-speed Internet revenues are contracting due to the legacy Digital Subscriber Line decline, simplified pricing and bundle discounts. As AT&T tries to woo customers with healthy discounts, freebies and cash credits, margin pressures tend to escalate, affecting its growth potential to some extent. Moreover, AT&T operates in a competitive and almost saturated U.S. wireless market. Spectrum crunch has become a major issue in the U.S. telecom industry. Most carriers are finding it increasingly challenging to manage mobile data traffic and video streaming demand, which is growing by leaps and bounds.

Image Source: Zacks Investment Research

Estimate Revision Trend

Earnings estimates for AT&T for 2025 and 2026 have moved down 7% each to $2.14 and 2.26, respectively, over the past year. The negative estimate revision depicts bearish sentiments about the stock.

Image Source: Zacks Investment Research

End Note

By investing steadily in infrastructure and pioneering new technologies, AT&T is well-positioned to bridge the digital divide and enhance the connectivity landscape nationwide. This is likely to translate into solid postpaid subscriber growth and higher average revenue per user in the Mobility Service business.

However, a saturated wireless market and price wars owing to competitive pressure have eroded its profitability. The downtrend in estimate revisions portrays skepticism about the stock’s growth potential. With a Zacks Rank #3 (Hold), AT&T appears to be treading in the middle of the road, and investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)