Gold has maintained levels above $3,000 recently, but mounting technical evidence strongly suggests we're following the 2011 pattern rather than the more benign 2017-2018 consolidation some investors hoped for.

The monthly RSI indicator reading above 80 represents a severe overbought condition seen only at major market extremes - a stark contrast to the mid-cycle consolidation of 2017-2018 when RSI oscillated around neutral territory. Many investors wonder if there are similarities in price patterns since those were also the early years of Trump's presidency, but the technical structure tells a different story.

What's particularly revealing is the percentage similarity between the 2015-2025 rally and the 2008-2011 advance that preceded gold's multi-year bear market. Both rallies demonstrated nearly identical magnitudes, suggesting the current move may be approaching natural exhaustion. Additionally, gold has now reached the upper boundary of its long-term rising trend channel - a strong technical resistance level.

Mining Stocks Signal Distribution Phase

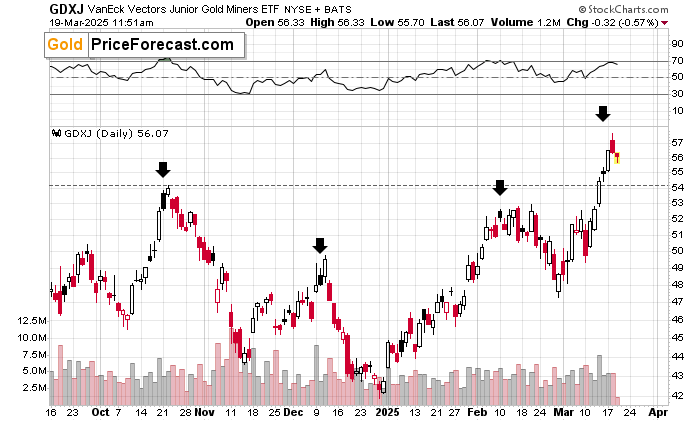

Yesterday's shooting star reversal in mining stocks represented textbook distribution behavior, with early strength giving way to significant weakness by session's end.

This price action typically signals institutional investors using strength to reduce positions. The GDXJ's continued weakness in recent trading further validates this bearish signal.

This pattern of mining stock underperformance relative to gold has historically proven one of the most reliable precursors to significant gold market corrections. When miners fail to confirm gold's strength, it often indicates smart money positioning ahead of a trend change in the broader precious metals complex.

Interestingly, the same thing is happening in silver. The gold-silver relationship often provides critical clues about market direction.

The white metal declined shortly after reaching its 2024 high (there was no breakout) and it's taking place without an analogous daily decline in gold or stocks. Silver is most likely telling us something here.

Also, if you're wondering if silver needs to outperform here in order to confirm a top (as that's what often accompanies tops), I'd say that this doesn't have to be the case as we already saw this kind of outperformance recently. What was likely to happen (silver's brief outperformance), already happened.

Fed Decision Context: Stagflation Fears Reach Multi-Year Highs

Recent markets demonstrated typically cautious pre-Fed behavior, with stocks edging higher and Treasury yields rising modestly ahead of Fed announcements. The Fed is widely expected to maintain rates in the current range while projecting further rate cuts for 2025.

However, the context for these decisions has shifted dramatically. Bank of America's latest Global Fund Manager Survey revealed 71% of surveyed investors now expect stagflation - the highest level since November 2023. This psychological shift among institutional investors creates significant vulnerability for asset prices should the Fed strike a less dovish tone than expected.

Goldman Sachs projects the Fed will raise its 2025 inflation outlook while simultaneously reducing its growth forecast due to tariff impacts - the textbook definition of stagflationary pressures. This deteriorating growth/inflation mix creates precisely the kind of monetary policy constraint that historically precedes major market declines.

During uncertain economic times like these, many investors consider diversifying with precious metals in tax-advantaged accounts such as a Gold IRA or Silver IRA to help protect retirement savings from market volatility and inflation.

Gold's Potential Reaction Pattern

Gold holding above $3,000 suggests market participants remain hesitant to take decisive action before gaining clarity on the Fed's outlook. However, the combination of extreme technical conditions with clear distribution signals from mining stocks creates vulnerability regardless of the Fed's specific messaging.

The interest rate relationship with gold will be critical to watch in the coming weeks as the Fed navigates this challenging economic environment.

The parallel to 2011 continues to strengthen with each trading session. In that instance, gold similarly maintained strength temporarily at psychologically important levels ($1,900-2,000) while miners and silver showed early weakness before all three assets eventually synchronized to the downside. Today's continued mining stock weakness while gold maintains the $3,000 level represents nearly identical market behavior.

Bitcoin-Gold Relationship Adds Another Warning

Bitcoin's recent behavior reinforces another important parallel - the cryptocurrency's behavior in 2022 preceding major market stress. During that period, Bitcoin demonstrated similar technical characteristics to today's gold market, with extreme sentiment and deteriorating technical underpinnings despite headline price stability.

The take-away is that given a considerable degree of similarity between both periods (technically), we're likely going to see a decline in the precious metals sector when bitcoin resumes its decline. It's now correcting from its rising, medium-term support line, which is quite natural. When this correction is over, the declines in bitcoin and precious metals (and miners) are likely to follow. And given the link to 2022, the upcoming decline is not likely to be small.

Speaking of the USD Index, please note that it's forming a broad bottom, just like it did in September last year.

The November low appears to have stopped the decline. Despite two attempts to move lower (and additional comments from Trump that "should" make USD decline), the USD Index stands firm.

Once the move below the 61.8% Fibonacci retracement is invalidated, we'll know that the bottom is indeed in. This would be likely to translate into declines in gold, silver, miners, bitcoin, and copper. And many other markets.

Geopolitical Wild Cards

Recent news brought additional geopolitical complexity, with Turkey's political situation destabilizing markets in that region and the potential Ukraine ceasefire following Trump-Putin discussions. These developments could create unexpected volatility across asset classes, particularly if they affect energy markets or broader risk sentiment.

Of particular note is oil's decline following news of the 30-day pause in attacks on Ukraine's energy infrastructure. This demonstrates how quickly geopolitical risk premiums can dissipate - a pattern that could similarly affect gold's recent premium.

During times of geopolitical uncertainty, many investors turn to gold as a safe haven asset, but it's important to recognize when these risk premiums may be priced out of the market.

Technical Confluence Points to Major Inflection Point

The current market represents a remarkable technical confluence that demands attention:

- Gold at the upper boundary of its long-term trend channel

- Monthly RSI reaching extreme levels only seen at major turning points

- Mining stocks forming clear distribution patterns (weakness plus clear daily reversal)

- Nearly identical percentage gains compared to the 2008-2011 bull run

- Major institutions revising economic forecasts to reflect stagflationary pressures

This constellation of technical and fundamental factors suggests we may be approaching not merely a routine correction but potentially a major inflection point for precious metals and broader markets. The price action following upcoming Fed decisions will likely provide critical insights into how these competing forces resolve.

For investors with substantial gold and mining positions, this technical evidence warrants careful consideration of risk management strategies. While precious metals often perform well during periods of economic uncertainty, the historical evidence suggests markets rarely move in straight lines. Technical extremes like today's readings have historically provided important warning signals that prudent investors cannot afford to ignore.

For those looking to navigate these complex markets, professional gold analysis can provide valuable insights into potential turning points and investment strategies.

Thank you for reading my analysis (which is only a fraction of what our Gold Trading Alert subscribers enjoy on a regular basis). If you'd like to stay updated with our other free analyses, I encourage you to sign up for our free gold newsletter today.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

/Facebook%20headquarters%20sign%20by%20Greg%20Bulla%20via%20Unsplash.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20phone%20and%20stock%20data-by%20Poetra_RH%20via%20Shutterstock.jpg)