Defense contractors are experiencing significant market turbulence following Secretary Pete Hegseth's announcement of $580 million in Department of Defense contract cancellations, which is part of a broader $800 million cost-cutting initiative at the Pentagon.

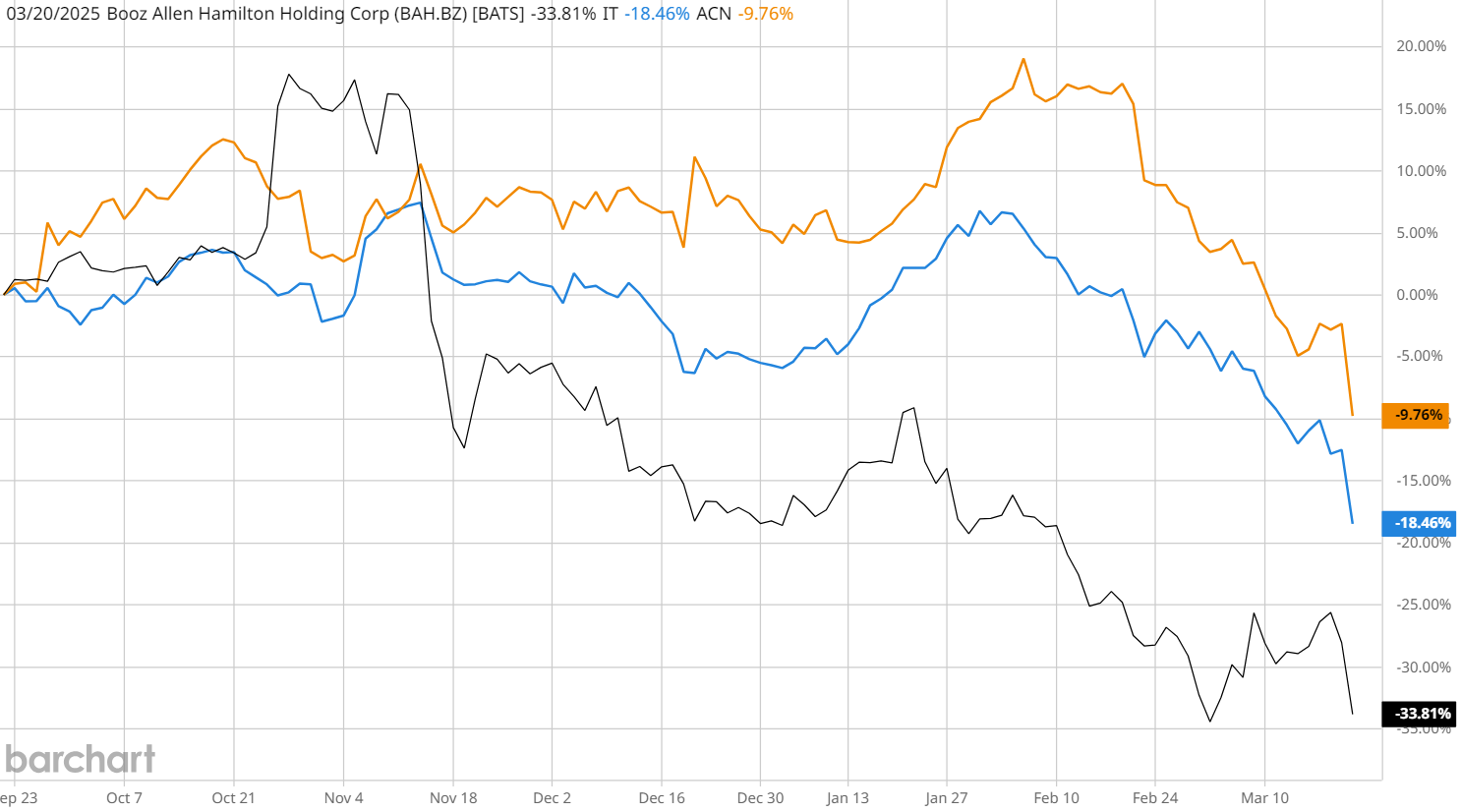

Major IT defense contractors including Booz Allen Hamilton (BAH), Gartner (IT), and Accenture (ACN) notched heavy stock price declines today, while beaten-down Palantir (PLTR) clawed out a gain of 1.50%.

#1. Booz Allen Hamilton (BAH), down -8.10%

According to recent data, Booz Allen Hamilton derives approximately 98% of its total revenue from federal contracts. This extremely high dependence on government contracts has historically been a strength in terms of stable revenue streams, but could now be a potential risk in terms of concentration, particularly as the company faces new challenges from Department of Government Efficiency (DOGE) initiatives.

#2. Accenture (ACN), down -7.26%

Based on recent reports, Accenture's federal services unit accounts for 8% of their global revenue and represents 16% of their Americas revenue segment.

#3. Gartner (IT), down -6.82%

Gartner was called out by name in Hegseth’s commentary on DoD cuts today, and reportedly has up to $270 million in federal contracts up for review over the course of this year. The company reported total annual revenue of $6.27 billion in fiscal year 2024.

What’s Driving Volatility in Defense Stocks?

The Pentagon's announcement of plans to reduce its civilian workforce by 50,000 to 60,000 positions has added another layer of uncertainty to the defense sector, with approximately 21,000 workers already opting for voluntary resignation.

The contrast between U.S. and European defense markets has become particularly stark, with European defense stocks surging 69% since January 2025, compared to a mere 1% gain for their U.S. counterparts. This divergence is further highlighted by Baird's recent upgrade of RTX Corp (RTX) to Outperform with a $160 price target, citing opportunities in European rearmament and DoD replenishment cycles.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)