Tune in daily to catch Bill Baruch dissecting the day’s market happenings after the bell rings. Gain insightful analysis and stay ahead in the financial game with Bill as your guide!

Do not miss Bill Baruch’s daily video posted to his Twitter (X), LinkedIn, and Instagram after the close, follow him at @Bill_Baruch.

Futures Hold Gains as Market Awaits Key Data and Fed Speak

E-mini S&P (June) / E-mini NQ (June)

S&P, yesterday’s close: Settled at 5815.50, up 97.25

NQ, yesterday’s close: Settled at 20,374.25, up 413.25

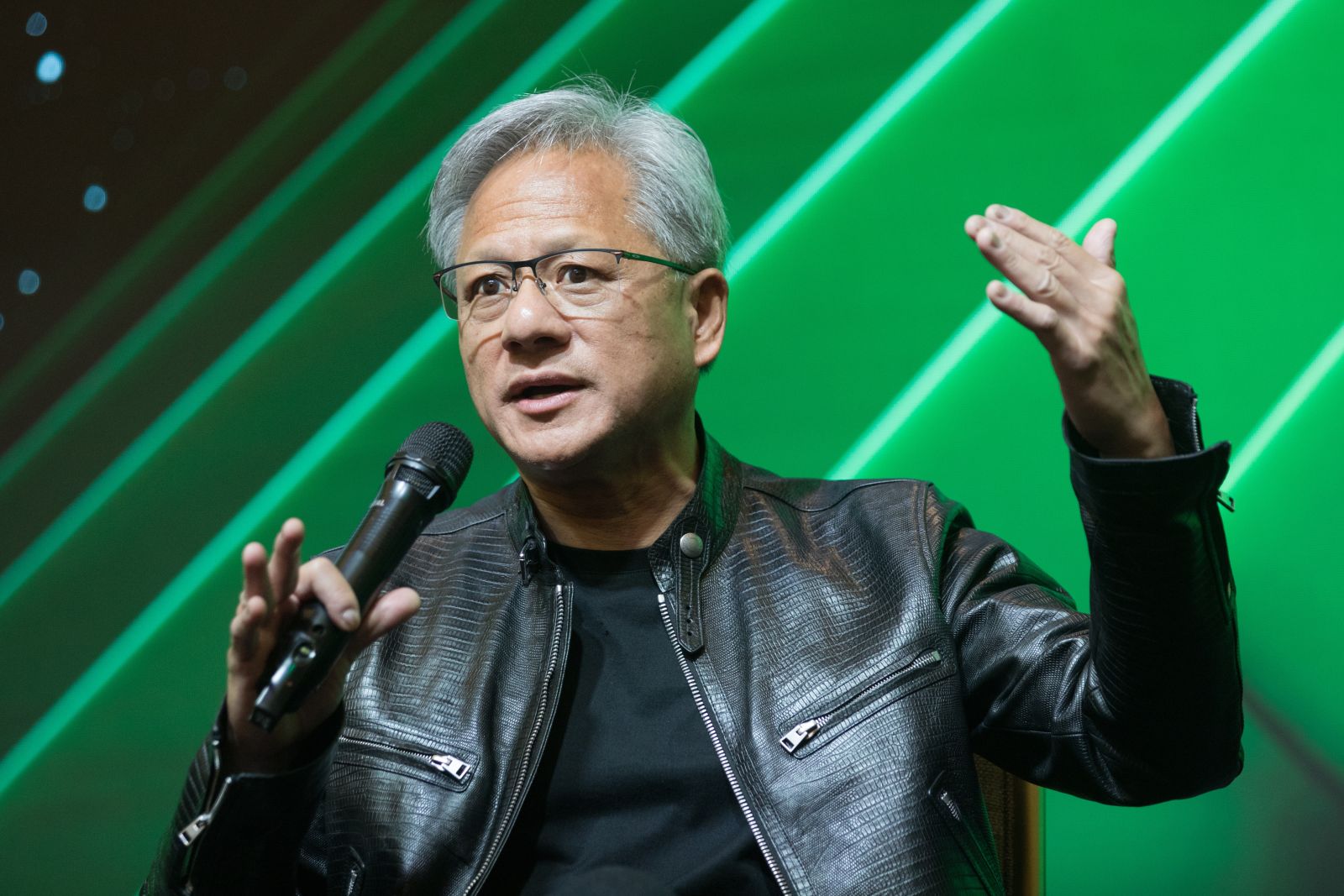

E-mini S&P and E-mini NQ futures consolidated constructively and quietly overnight, finding help from a muted news cycle. The week started with a bang; the four names that stood out most were TSLA +11.93%, AMD +6.96%, PLTR +6.37%, and MTZ +6.17%. Additionally, each NVD, AMZN, META, and LLY added at least 3%. Yesterday, we cited a carefully crafted offensive by the White House to control the narrative around the April 2nd tariffs as well-timed and calming, helping to bring bullish tailwinds into quarter-end. Given post-expiry positioning and bullish flows from institutions, things are on that path, and a quiet news cycle will be seen as supportive.

Home Price data is due at 8:00 am CT, CB Consumer Confidence is out at 9:00 am CT along with New Home Sales, and traders want to keep an eye on both Fed speak, and a 2-year auction at noon CT.

E-mini S&P futures tested into rare major four-star resistance yesterday at 5810.75-5829.75 and settled at 5815.50. This will create a pivot and point of balance at 5810.75-5815.50 and define resistance at the exact March 7th close as a level we must decisively settle above in order to pave the way higher. Similarly, the E-mini NQ has rare major four-star resistance at 20,445-20,463. Today’s price action will be critical in helping to define whether yesterday was a fluke or if there are serious bullish flows. While we have key resistance at 5840.25-5844.50, we believe that confirmation of yesterday’s strength should target major three resistance at…

Want to keep up with the market?

Subscribe to our daily Morning Express for essential insights into stocks and equities, including the S&P 500, NASDAQ, and more. Get expert technical analysis, proprietary trading levels, and actionable market bias delivered straight to your inbox.

Sign Up for Free Futures Market Research – Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock(1).jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)