Protective Collar Option Strategy

Hi, and welcome to this edition of the Options Learning Center. I'm excited to explore the protective collar, and how to use Barchart to get the most out of the strategy.

What is a Protective Collar?

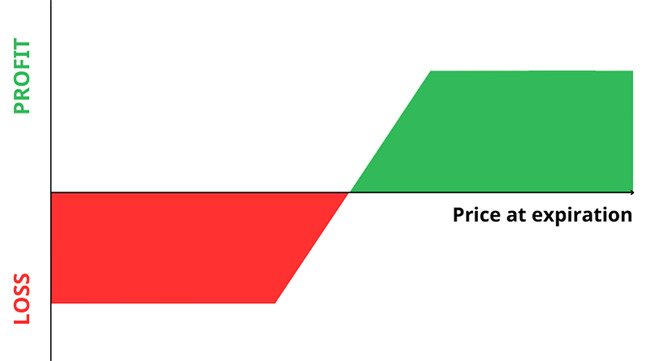

The protective collar is a hedging option strategy that involves holding shares in a company, or an ETF, then selling an out-of-the-money call and buying an out-of-the-money put on the same underlying asset, all with the same expiration date. This strategy combines a covered call and protective put, resulting in a net debit or credit, depending on market conditions. A protective collar limits downside risks while earning premiums from the short call but limits the overall potential profit from the trade.

Protective Collar:

- Hedging Strategy Using Shares Held

- Sell Out-Of-Money Call Option

- Buy Out-Of-Money Put Option

- Same Expiration For Both Options

- Combines Covered Call And Protective Put

- Limits Risk, Caps Profit Potential

Like a married put, a protective collar can profit in two ways. First, when the price of the underlying stock moves beyond the short call's strike price and the option is exercised, the stock is sold. The maximum profit is limited and is calculated by taking the difference between the purchase and strike prices and then adding or subtracting the debit or credit, whichever is the case. Second, the trade can profit if the stock's price undergoes substantial downside movement before expiration, in which case the put can increase in value and be sold for a profit, though this depends on market movements.

The maximum loss of a protective collar happens when the underlying's price goes below the long put's strike price and the trader exercises the put. The maximum loss is the cost basis on the underlying security plus the premium paid if the setup results in a debit or less the premium received if credit, minus the strike price.

- Two Ways a Collar Profits

- Upside: Stock Exceeds Call Strike

- Downside: Put Gains From Downside

- Profit Depends On Market Movements

- Maximum Loss: Stock Trades Below Put Strike

A collar trade can be set up by either looking for new opportunities, which means buying the underlying security, selling the call, and buying the put, or you it can be done on stocks or ETF's you already own.

Next, I'll show you how to scan the entire market for collar trades, and then later, I'll show you how to find trades on a specific stock or ETF.

Screening The Market For Protective Collar Trades

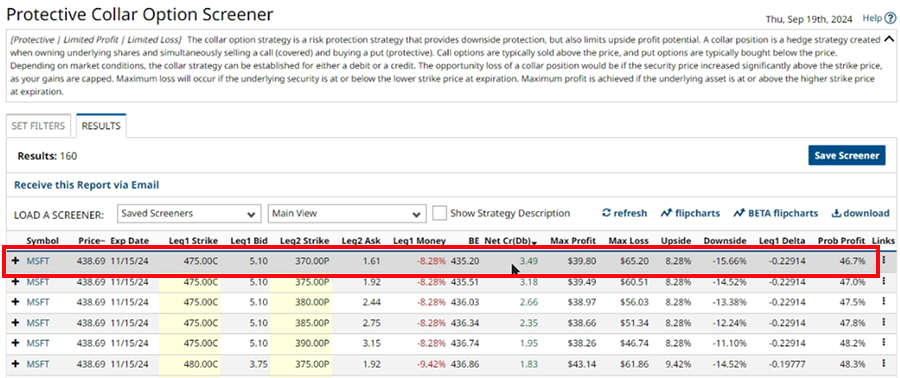

To access the Protective Collar screener, go to Barchart.com, click on the Options tab, and then click on Protective Collar Option Screener. This will immediately bring you to the Results page, where you can find likely protective collar trades.

The Results page includes relevant trade information, like strike prices, premiums, costs to enter the trade, and more. Each column header can be clicked, allowing you to arrange the results from the highest to lowest of your chosen column header.

These results are already a perfect start. However, if you want a more granular search, you can click the Set Filters tab at the top left of the page. This brings you to the default filters for this specific strategy.

Filters range from options details to stock and company information like financials, technical analysis, and so on. Everything you might ever need is right here on the screener.

The default filters are perfectly fine for most traders. However, I do want to point something out. Let's look at Delta Leg 1. This is your short call. And in a collar trade, you don't normally want your shares to be called away. So, delta will help us make the right choice.

Delta is a measure of how much an option's premium changes relative to a one dollar change in the underlying price. But, it can also be used to measure the probability of an option expiring in the money. Since we want to keep our shares, you want a trade with a low probability of expiring in the money.

Now, when you're selling a call, the delta appears as negative, and the default value is -0.25. That means the short call has a 25% chance of getting assigned or a 75% chance of expiring out of the money.

All I have to do now is click See Results and get potential trades that fit the default criteria. The results are arranged from highest to lowest credit so that you get the opportunity to get paid while protecting your shares.

By the way, you can also save your screener to reuse it later. You can also have Barchart email you at a specified time with your trades. Just click Save Screener near the top right, then name the screener and select when you want the email to arrive.

Now, collars can result in a net debit or credit. I'm going to click the Net Cr(Db) column to find all the trades that end up in a credit. This means I'll be paid to enter this trade.

For illustration, we'll take the first trade suggestion on this list.

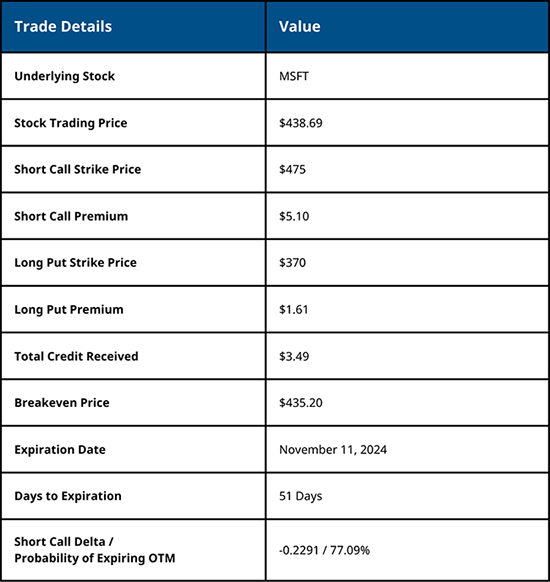

According to the screener, you can buy 100 shares of MSFT for $438.69 per share. That will be your cost base for the underlying stock. Then, you can write a $475-strike call and collect $5.10 per share.

After that, you can buy a $370-strike put and pay $1.61, bringing your net credit to $3.49 per share or $349 total. All options expire on November 11, 2024, 51 days from the scan date, and the short call has a delta of minus twenty-three or a 77% chance of the call expiring out of the money.

This means you get protection below the $370 strike, at the expense of capping your upside at $475 on the MSFT shares.

With those details, let's jump into the trade breakdown.

Profit Scenario: Stock Price Doesn't Move Significantly (Long Put And Short Call Expires Worthless)

The ideal and most likely scenario for this trade is for Microsoft's price to stay below the short call strike and above the long put strike. If that happens, both options expire worthless, meaning you keep the $349 credit that you collected at the start of the trade and your 100 MSFT shares, which you can use for another protective collar trade.

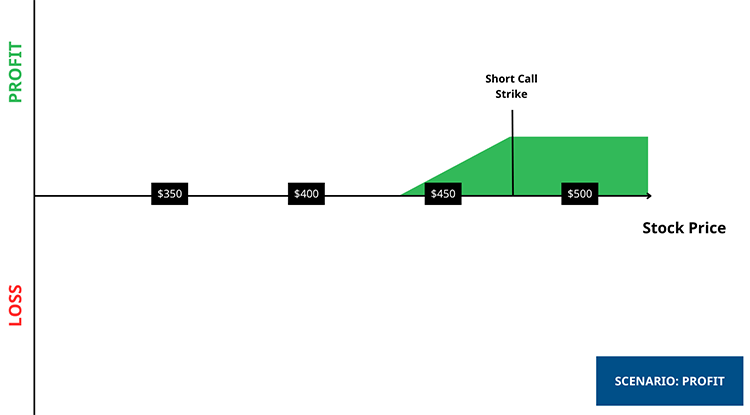

Profit Scenario: Stock Price Increases At Expiration (Long Put Expires Worthless, Short Call Assigned)

Now, let's say that Microsoft reaches $500 at expiration, and your short call gets assigned. In that case, you must sell your 100 shares for $475.

To calculate the profit on the trade, subtract your stock's purchase price from the strike price. That works out to $36.31 a share, or $3,631 per contract.

But don't forget, you also received $3.49 per share for the collar, bringing your total profit to $39.8 per share or $3,980 total.

$475 - $438.69 = $36.31

$36.31 + $3.49 = $39.80 * 100 = $3,980

But with any short call, you lose out on roughly $2,500 - the opportunity cost - but, that's the cost of the collar.

Opportunity Loss

$500 - $475 = $25 * 100 = $2,500

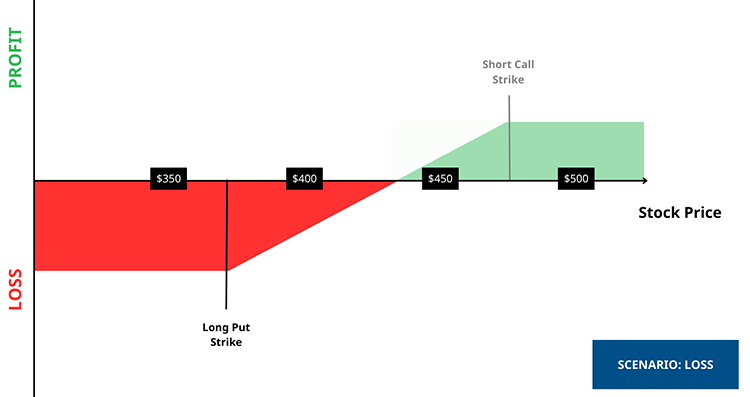

Loss Scenario: Stock Price Plunges At Expiration (Long Put Exercised, Short Call Expires Worthless)

On the other hand, if the price of Microsoft experiences a significant downward movement to, let's say, $300 at expiration, your long put is now in the money, while your short call expires worthless. Instead of taking the loss by selling the shares at $300, you can exercise your long put and sell your shares for $370. That way, you'll mitigate some of the losses.

To calculate the maximum loss, subtract the strike price from your cost base, which works out to a loss of $68.69. But, don't forget to add the net credit you received at the start. So your net loss would be $65.20 a share, or $6,520 per contract.

$370 - $438.69 = -$68.69

-$68.69 + $3.49 = =$65.20 * 100 = -$6,520

Profit/Loss Across Different Price Points

Here are different profit and loss scenarios for different price points to better understand how this protective collar trade can turn out, provided that the call is assigned or the put is exercised at the relevant prices.

As you can see, with this trade, the maximum profits and losses are capped at $3,980 and $6,520 at their respective strike prices.

Screening For Collar Spreads With Specific Assets

As I mentioned earlier, protective collars are typically used on assets that you already own. Let's say for example you own 100 Microsoft shares and want to trade a collar with that underlying security. If that's the case, you can go to Barchart.com and search for your owned asset to look for protective collar trade ideas.

Once at the stock's profile page, navigate to the left-hand side of the menu and look for Protection Strategies, and then click on the Protective Collar tab. From there, you can change the short call strike, or change the expiration date on the dropdown. And if you want to further refine the matches, you can hit the screen link, and set filters. It's that easy.

Pros And Cons Of Protective Collar Spreads

The biggest advantage of a collar spread is its protection against significant downside price movement. Not only that, the short call's premium offsets the cost of downside protection. And depending on your risk tolerance, it can even result in a net credit.

- Downside Protection

- Multiple Ways To Profit

- Controlled Risk/Reward

However, a protective collar effectively limits your profitability, and the protective put comes with associated costs. It is also a complex strategy with two trade legs and there is the risk of assignment to consider - which means there's opportunity loss if the stock moves significantly above the short call strike price.

- Limited Profits

- Protection Cost

- Complexity

- Risk of Assignment

- Opportunity Loss

Conclusion

The protective collar can be an excellent hedging strategy to protect your shares from short-term volatility while potentially earning a premium. However, every trade is different, so you must review your potential protective collars to determine if the results fit your trade preference and risk tolerance. To get a 360-view of your trades before starting them, use every resource and utility at your disposal, including option screeners.

If you need more information, visit the Barchart Options Learning Center, where you can learn more about all the other options trading strategies, how they work, and how to profit from each.

Back to Top ↑