Long Call Butterfly Option Screener

Long Call Butterfly Option Screener

Hi, and welcome to the Options Learning Center. I'm going to show you how to buy long call butterflies and use Barchart to get the most out of the strategy.

What Is A Long Call Butterfly Spread?

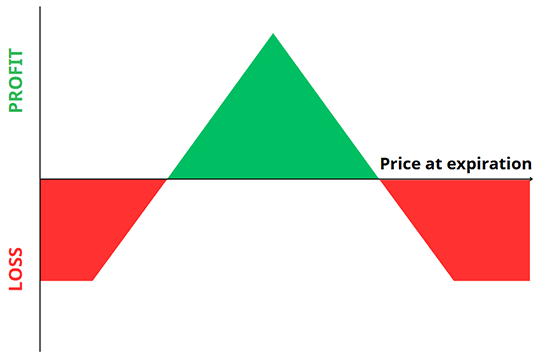

The long call butterfly spread is an neutral options strategy where the investor expects the underlying security to trade within a specific price range. The trade requires four call options, two of which are at the same strike price, on the same underlying asset, and with the same expiration date.

The strategy works best if you expect the asset will trade with low volatility until expiration.

For that reason, you could consider trading a long call butterfly after a big event, such as earnings or news release - after the volatility is already baked into the underlying securities' price. The maximum profit condition happens if the asset's price ends exactly at the middle strike price, however, you'll make a profit so long as the underlying trades between the breakeven points at expiration.

You receive maximum profit if the asset's trading price ends exactly at the middle strike price.

Long Butterfly Spread Options Strategy:

- Combines Four Call Options

- Same Underlying Asset And Expiration

- Profit If The Price Ends At The Short Strikes

- Result: Bull Call & Bear Call Spread

- Max Profit: Spread Width Less Net Debit

- Loss: Underlying Asset Trades Beyond Long Strikes

To set up the trade, you'll buy one call at a lower strike, sell two calls at a middle strike, and buy one call at a higher strike. All options will have the same underlying asset and expiration date, with the strike prices equally spaced.

Long Call Butterfly

- Buy One Call (lowest strike price)

- Sell Two Calls (higher strike price)

- Buy One Call (highest strike price)

The result is a bull call and bear call spread that results in a net debit.

The goal of a long call butterfly is for the underlying asset's price to trade at exactly the middle strike price. If that happens, you'll achieve maximum profit at expiration when the options settle.

The maximum profit on a long call butterfly is the difference between the middle strike and either of the outer strike price, minus the net debit.

The maximum loss is limited to the net debit paid at the start of the trade and happens if the asset price at expiration either trades below the lowest strike price or above the highest strike price.

Trade Examples

Now, I'll show you how to look for long call butterflies using Barchart.

Screening The Market For Long Call Butterfly Trades

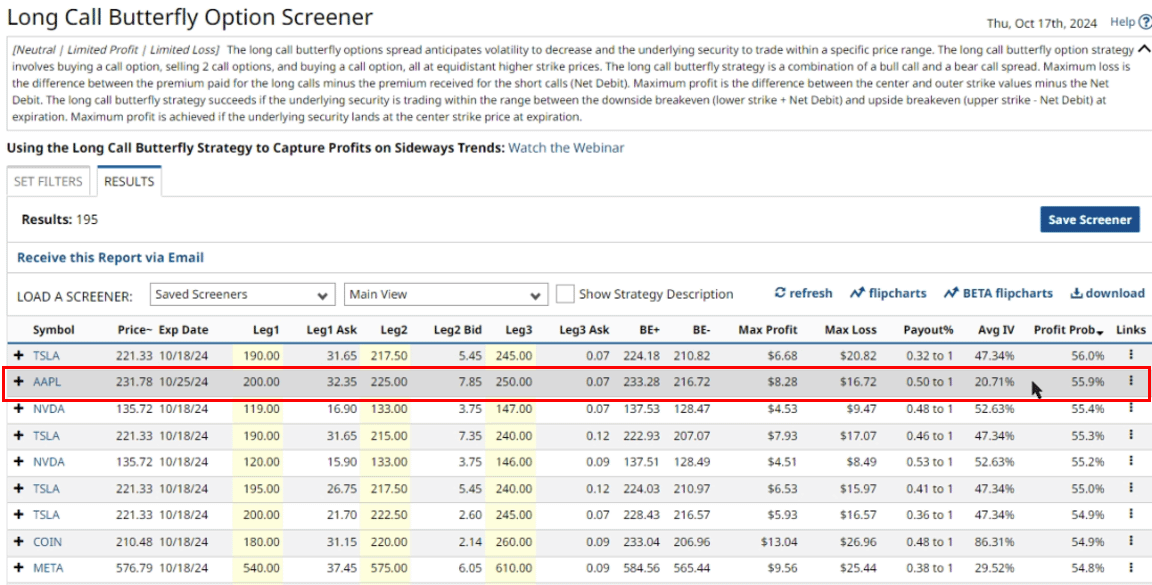

To access the Long Call Butterfly screener, go to Barchart.com, click on the Options tab, and then click on Long Call Butterfly Screener. This will immediately bring you to the Results page, where you can immediately see the long call butterfly trades based on the default filters - which is a good start for most traders. From here, you'll get important trade details like expiration dates, strike prices, premiums, max profits and losses, and the probability of profit right here.

You can click on any of these columns to change their arrangement.

These are already a good selection of potential trades, but if you need to tweak the search parameters, click the Set Filters tab, showing the default filters for this specific strategy.

On this page, you can search for filters you want. The filters include stock and option information like option analysis, underlying prices, and trading details, and technicals—everything you might think you need to fully customize your trade is right here.

You can also remove filters that you don't want or need. The rest of the values are there by default and work best as a starting point. But, you can change them if you like. For example, let's scroll down to the probability of profit.

As the name suggests, this filter shows the chance of you profiting from the trade by even 1 cent. This happens if the underlying security trades between the breakeven points by expiration. Maximum profit, however, is rather unusual, as it'll happen only if the underlying asset trades at a precise price point at expiration.

So, let's say you want to look for trades with profit probabilities higher than 50%, even if it's just one penny. I'll set it to above 50%, then click on see results. Then, I'll click on the Probability of profit column to change it from highest to lowest.

And there we go; we have a list of potential trades that we can use. Now, we could take the top trade, which is on Tesla, but, I think for this video, I'll take the 2nd best which is an Apple trade, which has a similar profit probability. The payout ratio is also only 0.5 to 1, which means your maximum profit is about half the maximum loss.

Now, before we get into the trade details, let me show you how you can save your screener to reuse it later. Just click Save Screener at the top right, then type in the name of the screener. At the bottom, you can also have Barchart email you at a specified time with your trades. It's that easy.

Now that's done, let's move on to the trade example.

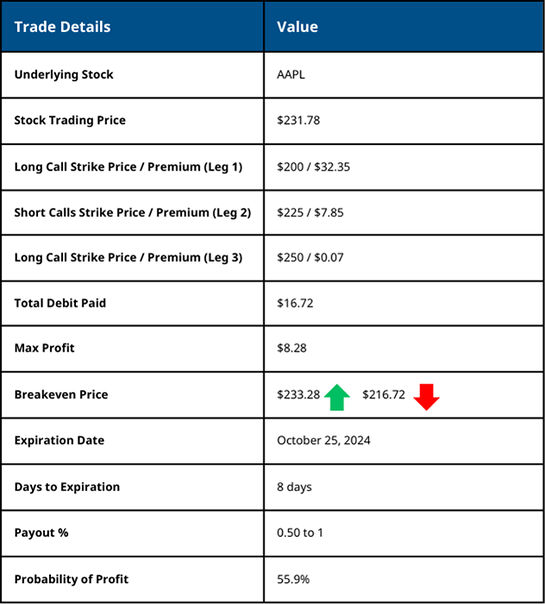

According to the screener, you can set up a long call butterfly spread on AAPL, with the stock currently trading at $231.78. Here's how this trade works: you buy the $200-strike call for the lower long call, paying a premium of $32.35 per share. Then, you sell two $225-strike calls, collecting $7.85 per share for each. Finally, you buy the $250-strike call, paying $0.07 per share.

This setup results in a total net debit of $16.72 per share, or $1,672 for one contract. Your maximum profit on the trade is $8.28 per share. All options expire on October 25, with eight days remaining until expiration. And the trade has a 55.9% probability of profit.

I find it's best knowing the breakeven points on the upside and downside to when monitoring the trade. Barchart gives you the breakeven points, but, if you want to calculate it yourself, you can add the net debit to the lower strike to get the downside breakeven price. For the breakeven price to the upside, subtract the net debit from the higher strike. That gives you breakeven points of $216.72 on the lower end and $233.28 on the upper end.

Breakeven Calculation

- Lower Breakeven: Lower Long Call Strike + Net Debit

- Upper Breakeven: Higher Long Call Strike - Net Debit

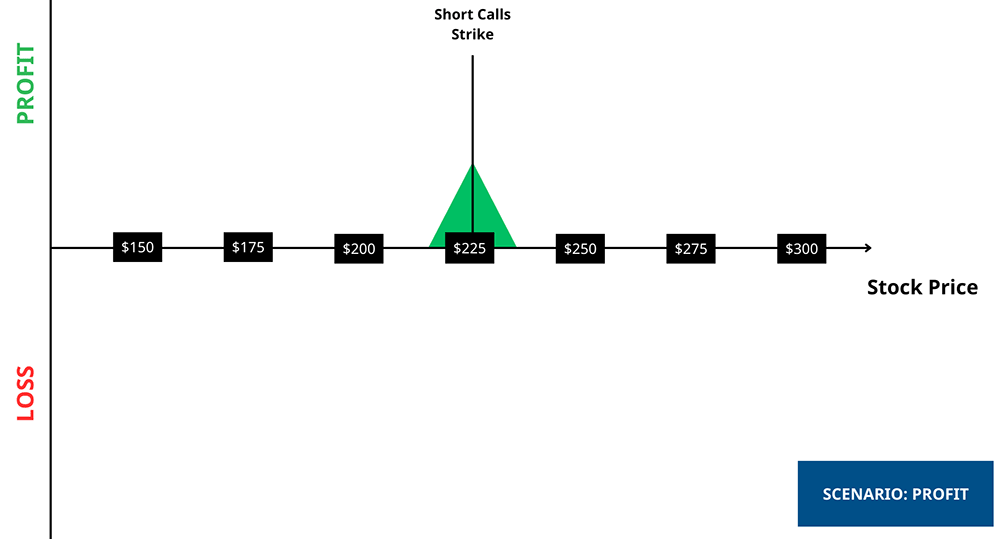

Profit Scenario

Now, suppose everything works out, and Apple's price trades at exactly $225 at expiration. If that's the case, you'll get the maximum profit for this trade, and that is calculated by taking the difference between the outer and middle strike price, also known as the width of the spread, and then subtracting the net debit. That brings us to $8.28, or $828 per contract.

Maximum Profit Calculation

Width of Spread: $225 - $200 = $25

Debit Paid: ($32.35 + $0.07) − ($7.85 * 2) = $32.42 − $15.70= $16.72

Total Profit: $25 - $16.72 = $8.28 * 100 = $828

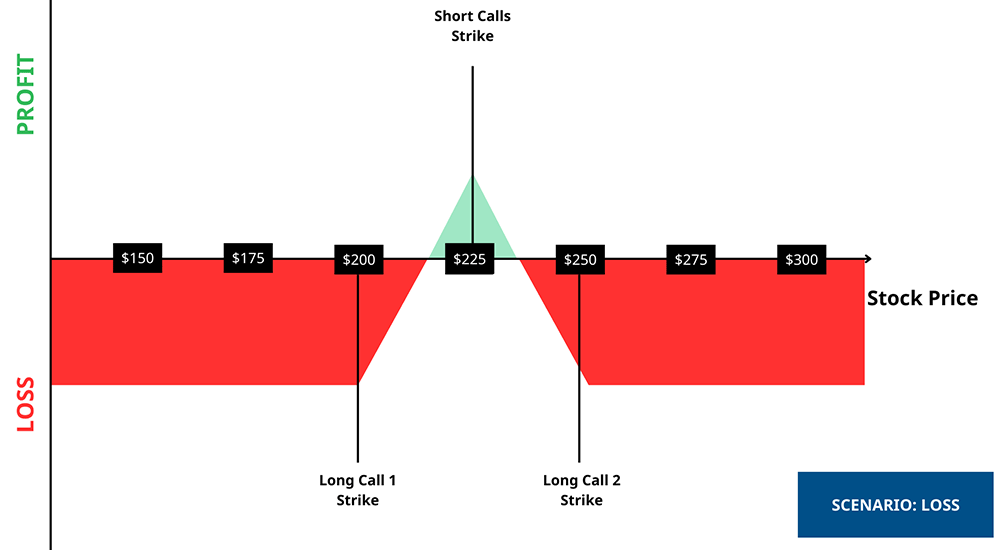

Loss Scenario

However, if Apple's price exceeds the long call strikes in either direction, this long call butterfly will end at a maximum loss. Again, max loss is the debit paid at the start of the trade, which is $16.72 or $1,672 total.

Debit Paid: ($32.35 + $0.07) − ($7.85 * $2) = $32.42 − $15.70 = $16.72

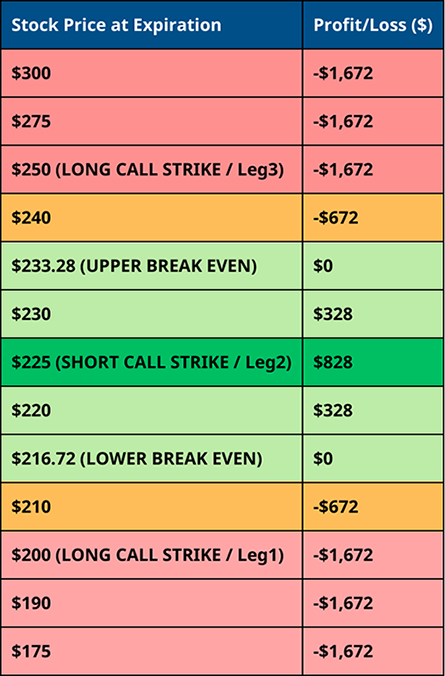

Profit/Loss Across Different Price Points

Here's a profit/loss table for different prices to give you a better idea of the potential results of this trade.

As you can see, the maximum profit is only achieved at one price point, if Apple stock trades at exactly $225 at expiration. The trade will also result in a profit as long as the stock trades between the breakeven points, and results in a loss when it breaches the upper or lower breakeven points.

Screening For Long Call Butterflies For Specific Assets

So that's screening the entire market for assets to use for long call butterfly trades. But what about if you have a specific stock in mind? You can do that in a couple of easy steps.

All you need to do is go to the stock or asset's Price Overview page on Barchart.com. Once there, navigate to the left and look for Butterfly spreads. Then, click the long call butterfly tab to see the trade search results.

You can click on the dropdown to change the expiration dates, change trade legs, rearrange each column, or click the screen button, then set the filter to reach the option screener page for a more granular search.

Closing Your Positions Before Expiration

It is always a good idea to close your positions right before expiration when using any strategy that requires writing or selling options. For this example, you have two short positions in this trade at the same strike price, and if they're in the money by expiration, the option will be automatically exercised, or, in your perspective, you will be assigned.

- Strategy includes two short positions

- ITM option(s) will be exercised at expiration

If any of the short calls gets assigned, you are obligated to sell 100 shares of stock for every contract you wrote. This means you might need to purchase the shares at the current market price—which could be higher than the strike price—and then sell them at your strike price, potentially resulting in a loss.

- Assignment means selling 100 shares

- Adverse market conditions could lead to a loss

You can also sell the relevant long call positions to capture any remaining value which will mitigate some of your losses or even reach profitability if they haven't expired yet. But keep an eye out for trading fees, as they might make buying shares from the market preferable.

- Sell long calls to capture any remaining value

- Watch out for trading fees

Pros and Cons

Like all spreads, the long call butterfly has a defined profit/loss profile, which means you know what you're getting into at the setup. Also, like all debit spreads, it has potentially higher profits than credit spreads. Lastly, this strategy is perfect in low-volatility trading environments.

- Defined Profit/Loss Profile

- Higher Potential Profits

- Neutral Strategy

However, like all spreads, your potential profits are limited. It is also a three-legged strategy with four active option trades, so it's a bit more complex than, say, buying a long call. Since it has four trades, there's a potential for increased trading fees and commissions. You also need pinpoint prediction for long call butterflies if you want maximum profits since that only happens at one price point. This can be difficult as slippage (when the expected and actual trading price are different) can affect the trade.

- Limited Profit Potential

- Complex Strategy

- High Trading Fees

- Max Profit Only Achieved At One Price Point

- Sensitivity to Slippage

Conclusion

The long call butterfly is an excellent strategy for neutral and low-volatility markets. However, its very limited profit range, low chances of profitability, and multiple trade legs can take a bite out of your bottom line. That's why monitoring your trades closely and utilizing all resources, including Barchart's option screener, is essential to maximize your profitability.

If you need more information, visit the Barchart Options Learning Center. You can also find other option trading strategies broken down into their working parts, so that you know exactly what you need for trading.

Back to Top ↑