Long Call Calendar Option Screener

Long Call Calendar Option Screener

Hi, and welcome to the Options Learning Center. I'm excited to discuss long call calendar spread and how to use Barchart to get the most out of the strategy.

What Is A Long Call Calendar Spread?

A long call calendar spread is an option strategy that involves selling a call option that expires near-term while simultaneously buying another call option with a longer expiration date on the same underlying asset and the same strike price. The trade results in a net debit to initiate the trade.

Long Call Calendar Spread Options Strategy

- Strategy Definition: Sell Near-Term Call, Buy Long-Term Call

- Same Parameters: Identical Asset And Strike Price

- Trade Cost: Net Debit To Open Position

The goal of a long call calendar is to profit from the difference in volatility of both options while relying on theta decay to render the short call worthless. Theta is an options Greek that tells us how much the options premium will lose each given day, all things being equal.

- Strategy Goal: Profit From Volatility Differences

- Theta Decay Role: Reduces Short Call Value Over Time

- Theta Definition: Daily Decay in Option Premium

The strategy aims to profit from low volatility on the short option and increasing volatility on the long option.

By collecting a premium on the short call, with the shorter expiration, it offsets the cost of the long call with the longer expiration. As a result, long call calendar spreads are much more capital efficient than buying a longer-dated call option alone.

- Short Call Premium: Offsets Long Call Cost

- Efficient: Lower Than Single Long-Dated Call

- Expiration Difference: Key To Spread Strategy

Traders often use long call calendar spreads when near-term historical volatility, or HV is low, with the expectation that implied volatility ,or IV, will increase as the trade approaches the short call's expiration date. The logic is that the long call's premium increases with increased volatility.

- Short Call Premium: Offsets Long Call Cost

- Efficient: Lower Than Single Long-Dated Call

- Expiration Difference: Key To Spread Strategy

Traders often use long call calendar spreads when near-term historical volatility, or HV is low, with the expectation that implied volatility ,or IV, will increase as the trade approaches the short call's expiration date. The logic is that the long call's premium increases with increased volatility.

- Ideal Entry: Low Near-Term HV

- Expectation: Implied Volatility Will Increase

- Logic: Long Call Gains Value With Higher IV

Long call calendar spreads can be at the money or out of the money, depending on your trading preference and risk tolerance. Out-of-the-money calendar spreads are less risky, have lower starting costs, but offer a lower profit potential. On the other hand, at-the-money long call calendar spreads are more expensive and have higher potential profit but are more sensitive to vega.

- Strike Selection: At-The-Money Or Out-Of-The-Money

- OTM Spreads: Lower Risk, Cost, And Profit Potential

- ATM Spreads: Higher Cost, Profit, And Vega Sensitivity

Vega tells us how much the option premium might change with a 1% change in volatility - so this is an essential Options Greek to know when trading calendar spreads.

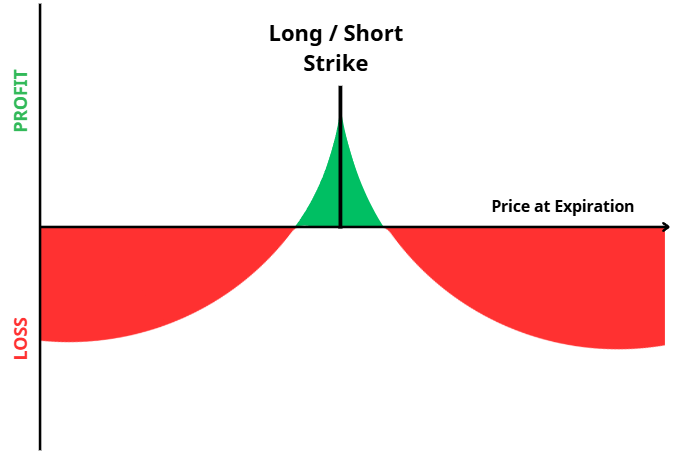

The maximum profit of a long call calendar spread happens when the underlying asset's price trades at exactly the strike price, at the short call's expiration. If that happens, the short call expires worthless, while the long call becomes more valuable.

- Max Profit Point: Price At Strike On Expiration

- Short Call Outcome: Expires Worthless At Expiration

- Long Call Outcome: Gains Value Near Strike Price

The net debit paid at the start of the trade is the strategy's maximum loss. This happens if the underlying asset trades significantly below or above the strike price at expiration. The specific price for the maximum loss condition depends on the options premiums at the short call's expiration. The trade reaches its theoretical maximum loss when the short call's premium is equal to that of the long call's premium, which renders the entire spread worthless.

- Maximum Loss: Premium Paid for Long Call - Premium Received from Short Call

The breakeven prices of a long call calendar spread can be found on the upside and downside and vary depending on the value of the spread, which changes as time goes on. Breakeven prices are also affected by implied volatility, making it a challenge to predict since most of the trade's value is derived from extrinsic (and therefore, variable) value.

- Breakeven: Highly Variable Based on Spread Value and IV at Expiration

Trade Example

Long call calendar spreads are more complex than trading single-leg options strategies, and looking for a specific trade with specific profit conditions will be difficult and time-consuming. Thankfully, with Barchart, we've got you covered. Our screener can find trade legs that meet your specifications. Let me show you how.

Screening The Market For Long Call Calendar Trades

To access the Long Call Calendar screener, go to Barchart.com, click on the Options tab, and then click on Long Call Calendar Screener.

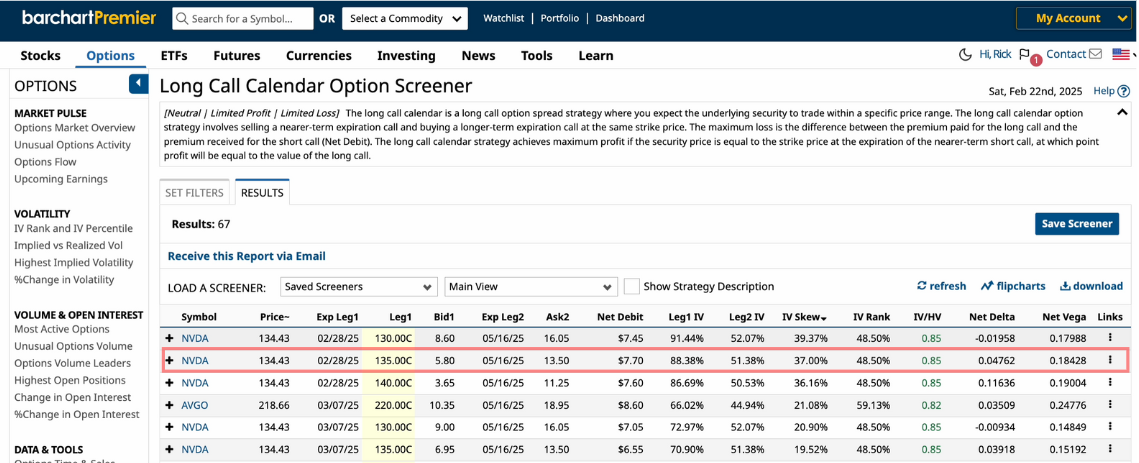

Once you click on that, you'll be brought to the results page with a list of default trades. You can rearrange the results page from highest to lowest or vice versa according to any of the column headers you see here by just clicking on them.

Now, while the default results are an excellent starting point, you may want to further refine the search. So, to customize the results, you can click on Set Filters at the top of the results window, and you'll be brought to the Screener page.

Here, you'll find our default filters, and you can add and remove any, as you like. To add a filter, just click on the "add a filter" field and type in whatever you need. Let's say I want only large mega-caps in my results. So, I can type in Market cap here, hit add, then I'll click mega.

Other Filters include your options trading data like the Greeks, price changes, moneyness, days to expiration, and more. Plus, you also have access to filters for the underlying assets themselves, including technical and fundamental analysis information, trading prices, percent changes, dividend information, and more. Everything you need to fine-tune your trading experience is right here.

Let's change a few of the filter values.

I'll change the days to expiration or DTE of the first trade leg, which is the short call, to 60 days and below, then change the DTE for the second leg or long call to between 60 and 100 days.

And now, I'll click on See Results. The results are sorted by highest to lowest IV Skew by default. IV Skew is the difference between the short and long call's individual implied volatility. A positive IV skew is preferable because it means the short-term option will have higher implied volatility than your longer-dated long call - which is what traders want from the strategy.

You can also have Barchart automatically screen the market for the same filters, and email you the results every day. To do that, hit the Save Screener button, give it a name then select when you'd like to get the emails.

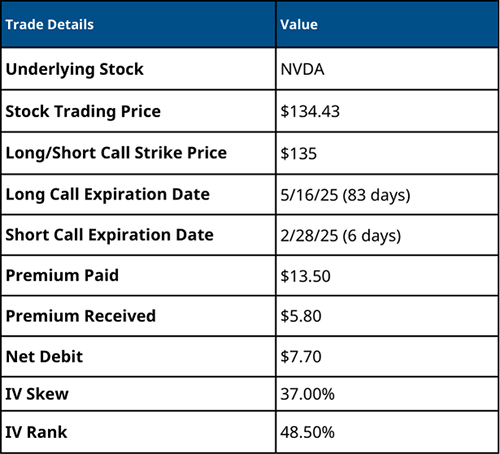

Let's take this trade here as an example:

According to screener, you can trade a long calendar spread on Nvidia, with the stock currently trading at $134.43. The strike price for long and short calls will be $135. The short call, expiring in 6 days on February 28, is priced at $5.80, while the premium paid for the long call, expiring in 83 days on May 16, is $13.50. The net debit for the trade is $7.70.

Profit Scenario

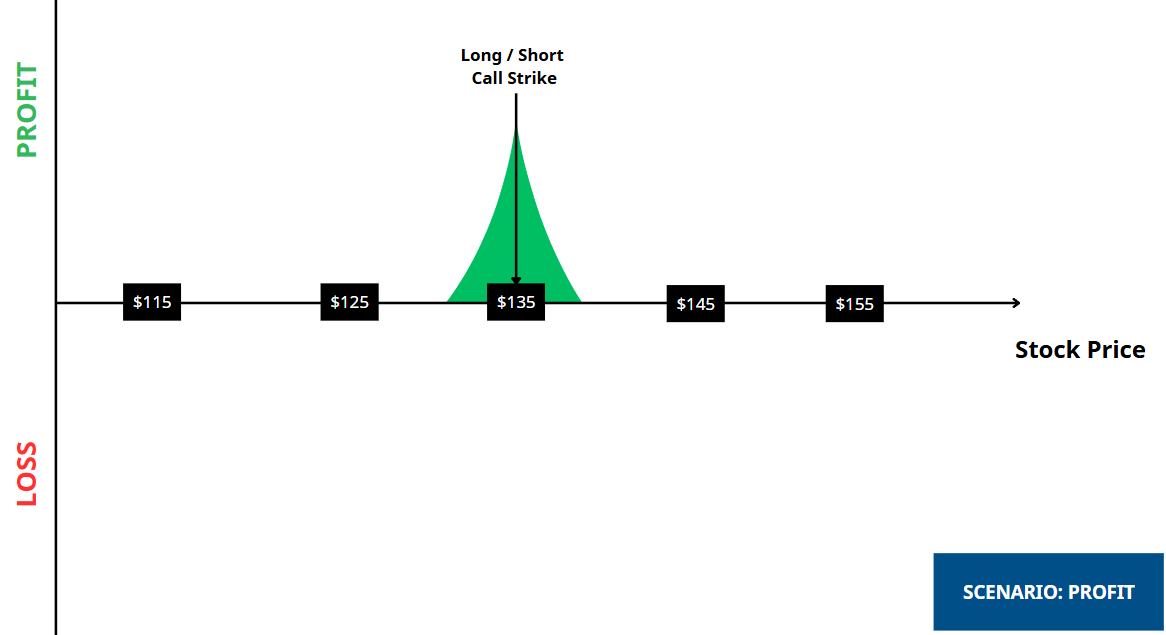

Let's say, for example, that Nvidia trades at $135 on the expiration of the short call. That means the short call has no intrinsic or extrinsic value and expires worthless. Meanwhile, the long call is now at the money and still has lots of time value left.

Now, you're banking on implied volatility increasing during this time, and let's assume it is. So, let's say that traders are now willing to pay $15 for your long call, and you sell it as such. To calculate your profit, subtract the initial net debit of $7.70 from the long call's current premium, and you're left with $7.30, or $730 per contract in profit.

Profit Calculation: ($15 - $7.70) * 100 = $730

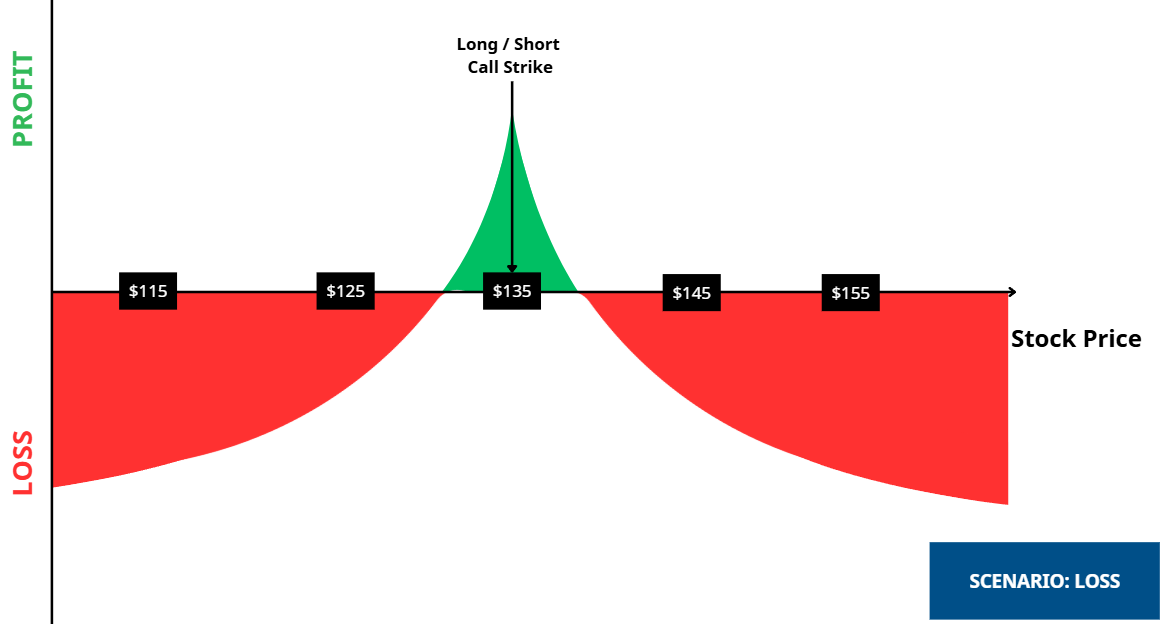

Loss Scenario

Now, let's see what might happen in a loss scenario. If Nvidia trades significantly above or below the strike price, the trade will hit its maximum loss. This is because the options premiums will become equal, and when that happens, the net premium of both options will become zero.

The maximum loss for the trade is limited to the net debit paid. However, the exact price where the maximum loss occurs depends on the premiums and implied volatility (IV). But, let's assume that the stock trades above the strike, say at $150 before the expiration of the short call.

This means both options are deep in the money, and you'll want to close them out to avoid assignment on the short call.

Screening For Long Call Calendar Spreads For Specific Assets

Barchart also allows you to search for long call calendars for a specific asset. All you need to do is go to the the stock or asset's Price Overview page on Barchart.com. Once there, look for Horizontal Spreads. Then look for the Long Call Calendar tab. You can click on the dropdown to change the expiration dates or click the screen button to reach the option screener page for a more granular search.

Closing Your Positions Before Expiration

It is always a good idea to close your positions, if they are in the money, right before expiration. For the long call calendar spread, you have one active short position, the short call, so if its in the money, I recommend closing it out to avoid assignment.

- Strategy Includes One Short Position

- ITM Option Will Be Exercised at Expiration

This is because if that short call gets assigned, you will be obligated to sell 100 shares of the underlying asset for every contract you wrote. Now, if this happens, you can exercise your long call, and the shares you buy with that trade can get sold to satisfy the assignment on your short call.

- Assignment Means Selling 100 Shares

- Exercise the Long Call

- Buy 100 Shares of the Underlying

Pros and Cons of Long Call Calendar Spreads

Pros and Cons of Long Call Calendar Spreads The first advantage of long calendar spreads is that they heavily benefit from theta or time decay, since you're selling a near-term call against buying a long-term call. It also benefits from vega, or volatility expansion, increasing the value of the long call as implied volatility rises. Long call calendar spreads are also excellent for neutral to moderately bullish market conditions, and can be easily adjusted by rolling the short option to extend the trade. Lastly, it has limited risk and is cheaper than long calls, since the sold call offsets the cost of the long-term call.

- Benefit From Theta

- Benefit From Volatility Expansion or Vega

- Excellent for Neutral to Slightly Bullish Markets

- Flexible

- Limited Risk

- Capital-Efficient

On the other hand, a long call calendar spread's profit potential is limited to the value of the long call, after the short call expires. It is also highly dependent on low IV, as initiating a trade with a higher IV puts you at risk of volatility contraction while your trade legs are active. If that happens, your spread will lose value. Finally, this more complex than most option strategies, and, of course, having a short call means you need to look out for assignment risk.

- Limited Profit Potential

- Requires Low IV During Entry

- Vulnerable To Significant Price Movements

- Complex Strategy

- Risk of Assignment

Conclusion

The long call calendar spread is best used during neutral or moderately bullish markets and benefits from theta and volatility expansion. However, it is also a complex strategy and requires precise price forecasting to get maximum profit. That's why using any and all resources, including option screeners, will help you get the most out of your trade.

If you need more information, visit the Barchart Options Learning Center where you can find more about long call calendar spreads, and also find other option trading strategies broken down into their working parts.