Long Call Condor Option Screener

Long Call Condor Option Screener

Hi, and welcome to the Options Learning Center. I'm going to show you how to buy long call condors and use Barchart to get the most out of the strategy.

What Is A Long Call Condor?

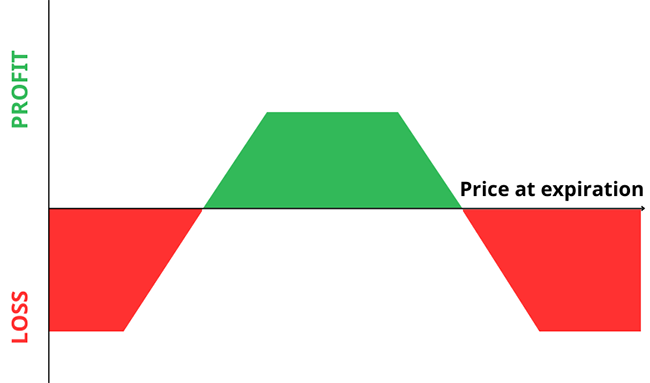

A long call condor spread is a directionally neutral options trading strategy that uses four call options with the same underlying asset and expiration date, but each at higher strike prices. It works well when you expect an underlying asset to trade with low volatility until expiration, that way you’ll achieve maximum profit.

Long Call Condor Options Strategy:

- Directionally Neutral

- Combines Four Call Options

- Same Underlying Asset And Expiration

- Profit If The Price Stays Between Short Strikes

- Result: Bear Call & Bull Call Spread Max

- Profit: Width Of Spread Less Net Debit

- Loss: Underlying Asset Trades Beyond Short Strikes

To setup the trade, you’ll buy an in-the-money call at one strike, then sell a call at a higher strike, sell another at an even higher strike, and finally, buy a call at the highest strike.

Long Call Condor Setup

- Buy One ITM Call (lowest strike price)

- Sell One Call (higher strike price)

- Sell Another Call (even higher strike price)

- Buy OTM Call (highest strike price)

The result is a bull call and bear call spread that creates a long call condor which results in a net debit.

The goal of a long call condor is for the asset to stay between the two middle strike prices at expiration. If that happens, maximum profit will be achieved at expiration when the options settle.

The maximum profit on a long call condor is the difference between the strike prices of the bull call spread (the lower spread width) minus the net debit paid. The maximum loss is limited to the net debit paid at the start of the trade and happens if the asset price at expiration either trades below the lowest strike price, or above the highest strike price.

Trade Examples

Traders usually screen the market for assets to use on long call condors, but they can sometimes identify a specific asset beforehand. I’m going to discuss how to do both of these using Barchart. So, let’s start with screening the market first, then specific assets later, and let’s head to Barchart.com.

Screening The Market For Long Call Condor Trades

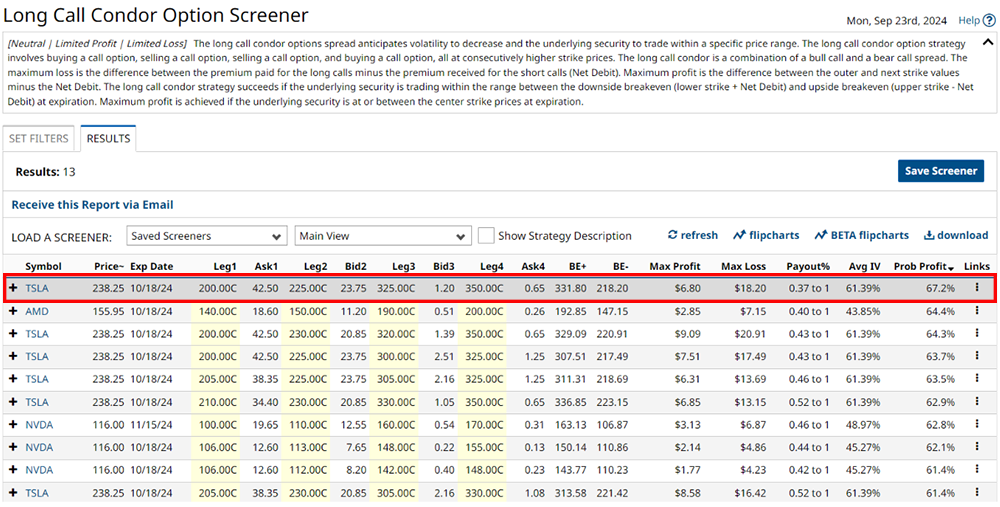

To access the Long Call Condor screener, go to Barchart.com, click on the Options tab, and then click on Long Call Condor Screener. This will immediately bring you to the results page where you can find likely trades. These results are perfect place to start. The headlines include all the necessary information, and you can rearrange them from highest to lowest or vice versa by clicking on the column header.

These results are already great to get you started on the trade, but if you want more customization, click the Set Filters tab at the top. This will bring you to the options filters page.

As you can see, several default filters are already in place, and it's a perfect place to start the trade. But, if you'd like, you can add or remove filters according to your preference. To do that, just click in the Find a Filter field, type in your desired filter, and click Add. Or, if you're unsure of what to add, click the dropdown below and select from dozens of filters. Regardless of your trading experience, you can find everything you need right here.

You can also delete any filters you like.

For example, lets scroll down to the Probability of Profit. As the name suggests, this filter shows the chance of you profiting from the trade by even 1 cent. Since long call condors typically have low payout percentages, or high risk/reward ratios, you want to maximize this value without sacrificing potential too much profit.

Not only that, long call condors don’t have high profit probabilities. So I’m going to set the probability here to 60 or more, and click see result. I’ll then arrange the results for highest probability of profit. And there we have it, a likely trade candidate.

Before I get to the trade example, it’s important to know that you can also save your screener to reuse it later. You can also have Barchart email you at a specified time with your trades. Just click Save Screener near the top right, then type in the name of the screener and click on when you want the email to arrive. That’s it!

Now, let’s pick apart this trade.

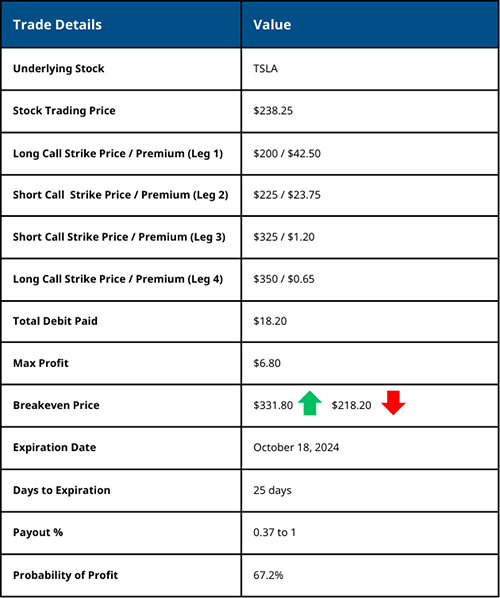

According to the screener, you can set up a long call condor on TSLA with the stock currently trading at $238.25. Here’s how this trade works: for the bull call, you can buy the $200-strike call, paying a premium of $42.50 per share, and sell the $225-strike call for $23.75 per share. For the bear call, you sell the $325-strike call, collecting $1.20 per share, and then buy the $350-strike call for $0.65 per share.

This setup results in a total debit of $18.20 per share, or $1,820 total. Your maximum profit on the trade is $6.80 per share. All options expire on October 18, 2024, with 25 days remaining until expiration from the time of recording. The trade has a 67.2% probability of profit.

For easier trade calculations, it’s best to know the breakeven points on the upside and downside. Add the net debit to the lower long call strike to get the breakeven to the downside. For the breakeven to the upside, subtract the net premium paid from the higher long call strike. So, that makes your breakeven points $218.20 on the lower end and $331.80 on the upper end.

Breakeven Calculation

- Lower Breakeven: Lower Long Call Strike + Net Debit

- Upper Breakeven: Higher Long Call Strike - Net Debit

Profit Scenario

If the price of Tesla stock trades between $225 and $325 at expiration, you’ll hit the maximum profit condition for the trade. This is calculated by taking the width of either of the spreads, since they have equal distance, and subtracting the premium paid to set up the long call condor. This works out to $6.80, or $680 per contract.

Maximum Profit Calculation

Width of Spread: $350 - $325 = $25

Debit Paid: ($42.50 + $0.65) - ($23.75 + $1.20) = $43.15 - $24.95 = $18.20

Total Profit: $25 - $18.20 = $6.80 * 100 = $680

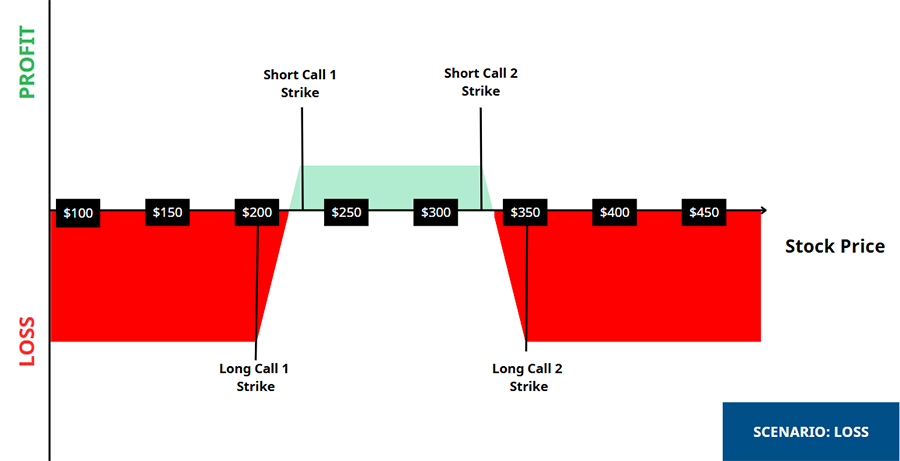

Loss Scenario

If, however, Tesla’s stock price trades beyond either of the long strikes, below $200 or above $350, your trade enters its maximum loss condition. And, the maximum loss is simply what you paid to enter the trade, which is $18.20 a share or $1,820 per contract.

Debit Paid: ($42.50 + $0.65) - ($23.75 + $1.20) = $43.15 - $24.95 = $18.20

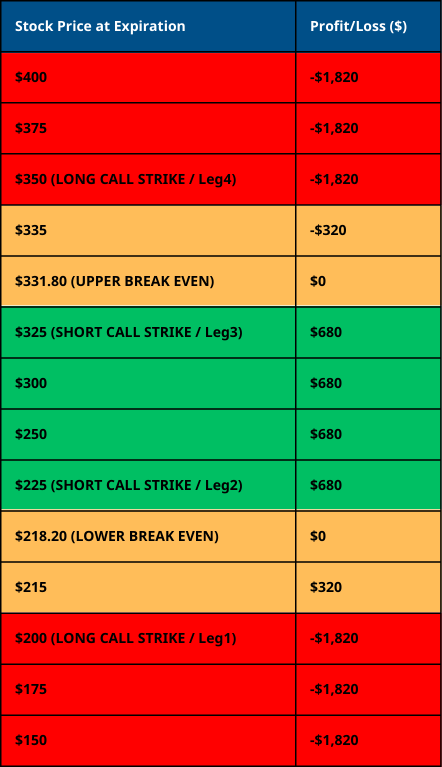

Profit/Loss Across Different Price Points

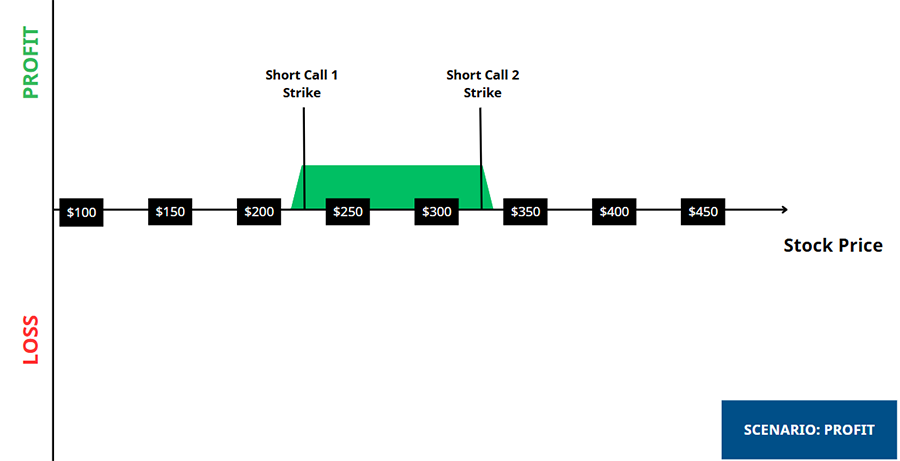

Here’s how the long call condor looks across different price points at expiration.

As you can see, the profit zone is in the middle, between the two short strike prices. As the stock price moves above or below the short calls, the trade starts losing money. If the stock moves beyond the long strikes, the maximum loss, which was the net debit paid, is reached. That’s why long call condors are perfect for low-volatility assets as they profit when the stock trades between a certain range.

Screening For Long Call Condors For Specific Assets

So that's screening the entire market for potential long call condor trades. But what about if you have a specific stock in mind? That's also easy. Let me show you how.

All you need to do is go to the stock or asset's Price Overview page on Barchart.com. Once there, navigate to the left and look for condor strategies. Then, click the long call condor tab to see the trade search results.

You can click on the dropdown to change the expiration dates, change trade legs, or click the screen button, then set the filter to reach the option screener page for a more granular search.

Closing Your Positions Before Expiration

It is always a good idea to close your positions before expiration when using any strategy that requires writing or selling options. For this example, you have two short positions in this trade, and if either of them is in the money by expiration, the option will be automatically exercised, or, in your perspective, you will be assigned.

- Strategy includes two short positions

- ITM option(s) will be exercised at expiration

If any of the short calls gets assigned, you are obligated to sell 100 shares of stock for every contract you wrote. This means you might need to purchase the shares at the current market price—which could be higher than the strike price—and then sell them at your strike price, potentially resulting in a loss.

- Assignment means selling 100 shares

- Adverse market conditions could lead to a loss

You can also sell your long call positions to capture any remaining value which will mitigate some of your losses or even reach profitability if they haven't expired yet. But keep an eye out for trading fees, as they might make buying shares from the market preferable.

- Sell long calls to capture any remaining value

- Watch out for trading fees

Pros and Cons of Long Call Condors

Like most spreads, the long call condor has a well-defined risk and reward profile. The strategy is great for low-volatility or neutral markets. Lastly, the trade is very flexible, with strike prices, spread widths, and all other setup details adjustable according to your trading and risk preferences.

Pros

- Defined Maximum Profit And Loss

- Beneficial In Low Volatility Environments

- Can Profit In A Neutral Market

- Flexible Strike Price Selection

However, long call condors have limited profit potential. Setting the spreads too wide can also result in significantly reduced profitability. Additionally, like any strategy that requires writing options, the risk of early assignment is always present. Managing and adjusting your trades during significant price swings and changing markets can also be challenging. Lastly, your admittedly limited profitability can be further impacted by trading fees since you need four option legs for a long call condor.

Cons

- Limited Profit Potential

- Wide Spreads May Reduce Profitability

- Potential Assignment Risk On Short Options

- Difficult To Manage In Rapidly Changing Markets

- High Trading Fees

Conclusion

The long call condor is ideal in sideways or neutral markets, though it ends in a net debit and may lead to high trading fees. So, it’s best to keep your eye on the trades and maximize your profit potential by using every resource at your disposal, like Barchart’s option screeners.

Don't forget to visit the Barchart Options Learning Center where you can learn more about all the other options trading strategies, how they work, and how to profit from each.

Back to Top ↑