After shrugging off the Fed-induced correction, Palantir's earnings report will be the next opportunity for the bulls or bears to be proven right

High-yield dividend stocks provide predictable and regular income to investors.

Rio Tinto RIO has joined forces with BHP Group BHP and BlueScope to develop Australia’s largest ironmaking electric smelting furnace (ESF) pilot plant in Western Australia. The BHP-RIO alliance will...

/CNW/ -- Energy Metals News – The global shift toward green energy is accelerating, but experts warn that a looming copper shortage could jeopardize efforts to...

Copper is now in the early stages of a long-term, multi-year bull market. With soaring demand for the copper needed in electric vehicles, the power grid, data centers and infrastructure, there is still...

Copper is now in the early stages of what appears to be a long-term, multi-year bull market. With soaring demand for the copper needed in electric vehicles, the power grid, data centers and more there...

The copper market, much like gold, is in the midst of an impressive bull run with no signs of slowing down thanks to soaring demand for copper worldwide. In fact, as noted by Reuters, “Copper’s bull...

Copper is now in the early stages of what appears to be a long-term, multi-year bull market. With soaring demand for the copper needed in electric vehicles, the power grid, data centers and more there...

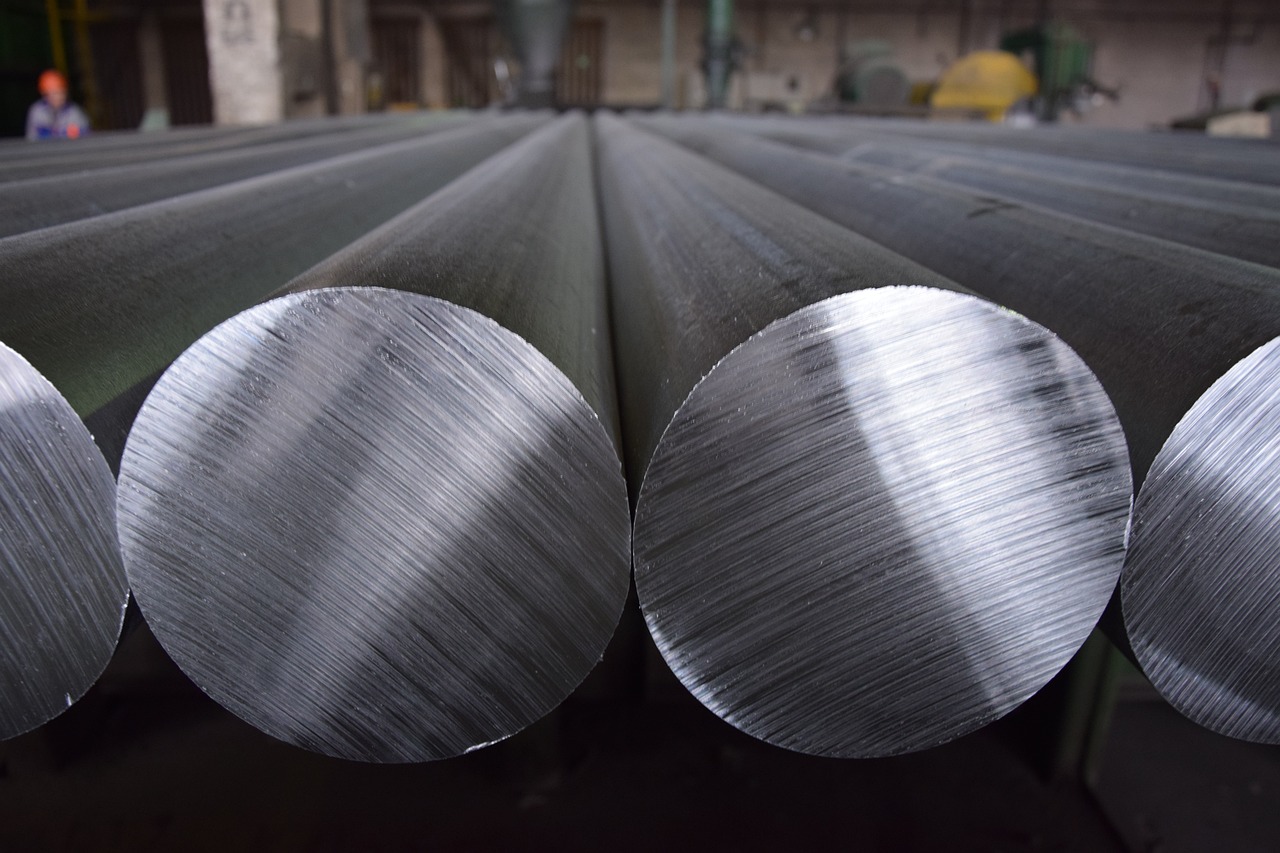

The blocking of bauxite exports from Guinea is the latest news to send alumina prices skyrocketing, with much of the panic buying coming from China, the world's biggest aluminum producer. Prices hit a...

Issued on behalf of Battery X Metals Inc. VANCOUVER – USA News Group News Commentary – Within the green energy transition that includes a major shift towards electric vehicles (EVs), is a potential...