Sometimes, the headline numbers don't tell the whole story. That's definitely the case with industrial software company PTC (NASDAQ:PTC) and workflow technology company Trimble (NASDAQ:TRMB). Both companies have excellent underlying growth rates in their recurring revenue, resulting in excellent cash flow generation in the coming years. As such, they represent two hidden growth stocks that would make an excellent addition to a long-term investor's portfolio.

PTC and Trimble: The numbers that matter

The thesis behind buying both stocks is similar. Both companies have solutions with significant secular growth drivers behind them, and they are encouraging the increasing adoption of their respective technologies.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

In both cases, the growth is demonstrated in their recurring contract and subscription revenue, which ultimately guides their free cash flow (FCF) rather than in their revenue lines. The reasoning is that both companies offer solutions that are integral parts of their customers' long-term operations, rather than being a one-off sale of hardware or on-premises software.

As such, both companies are growing their recurring revenue at a double-digit rate (above their total revenue rate), and both trade on highly attractive FCF-based valuations based on their FCF growth rates.

PTC's solutions are the future of manufacturing

In the case of PTC's industrial software, the growing use of digital technology in manufacturing is used to continuously improve product design, production, servicing, and disposal. By creating a digital thread of a product -- from initial design using computer-aided design (CAD) software through product lifecycle management (PLM) software to service lifecycle management (SLM) software -- a customer can gather a wealth of digital data that is continuously analyzed to produce actionable insights.

Products can be redesigned to optimize production efficiency or improve service requirements, and manufacturing processes can be changed to enhance servicing, etc. This continuously improving process helps customers design and get products to market quicker.

Despite challenging markets, the benefit of PTC's solutions continues to encourage double-digit growth in its annual run rate (ARR) of "active subscription software, cloud, SaaS, and support contracts"

As you can see, the trend of growing ARR leading to super growth in FCF is clear.

Data source: PTC presentations, www.marketscreener.com, organic ARR (as defined by PTC) growth at constant currency, Chart by author.

Moreover, Wall Street analysts see that trend continuing, with mid-teens to high-teens annual growth in the FCF forecast for 2025-2027. In terms of valuation, that means $841 million in 2025, $979 million in 2026, and $1,162 million in 2027. On a price-to-FCF basis, that equates to 23 times FCF in 2025, 20 times FCF in 2026, and 17 times FCF in 2027.

These are extremely attractive valuations for this kind of FCF growth. Moreover, if the economy improves, those estimates have a potential upside, as capital spending and research and development budgets are likely to be freed up by manufacturing companies.

Trimble's solutions add real value

While its origins lie in precise positioning hardware, Trimble's future lies in helping its customers use the masses of data produced by its hardware to improve its daily workflow. Trimble's key end markets include construction/infrastructure, transportation/logistics, and geospatial, and it uses its "connect and scale" strategy to generate significant efficiency gains for them.

"Connect" refers to the collation of masses of disparate digital data that multiple parties can share and use, and "scale" refers to the data-driven insights that improve workflow. For example, in construction and infrastructure, the creation, analysis, and precise monitoring of digital data help designers, architects, and engineers improve planning and scheduling, reduce waste, and generate significant cost savings while ensuring the timely completion of projects in the physical world.

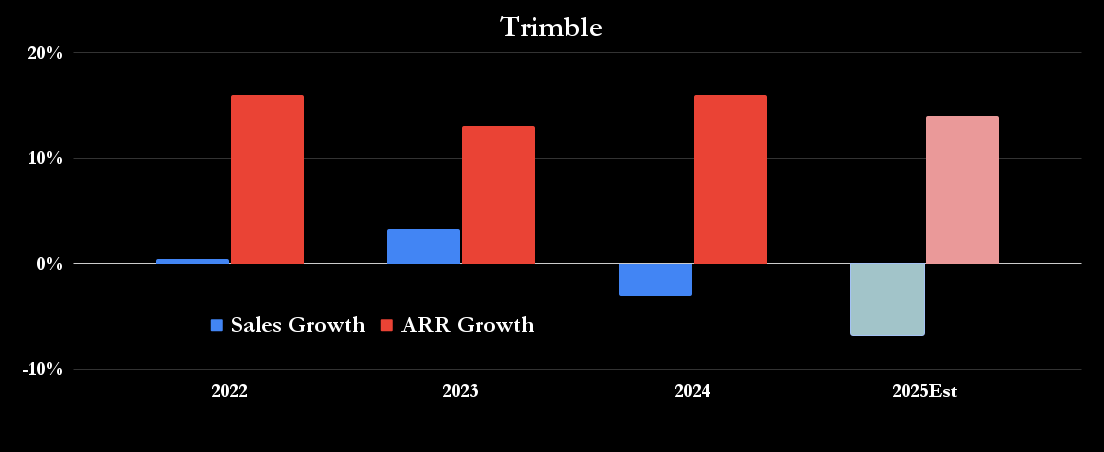

Adoption across its key end markets continues at an impressive rate, and Trimble continues to grow its annualized recurring revenue (ARR) at a mid-teens rate.

Here again, you can see the deceiving nature of Trimble's top line compared to its ARR growth. The reality is that Trimble's revenue has declined recently due to divestitures of noncore businesses and the creation of a joint venture in agriculture with AGCO.

Data source: Trimble presentations. Organic ARR (as defined by Trimble) growth. Chart by author

Trimble's FCF needs some explanation, as Wall Street analysts forecast an 11.4% decline in 2025 to $446 million before rising 79% to almost $800 million in 2026. The decline in 2025 comes down to an anticipated $250 million cash payment and $30 million worth of transaction costs relating to the AGCO deal. Adjusting for these one-off items means an underlying FCF of $726 million, implying a price-to-FCF multiple of 24 times the adjusted FCF for 2025 and then 22 times for 2026.

Image source: Getty Images.

Stocks to buy

Both companies are improving their key metrics over their revenue, and the hidden nature of this improvement makes them great stocks to buy for investors willing to go beneath the hood and kick the tires. As such, PTC and Trimble are excellent options for a growth-orientated portfolio.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $300,764!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,730!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $524,504!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 3, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends PTC and Trimble. The Motley Fool has a disclosure policy.

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)