Johnson & Johnson JNJ announced that the FDA has granted approval to its key drug, Tremfya, for its second inflammatory bowel disease (IBD) condition — moderately to severely active Crohn’s disease (“CD”). For the CD indication, Tremfya has gained approval for both subcutaneous (“SC”) and intravenous (“IV”) induction options.

The approval for the CD indication was based on data from the phase III GALAXI and GRAVITI studies, which demonstrated the robust efficacy of SC or IV Tremfya in achieving clinical and endoscopic endpoints.

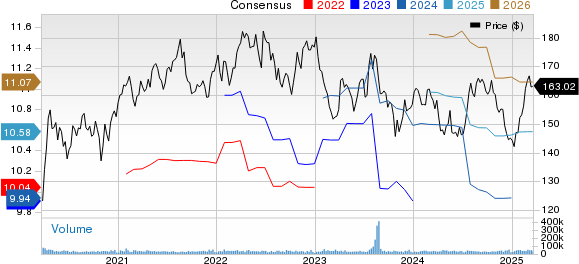

So far this year, J&J’s shares have risen 12.7% compared with the industry’s 7.0% increase.

Image Source: Zacks Investment Research

JNJ’s Tremfya in IBD Conditions

Tremfya was approved for its first IBD condition, moderately to severely active ulcerative colitis (“UC”), in September 2024. Tremfya, an IL-23 inhibitor, is already approved to treat moderate-to-severe plaque psoriasis and active psoriatic arthritis in several countries, including the United States and the EU. Crohn’s disease marks the fourth indication for Tremfya in the United States. Tremfya is under review in the EU for both UC and CD indications.

Tremfya is a Key Top-Line Driver for JNJ

Tremfya is an important drug in J&J’s immunology drug portfolio and a key driver of top-line growth. The drug generated sales of $3.67 billion in 2024, up 16.6% year over year, driven by strong market growth and share gains.

The approval of Tremfya for the IBD conditions, UC and CD is the key to its growth. J&J expects Tremfya to be a $5 billion product with approvals in IBD conditions.

Competition in the IBD Space

In recent years, there has been a surge in the prevalence of gastrointestinal disorders like UC and CD due to genetic factors, environmental factors and lifestyle changes. In addition, immune system irregularities, higher diagnosis rates, increased focus on early diagnosis and favorable reimbursement policies in developed countries are driving demand for IBD treatments.

Several big drugmakers are developing new medicines with novel mechanisms of action to help patients with UC and CD achieve long-term clinical remission. Some other key players in the IBD market are AbbVie ABBV, Eli Lilly LLY, Pfizer, Novartis, Merck MRK, Sanofi, Gilead and Amgen. Some of these companies have also in-licensed rights to IBD candidates with improved clinical profiles from smaller drugmakers in the past two to three years.

AbbVie has been seeing strong performance of its key immunology drugs, Skyrizi and Rinvoq, in IBD indications. In 2024, AbbVie acquired smaller biotechs like Landos Biopharma and Celsius Therapeutics, which are making novel drugs for treating IBD. It also signed a license agreement with China’s FutureGen to develop a next-generation anti-TL1A antibody for IBD.

Lilly’s Omvoh was approved for UC in the United States, Europe and Japan in 2023. Omvoh was approved for CD in the United States in January 2025, while applications are under review in Europe and Japan. In 2024, Lilly acquired small biotech Morphic Therapeutics, whose lead pipeline candidate is MORF-057, in mid-stage development for both UC and CD.

In 2023, Merck acquired small biotech Prometheus Biosciences, which added tulisokibart to its pipeline. Tulisokibart, a novel TL1A inhibitor, is being developed in phase III for UC.

In 2023, Roche acquired Telavant, including rights to the novel TL1A-directed antibody (RVT-3101) from Roivant for the treatment of IBD conditions.

In October 2023, Sanofiin-licensed rights to jointly develop and commercialize Teva Pharmaceutical’s IBD candidate, duvakitug/TEV-48574, an anti-TL1A therapy. Duvakitug is being evaluated in a phase IIb study for UC and CD, with a phase III study expected to begin this year.

J&J’s Zacks Rank

J&J currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock(1).jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)