Berkshire Hathaway (NYSE:BRK-A)(NYSE:BRK-B) is hard to describe. On a very basic level, it partially or wholly owns a vast and varied collection of businesses (or the stock of those businesses). But that description misses a lot of the complexities of how it operates. Despite this complexity, or perhaps because of it, the company is one of the most closely watched on Wall Street.

Given the strong interest in the company, there is also a strong interest in the stock. But is Berkshire Hathaway a buy, sell, or hold today? The answer to that is also complex.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The case for buying Berkshire Hathaway

Berkshire Hathaway is technically a conglomerate: It operates multiple distinct businesses under its corporate umbrella. However, it is like no other conglomerate on Wall Street given the huge diversity of those businesses. Railroads, utilities, pipelines, insurance, restaurants, home building, paint, precision parts, furniture, candy, and more are all parts of the Berkshire Hathaway empire. This odd assortment of businesses is all a function of one man: CEO Warren Buffett.

Image source: The Motley Fool.

This is because Berkshire Hathaway is essentially his investment vehicle. Buffett's approach to investing can be summed up as buying good companies when they are reasonably priced and then holding on for the long term to benefit from their growth. One key part of his philosophy is that he favors buying businesses that have strong management teams already in place. He then keeps those legacy leaders in charge and gives them plenty of leeway to do their jobs, so long as they aren't making massive mistakes. This is, basically, what a mutual fund does -- except that Berkshire Hathaway is buying entire companies while mutual funds are only buying stock in the company.

Of course, Berkshire is well known for having a stock portfolio, too, but the value in its portfolio of wholly owned businesses is larger. Currently, the stock portfolio is worth around $287 billion. It's also holding $334 billion in cash and equivalents. So based on the conglomerate's market cap of $1.140 trillion, the value that Wall Street places on its varied collection of subsidiaries is about $519 billion.

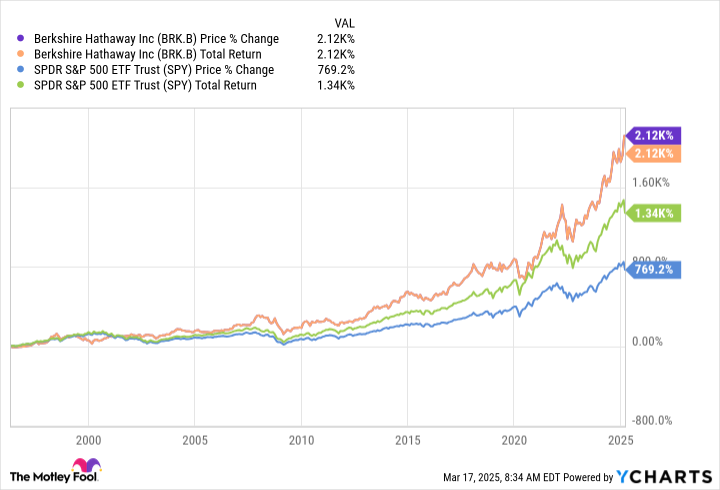

All in all, however, it's hard to argue with success, and Berkshire Hathaway's stock has vastly outperformed the S&P 500 (SNPINDEX:$SPX) index over the long term. Ultimately, the chief reason to buy shares of Berkshire Hathaway today is the same as it is on any day -- to invest alongside Buffett and his team.

Data by YCharts.

The case for selling (or avoiding) Berkshire Hathaway

Although Buffett is held in high esteem on Wall Street, and his nickname is the Oracle of Omaha, he isn't a magician. His results tend to wax and wane over time just like those of any other skilled professional investor, and just like the broader market. This is why it is noteworthy that the stock is literally trading near its all-time high right now. It's also noteworthy that based on all the traditional valuation metrics, it's trading at a premium. Berkshire's price-to-sales, price-to-earnings, and price-to-book-value ratios are all above their five-year averages.

Data by YCharts.

If you have a value bias as an investor, you probably won't be interested in buying Berkshire Hathaway at its current valuation levels. Some investors who have owned it for years might even be tempted to sell some shares and take some profits because of the increasing volatility in the broader market. In recent weeks, the Nasdaq Composite and the S&P 500 index have both dipped, at least temporarily, into correction territory.

The case for holding Berkshire Hathaway

That said, a key part of Berkshire Hathaway's success has been Buffett's penchant for buying and holding investments -- both stocks and whole companies -- over the long term. Given the incredible long-term performance of Berkshire Hathaway, trying to time the buying and selling of the stock seems like a less-than-ideal investment tactic. A better option if you own it is probably to just leave it alone and benefit from the growth of the many businesses under the Berkshire Hathaway umbrella.

There is one caveat here. Buffett is 94 years old. It is likely that he will not be the CEO for much longer. He has trained his successor and the team he works with, so they should be steeped in his unique investment approach. But if you hold the stock, you'll want to keep an eye on the CEO transition. The next leader of this company will have gigantic shoes to fill. If you are worried about the leadership transition, which is reasonable, you might want to think about selling some shares, even if you don't sell all of them.

Berkshire Hathaway isn't your typical company

Given the way Berkshire Hathaway is run, it is in some ways more like a mutual fund than a company. Is there ever a bad time to hire a great money manager? Probably not. However, that doesn't mean that Berkshire Hathaway stock will be a great choice for all investors, particularly since CEO Buffett is getting closer and closer to departing the company. Still, given Berkshire Hathaway's track record of success, long-term investors should definitely give it a close look, even at today's lofty valuations.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $307,378!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $40,591!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $512,780!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 18, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock(1).jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20video%20chip-by%20Antonio%20Bordunovi%20via%20iStock.jpg)