There's no such thing as a stock that's worth buying at any price. A no-brainer bargain at one valuation will necessarily be a bad purchase at another, higher one. Yet some stocks are worth owning even at a premium because their businesses are so consistently strong.

Costco (NASDAQ:COST) is a great example of a fantastic stock that's available at a compelling price today. Let's look at a few reasons why the warehouse retailing giant deserves a spot in your portfolio.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

1. People love it

Costco is more than just another place for its millions of members to shop. That fact is clear in the company's renewal rate, which is sitting at a record 93% in the core U.S. market. Nearly all of Costco's subscribers choose to renew their memberships each year, even when membership prices increase.

That's great news for investors because those membership fees, not product sales, account for most of Costco's profits. As a result, the chain can boost annual earnings more steadily than its retailing peers. Shareholders are also better protected from those sharp profit declines that plague most retailers during consumer spending downturns. That's the financial advantage of being a membership club first and a retailer second.

2. Competitors can't keep up

Owning Costco stock gives you a piece of a business that's outperforming peers in a very competitive market. Comparable-store sales this past quarter were up a blazing 9%. That result marked an acceleration from the previous quarter and was good enough to keep Costco at the top of the national retailing industry. Target last reported a 2% uptick on that metric, and Walmart's sales rose by about 5%.

Investors should be excited to see that a big part of Costco's growth in recent quarters has come from areas outside of its traditional stronghold of consumer staples sales. Revenue in its e-commerce division, which mainly includes discretionary products like consumer electronics and furniture, was up 22% last quarter. Costco's success at selling luxury products like gold bars also illustrates how the business can thrive through a wide range of selling conditions.

3. The price is right

There's no denying you'll pay a premium to own this high-performing business. Costco shares are trading at over 50 times earnings compared to Walmart's P/E ratio of 36. The stock is valued at 1.5 times revenue, too, while Walmart is valued at 1 times sales and Target is priced at 0.5 times sales.

Income investors might prefer Walmart stock, which is cheaper and carries a higher dividend yield of 1%. Walmart's recent payout hike, a 13% raise, marked the 52nd consecutive year of dividend increases for the retailing giant. That's enough to give it membership in the exclusive club of Dividend Kings. Costco's preference for unpredictable special dividends makes it less attractive for investors seeking a steadily growing income stream.

Still, you're likely to see market-beating returns by owning the stock from here. Costco is winning market share and expanding its influence into new growth avenues even as its stores enjoy record customer traffic. Don't expect management to let profit margins rise much above their current 4% rate, which is lower than most of Costco's peers. The company would rather reinvest any excess resources toward extending its price leadership. That's been a winning approach for decades, and it should continue to reward shareholders in the years to come.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

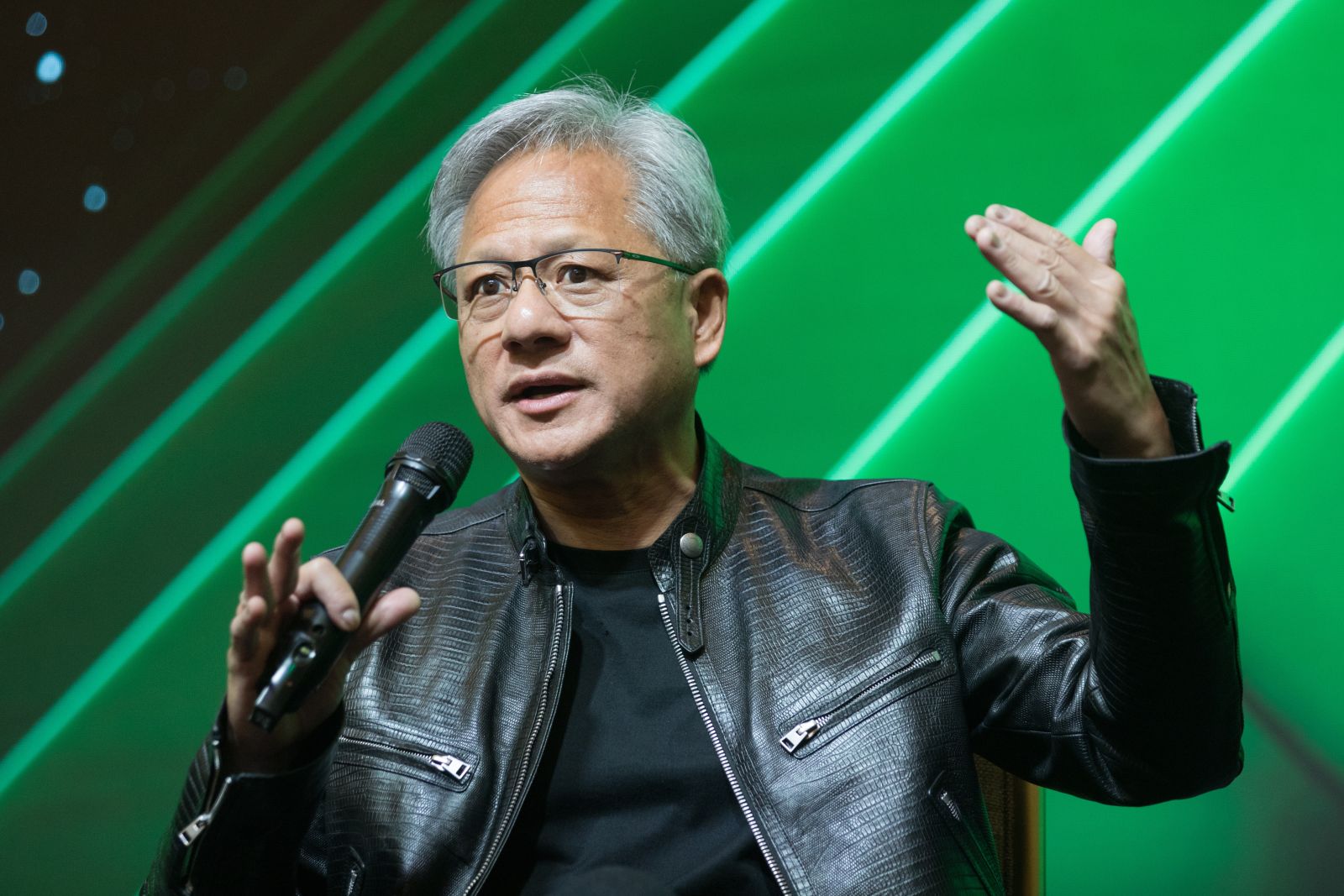

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $721,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 18, 2025

Demitri Kalogeropoulos has positions in Costco Wholesale. The Motley Fool has positions in and recommends Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock(1).jpg)

/Chipotle%20Mexican%20Grill%20lunch%20by-%20dennizn%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)