Tyson Foods, Inc. (TSN), valued at a market cap of $21.5 billion, is one of the world’s largest food processing and protein production companies. The company is a leading producer of chicken, beef, and pork, supplying fresh, frozen, and prepared foods to retailers, food service providers, and international markets.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and TSN perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the farm products industry. With a diverse brand portfolio that includes Tyson, Jimmy Dean, Hillshire Farm, Ball Park, and Wright, the company maintains a strong foothold in the sector, catering to a wide range of consumer preferences.

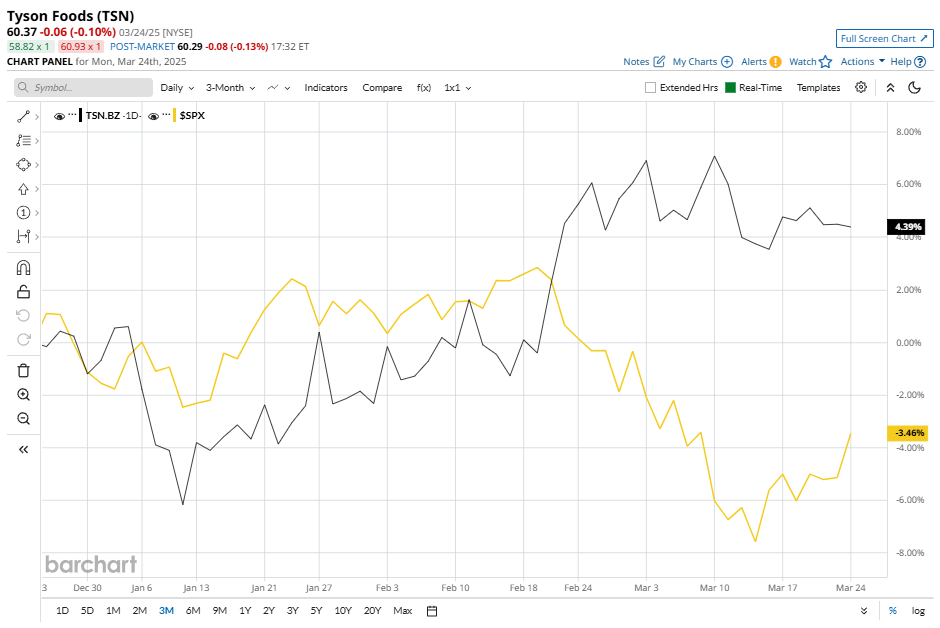

Despite its notable strength, TSN slipped 9.7% from its 52-week high of $66.88, achieved on Sep. 9. Over the past three months, TSN stock has climbed 4.6%, outpacing the broader S&P 500 Index ($SPX), which declined 4.5% during the same period.

In the longer term, shares of TSN have plunged marginally over the past six months but climbed 4% over the past 52 weeks. In contrast, the $SPX has gained marginally and 10.2% over the past year, outpacing the stock.

However, TSN has been trading above its 50-day and 200-day moving averages since last month, enforcing an uptrend.

On Feb. 3, Tyson Foods' stock rose 2.2% after reporting its Q1 earnings report, with EPS of $1.14 per share, a 65.2% increase year over year, with revenue up 2.2% to $13.6 billion. The company benefited from rising chicken demand and its diversified protein portfolio, boosting investor confidence.

Looking ahead, Tyson Foods anticipates that the total company’s adjusted operating income will be between $1.9 billion and $2.3 billion for the fiscal year 2025. The company expects its annual sales to be flat to up 1% compared to last year.

In the competitive arena of packaged food, Pilgrim's Pride Corporation (PPC) has taken the lead over TSN, showing resilience with a 17.9% uptick over the past six months and 50% gains over the past 52 weeks.

Wall Street analysts are cautiously hopeful about TSN’s prospects. The stock has a consensus “Moderate” rating from the nine analysts covering it, and the mean price target of $65 suggests a potential upside of 7.7% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock(1).jpg)

/Chipotle%20Mexican%20Grill%20lunch%20by-%20dennizn%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)