When I was a markets reporter for a newswire service back in the 1980s, one of my favorite newsletters I received via snail mail was from a cocoa market firm in New York City. The one-page newsletter was plain and simple — and effective – providing brief bullet points outlining the bulls’ case and the bears’ case for the cocoa futures (CAK25) market. Below I’ll do the same for gold (GCJ25) and silver (SIK25), and then at the end I’ll share with you my present biases.

The Bull Case for Gold and Silver Futures

- Save-haven demand continues to flow into gold and silver markets as President Donald Trump’s trade and foreign policies keep risk aversion elevated in the general marketplace.

- Technical charts remain firmly overall bullish for gold and silver.

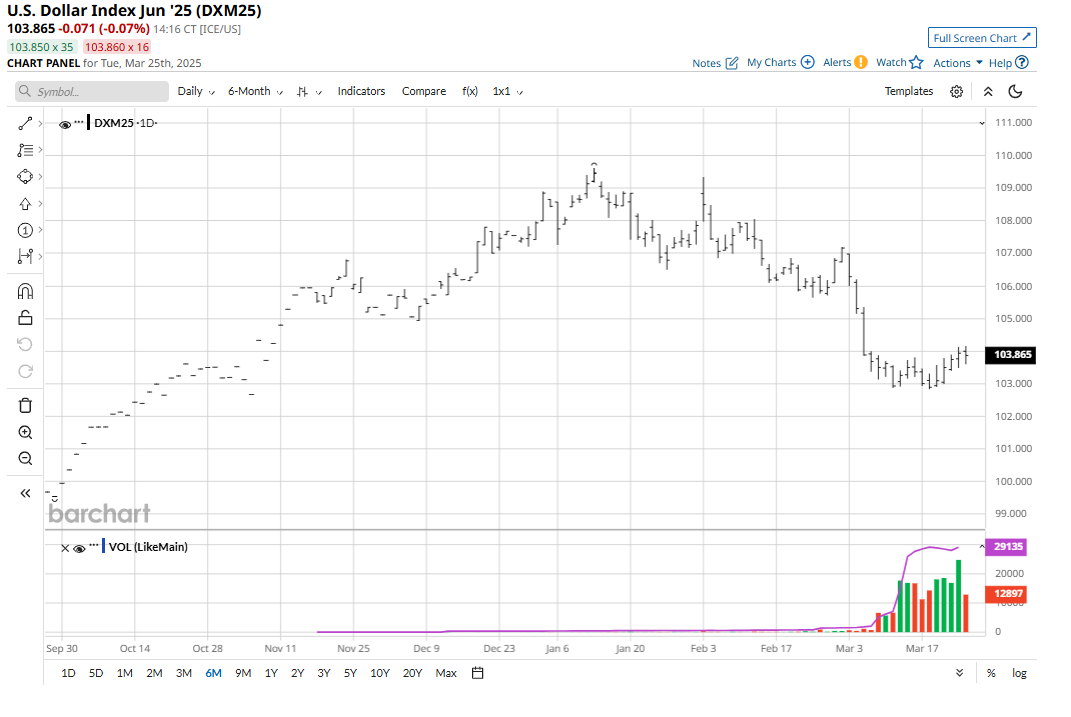

- U.S. Dollar Index ($DXY) remains in a downtrend on the longer-term weekly price chart.

- Slowing U.S. and global economic growth will prompt major central banks to keep their monetary policies less restrictive, which augurs for better consumer and commercial demand for metals due to lower borrowing costs and better consumer confidence.

- Several countries’ diversification away from holding the U.S. dollar in their sovereign reserves suggests they will continue to diversify away from the greenback and into gold.

- Raw commodity sector leader crude oil (CBK25) now sees its price starting to trend higher on the daily chart.

The Bear Case for Gold and Silver Futures

- Both gold and silver are in mature bull-market moves, suggesting most of the upside price action has already occurred.

- The daily chart for the U.S. Dollar Index shows a price downtrend has been negated and a bullish “rounding-bottom” reversal is forming.

- It’s very possible that the disruptive U.S. trade and foreign policy moves by the Trump administration have mostly been made and that markets have, or are close to, digesting them and factoring them into futures prices.

- Slowing U.S. and global economic growth in the coming months would dampen consumer and commercial demand for metals.

- The recent strong price rebounds in U.S. stock indexes begin to suggest they have put in near-term bottoms. That’s bearish for the competing asset class, precious metals.

- The recent selloff in the U.S. Treasury markets’ (ZBM25) prices (higher yields) is a bearish element for the gold and silver markets, as higher Treasury yields are a more attractive investment vehicle versus gold and silver, which carry no yield.

In my lists above, I’ll bet I’ve overlooked an element or two. Please email me at jim@jimwyckoff.com with your additions to the lists.

My Bottom Line

I think there is more price upside potential for the gold and silver markets in the coming weeks, or maybe a bit longer, but I would not be surprised to see solid downside price corrections in gold and silver in the coming weeks that, for many, would call into question the survivability of their mature bull runs.

Longer term, I think the bull markets in gold and silver will remain alive and well for many months to come, and potentially even longer. Thus, the longer-term buy-and-hold investors should continue to feel very comfortable. The shorter-term traders should remain confident but should also know that all bull markets experience significant downside price corrections.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nike%2C%20Inc_%20shopping%20by-%20hapabapa%20via%20iStock.jpg)

/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)