Reefer Madness was a 1936 American propaganda film about drugs, and the cautionary tale features a fictionalized take on marijuana use that destroyed lives. As of February 2022, thirty-seven of fifty US states have legalized the use of cannabis for medical purposes. Meanwhile, nineteen states have made recreational use legal.

On a federal US level, all marijuana remains illegal as the government classifies pot along with heroin and cocaine as a Schedule I drug with a high potential for abuse and little medical benefit. The gulf between Federal and state laws has created roadblocks for the burgeoning pot business, preventing traditional bank financing and consumer services. Dispensaries in states that have legalized cannabis can only collect cash or charge customers’ debit cards, and credit card use is a no-no as they are federally regulated tools. Transporting the contraband across some state lines from producers to consumers can carry severe trafficking penalties when traveling across states where pot remains illegal.

Over the past years, many marijuana companies listed shares on the stock exchange, hoping that Federal legalization was on the horizon. So far, those hopes have gone up in smoke, causing market caps to shrink. The AdvisorShares Pure Cannabis ETF product (YOLO) holds shares in some of the leading pot companies that have declined to a fraction of their value since early 2021.

The leading cannabis companies

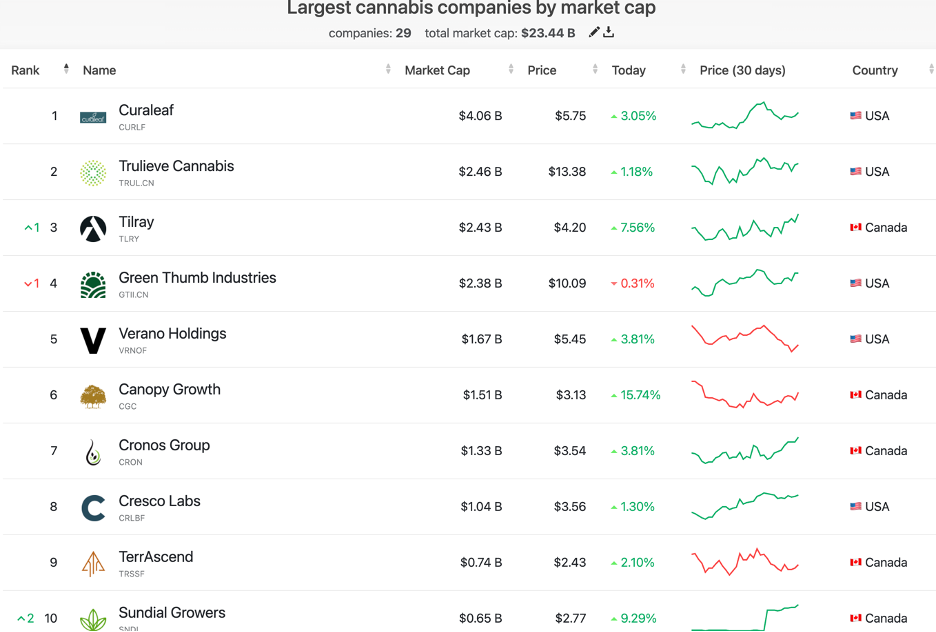

Over the past years, many US and Canadian marijuana companies started trading on the stock exchange. The ten leading cannabis companies by market cap are:

Source: Companiesmarketcap.com

Curaleaf (CURLF), Trulieve Cannabis (TRUL.CN), Tilray (TLRY), and Three Thumb Industries (GTII.CN) are the companies with market caps over the $2 billion level, with CURLF trading on the NASDAQ with an over $4 billion value.

Share prices have trended significantly lower- Pot is a commodity

Most of the shares of companies in the cannabis sector reached highs in early 2021 when the US administration changed on the prospects for legalization. CURLF, the leading company, traded at a high of $18.30 per share in February 2021.

The chart highlights the pattern of lower highs and lower lows, reaching a low of $4.7945 in July 2022 and was at the $5.60 per share level on August 9.

Tilray (TLRY) has done even worse since early 2018.

The chart illustrates that investment reefer madness took TLRY shares from $300.00 in February 2021. The shares plunged to $3.90 per share on August 9.

The top holdings of the AdvisorShares Pure Cannabis ETF product (YOLO) include:

YOLO’s performance has also suffered since reaching a peak in early 2021.

The chart shows the decline from the February 2021 $31.87 high to below $5.65 per share on August 9. The hopes for US federal cannabis legalization have gone up in smoke, and the leading companies continue to burn cash assets while they wait for Washington DC to pave a legislative path for traditional finance, payment options, and profits to flourish.

Meanwhile, pot is an agricultural commodity like corn, soybeans, wheat, cotton, sugar, coffee, cocoa, and many other products grown in fertile soil. The lack of US federal acceptance has also put a roadblock ahead of futures contracts that would allow for price discovery and producer and consumer hedging. The world’s largest futures exchange, the Chicago Mercantile Exchange (CME), cannot move forward with any plans to list pot futures until US federal legislation makes it a legal enterprise.

Expect lots of M&A if US Federal legalization continues to stall

As the leading cannabis companies continue to bleed cash waiting for the US to move on legalization, we could see an increase in merger and acquisition activities that create economies of scale. The top companies like CURLF, TLRY, and others are likely to survive, but others will likely find themselves seeking Chapter 11 protection or as inexpensive acquisition targets for the leaders.

Many companies wagered that the Biden administration would legalize pot early, but they have been disappointed by the lack of the administration’s desire and progress.

The leading tobacco companies could stand to be the big winners in the pot war

The leading tobacco and cigarette companies by market cap include:

Source: Companiesmarketcap.com

The chart shows that Philip Morris (PM) and Altria Group (MO) are the top US tobacco companies. At the $97.70 per share level, PM pays shareholders a $5 or 5.12% annual dividend. MO shares at $44.15 mean the $3.60 dividend translates to 8.15%. PM and MO are the two US companies that could be waiting in the wings for US pot legalization. With $151.54 and $79.72 billion respective market caps, PM and MO could easily vacuum up the leading cannabis companies if Washington DC legalizes the business.

Lobbyists in Washington DC are likely to determine the sector’s future

The bear market in pot stocks is welcome news for the leading US tobacco companies that conduct a significant amount of lobbying in Washington DC. The stalled efforts to legalize cannabis have cost the burgeoning companies, causing their share prices to plunge. PM and MO are perfectly positioned to pick up the pieces when legalization occurs.

Growing deficits and spending programs increase the US government’s need for new tax revenue verticals. Marijuana legalization with federal taxes remains very appealing for many legislators. It may be only a matter of time until legalization occurs, but the leading companies will likely come from the tobacco industry, where there is a natural synergy. If the lobbyists have their way, modern-day reefer madness will be a rush to buy established companies paying above-market dividends. My bet is on PM and MO to lead the pot business over the coming years when the US government finally makes a move.

More Food & Beverage News from Barchart

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)