Investing in the stock market is a powerful way to build wealth, and exchange-traded funds (ETFs) make the process simpler and more approachable.

A growth ETF is a collection of stocks with the potential to earn higher-than-average returns, with all of these stocks bundled together into a single investment. Some growth ETFs track particular industries, while others are more diverse and contain stocks across multiple sectors.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

While there are many growth ETFs to choose from, there's one in particular I'm loading up on right now -- and it can help limit risk while maximizing long-term returns.

Image source: Getty Images.

A tried-and-true ETF to supercharge your savings

If you're looking for an investment that can help balance risk and reward, the Vanguard Growth ETF (NYSEMKT:VUG) could be a smart choice.

This ETF aims for above-average returns, but it also leans heavily on industry juggernauts that can provide more stability. The top 10 holdings make up close to 60% of the entire fund, with almost one-third of the fund allocated to just three stocks: Apple, Microsoft, and Nvidia. The remaining 40% of the fund is spread across an additional 170 stocks.

Heavily weighting the fund toward industry leaders can help limit your risk, as these companies are more likely to survive market downturns and recessions. That said, smaller stocks are more likely to see explosive growth, and if one or two of these companies become serious performers, it could supercharge your earnings.

Historically, this ETF has a solid track record of outperforming the market. It's earned total returns of close to 300% over the past 10 years, as of this writing, and you'd have nearly quadrupled your money in that time.

One other advantage of this ETF is its low expense ratio of just 0.04% -- meaning you'll pay $4 per year in fees for every $10,000 you have invested. With some funds charging expense ratios of 1% or more, a lower rate could help you save thousands of dollars in fees over time.

The biggest risk to consider before you invest

Growth ETFs can carry more risk than other funds, and that's especially true during periods of market volatility.

High-growth stocks tend to thrive when the market is surging, often earning returns far above average. But when the market takes a turn for the worse, these stocks are usually the first to take a hit -- and they are often hit hard.

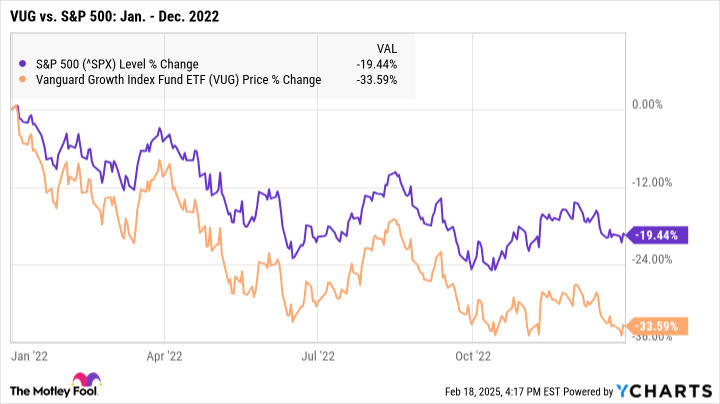

Case in point: Throughout the most recent bear market in 2022, the S&P 500 dipped by around 19% over the year. The Vanguard Growth ETF, though, sank by close to 34% in the same timeframe.

While this ETF has still outperformed the S&P 500 over the long term, the short-term rough patches tend to be more severe. Not everyone is comfortable with this level of volatility, so it's wise to consider your risk tolerance before you buy.

It's also a good idea to double-check that the rest of your portfolio is well-diversified. This ETF's top 10 holdings make up more than half of its overall composition. While these stocks are more likely to survive downturns, if any of them experience serious volatility (like Nvidia's historic sell-off last month), it could take a bigger toll on your portfolio.

By investing in a wide variety of stocks from many sectors of the market -- including those from more established companies that perhaps don't have as much room for growth but are more stable -- you can better protect your portfolio against downturns.

Investing in a growth ETF can be a powerful way to build lifelong wealth, and investing for the long term is key. While the short-term can sometimes be shaky, the Vanguard Growth ETF has a decades-long history of earning above-average returns -- with plenty of potential to supercharge your savings.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $361,026!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,425!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $562,659!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

Katie Brockman has positions in Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)