In a bold move to maintain its leadership position in the streaming industry, Netflix NFLX has unveiled an impressive slate of upcoming content for 2025 that should excite both viewers and investors alike. The streaming giant's strategic focus on diverse programming, encompassing anime, original series, reality shows and films, signals strong growth potential and continued subscriber engagement.

Anime Expansion Drives Global Appeal

Netflix's commitment to anime continues to pay dividends, with over half of its global members having watched at least one anime title in 2024. The company showcased its growing anime portfolio at AnimeJapan, revealing new content and trailers for highly anticipated titles like Moonrise, BEASTARS Final Season and Devil May Cry.

The anime expansion represents Netflix's understanding of global viewing habits and cross-cultural appeal. With more than 11,000 hours of HDR content now available and anime streaming up 300% over five years, this segment presents significant growth opportunities. Upcoming titles, such as SAKAMOTO DAYS, Blue Box and Fire Force Season 3, will likely continue driving international subscriber growth.

Technology Investments Enhance Viewing Experience

Netflix is not just investing in content but also in technology to deliver superior viewing experiences. The company recently announced support for HDR10+ content on AV1-enabled devices, enhancing picture quality with dynamic metadata that provides greater perceptual fidelity to original content.

This technical advancement preserves creative intent across more devices and offers an immersive viewing experience, potentially increasing viewing hours and subscriber satisfaction.

Original Programming and Star Power

The company continues to leverage star power in its original programming lineup. Kevin Hart will headline the upcoming comedy 72 Hours, while Kian's Bizarre B&B will feature Jin of BTS in what promises to be a unique reality show experience. The thriller series The Residence, produced by Shondaland and starring Uzo Aduba, adds to Netflix's prestigious original content slate.

These strategic content investments aim to maintain Netflix's competitive edge in an increasingly crowded streaming landscape. The company's fourth-quarter 2024 results show that this strategy is working, as revenue increased 16% year over year and operating income rose 52%.

Financial Performance Supports Bullish Outlook

Netflix's financial performance underscores the strength of its content strategy. The company finished 2024 with 302 million memberships, adding 19 million paid subscribers in the fourth quarter alone—the biggest quarter of net additions in its history. Revenues grew to $10.25 billion in fourth-quarter 2024, with operating income reaching $2.27 billion.

For 2025, Netflix forecasts revenues of $43.5-$44.5 billion and an operating margin of 29%, up from its previous forecast. Free cash flow is expected to reach approximately $8 billion, providing ample resources for continued content investment.

The Zacks Consensus Estimate for NFLX’s 2025 revenues is pegged at $44.47 billion, indicating 14.03% year-over-year growth. The consensus mark for earnings is pegged at $24.58 per share, indicating a 23.95% increase from the previous year.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

While the stock trades at a premium with a forward 12-month P/S ratio of 9.11 compared to the broader Zacks Broadcast Radio and Television industry's forward earnings multiple of 3.96, this valuation appears justified given Netflix's unique position at the intersection of technology and entertainment. The company's ability to outcompete both traditional media companies and tech giants like YouTube speaks of its exceptional business model and execution.

NFLX’s P/S F12M Ratio Depicts Premium Valuation

Image Source: Zacks Investment Research

Investment Opportunity

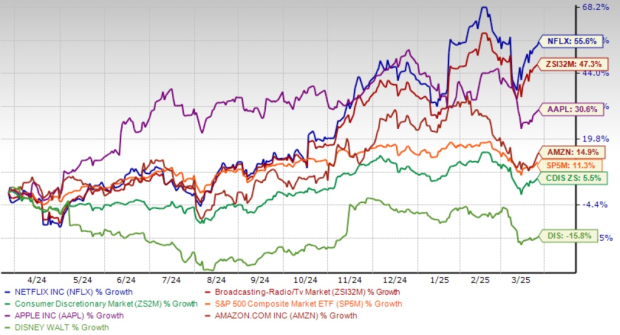

For investors, Netflix presents a compelling opportunity in 2025. The company has consistently outperformed market indices, with an 55.6% one-year return, significantly outperforming other streaming behemoths like Apple AAPL, Amazon AMZN and Disney DIS, the broader Zacks Consumer Discretionary sector as well as the S&P 500.

1-Year Performance

Image Source: Zacks Investment Research

The combination of the strong content pipeline, technological innovation and solid financial performance positions Netflix well for continued growth. While some popular K-dramas like When Life Gives You Tangerine won't be returning for additional seasons, the company's continuous introduction of new content should maintain subscriber interest and growth.

Conclusion

With returning seasons of blockbuster shows like Squid Game, Wednesday and Stranger Things in 2025, alongside an expanded anime catalog and innovative reality programming, Netflix appears poised to strengthen its leadership position in engagement, revenue and profit—making it an attractive investment option for the coming year. NFLX currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nike%2C%20Inc_%20shopping%20by-%20hapabapa%20via%20iStock.jpg)

/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)