Saguenay, Quebec--(Newsfile Corp. - February 28, 2024) - First Phosphate Corp. (CSE PHOS) (OTC: FRSPF) (FSE: KD0) ("First Phosphate" or the "Company") is pleased to announce that it has signed a memorandum...

Saguenay, Québec--(Newsfile Corp. - 28 février 2024) - First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) (« First Phosphate » ou la « Société ») a le plaisir d'annoncer qu'elle a signé...

Old Dominion Freight Line was the latest less-than-truckload carrier to announce an early general rate increase for the new year. The post Annual LTL GRIs slightly ahead of schedule appeared first...

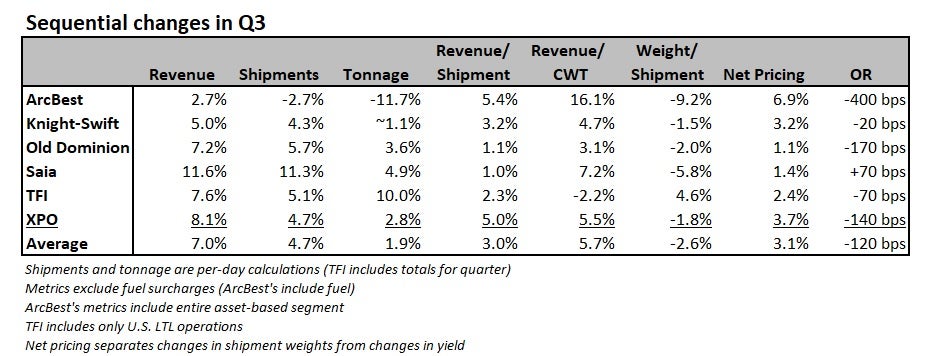

Third-quarter earnings reports show how Yellow Corp.’s market share was redistributed across the less-than-truckload industry. The post Where did Yellow’s freight go? appeared first on FreightWaves...

Old Dominion sees a 6% uptick in shipments following Yellow’s closure but says the industry’s freight reshuffle hasn’t been permanently settled. The post Old Dominion says Yellow freight redistribution...

Averitt Express received the highest overall ranking, with Old Dominion Freight Line voted top national less-than-truckload carrier in a value and loyalty survey. The post LTL survey: Averitt No. 1...